UK Market: The UK stock market trades marginally in red on Thursday after the announcement of the interest rate hike by the Bank of England (BoE). The bank rate has been increased by 25 basis points to 0.50%, with five committee members voting in favour of the rate hike. Though the decision hasn’t led to much volatility in the market as the decision was in line with earlier expectations and is already priced in.

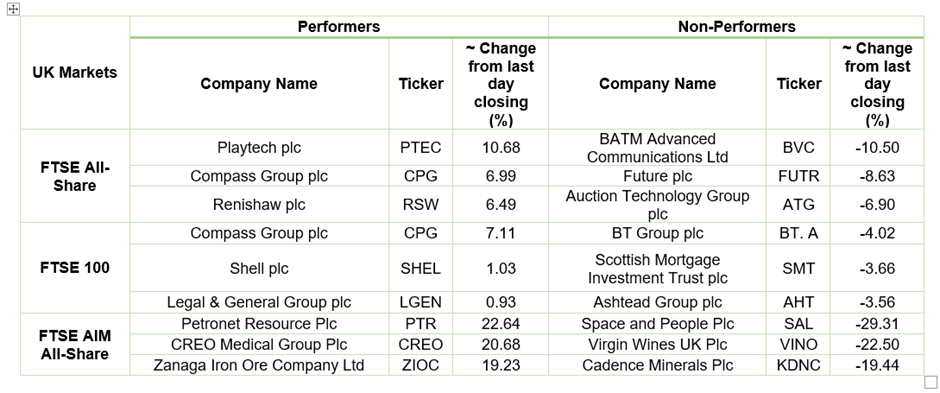

Future Plc (LON: FUTR): The media and magazine company were down by over 8%, with a day’s low of GBX 3,082 after the company announced its business update for four months to 31 January 2022. The stock price declined despite the positive business performance, which was in line with expectations.

BT Group Plc (LON: BT. A): The telecom service provider was down by over 4%, with a day’s low of GBX 182.10 following the announcement of a new joint venture. The company plans to set up a new sports and entrainment offering for its UK customers and is having an advance discussion with Discovery, Inc.

Virgin Wines UK Plc (LON:VINO): The direct-to-consumer wine retailer was down by over 22%, with a day’s low of GBX 155 after the company announced its business update for six months to 31 December 2021. The company’s revenue was in line with expectations but has warned that full-year revenue and profits could be below expectations.

US Markets: The US market is likely to open in red, as indicated by the movement of future indices. S&P 500 futures were down by 59 points or 1.29% at 4,518, while the Dow Jones 30 future was down by 0.37% or 126 points at 35,367. The technology-heavy index Nasdaq Composite future was down by 2.44% at 14,742 (At the time of writing – 8:50 AM ET).

US Market News:

Facebook owner Meta Platforms (FB) declined by over 22% in premarket after releasing its earnings numbers. The company reported a cautious outlook amid rising inflation which is impacting the advertising spending across different industries.

The audio streaming Spotify (SPOT) was down by over 9% after the company forecasted lower subscriber numbers. However, the revenue was above the market estimate, driven by higher advertising revenue.

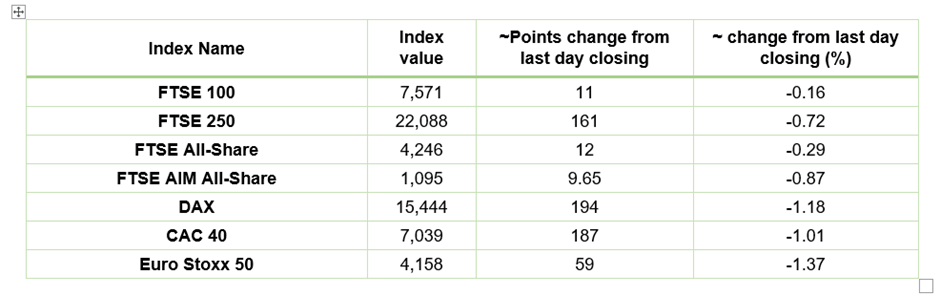

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 3 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BT Group Plc (BT. A).

Top 2 Sectors traded in green*: Energy (0.95%), Consumer Non-Cyclicals (0.01%).

Top 3 Sectors traded in red*: Technology (-1.70%), Industrials (-1.44%). Healthcare (-0.92%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $88.85/barrel and $87.59/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,805 per ounce, down by 0.28% against the prior day closing.

Currency Rates*: GBP to USD: 1.3577; EUR to USD: 1.1376.

Bond Yields*: US 10-Year Treasury yield: 1.827%; UK 10-Year Government Bond yield: 1.3705%.

*At the time of writing

.jpg)