The Fed’s buyback decision triggered the market as the FTSE-100 index increased by 3.56 per cent from the previous day close and was trading at 6,279.64. FTSE AIM All-Share index was trading at 879.49 and was up by 1.93 per cent (before the market close at 3:03 PM GMT+1).

- On 15th June 2020, the Fed announced that it would inject additional liquidity and expand lending to large employers by buying a broad portfolio of the corporate bonds from the secondary market. The buyback can be close to USD 750 billion.

- As per the market experts, on Thursday The Bank of England can increase its Corporate Bond Purchase Scheme by GBP 100 billion.

- The cue of increasing oil demand and declining production underpinned the rise in the oil price. The Brent was trading up by 3.81 per cent at USD 41.41 per barrel.

Given the above developments in the market, we will review two small-cap energy stocks - Nostra Terra Oil and Gas Company PLC (LON:NTOG) and Touchstone Exploration Inc (LON:TXP). On 16th June 2020, TXP was down by 0.99 per cent, and NTOG was up by 5 per cent (before the market close at 2:59 PM GMT+1).

Nostra Terra Oil and Gas Company PLC (LON:NTOG) – Announced Farmout Transaction for Pine Mills

NTOG is an Oil & Gas exploration and production company and has development and exploration assets in the US and Egypt. It is listed on the Alternative Investment Market (AIM) of London Stock Exchange since 2005.

Update on Pine Mills Farmout

- On 15th June 2020, NTOG exercised the option and increased its working interest in Pine Mills to 32.5 per cent, with 25 per cent is carried at no cost to Nostra Terra. The further 10 per cent increase of working interest translated to 7.5 per cent of a net additional increase.

- On 22nd April 2020, NTOG released a farmout transaction with Cypress Minerals LLC for drilling and completion of 80 acres of its 2,400 acres oil field (Pine Mills) in West County, Texas. NTOG retained the 25 per cent working interest in the well and its area. Cypress identified Upper Cretaceous Woodbine Sand, a low-risk drilling location for production.

- At the time of the initial agreement, NTOG had the option to seek an additional 10 per cent working interest at the cost in the non-carried portion of the asset.

- Nostra Terra will not incur any cost for the drilling of the oil field, and Cypress will bear all the expense, which is expected to be approximately USD 800,000.

- Nostra Terra can have access to additional funds by securing the working interest in the well to the collateral once the production in the well starts. There is a potential of five wells being drilled in the farmount area.

- Nostra Terra owns 100 per cent working interest of the remaining 2,320 acres of the land.

Business update as released on 8th June 2020

- The Company renegotiated the loan terms with the lender Discovery Energy Limited. The repayment date of the outstanding loan of GBP 233,481 as on 1st June 2020 has been extended to 1st April 2022. The borrowing rate is 10 per cent per annum. NTOG will pay a fee of GBP 24,000 to Discovery for restructuring the existing loan. An initial payment of GBP 10,000 has been made, NTOG will also make a monthly payment of GBP 5,000 till 1st April 2022, with the sum of the outstanding amount on or before the new repayment date.

- Lowering operating cost and adding storage capacity is the first agenda of the Company.

- The lifting cost at Pine Mills was reduced from approximately USD 23 per barrel to approximately USD 16 per barrel.

- Four four-hundred barrel storage tanks have been installed which translates to additional 1,600 barrel of storage capacity, to maximize the received price. NTOG can decide when to sell as it can store the produced oil in the tanks.

- NTOG has hedged the oil prices with BP energy and received a payment of USD 48,000 for the May contract. For the remaining year 2020, it has hedged 1,500 barrels per month of oil at USD 55.12 per barrel.

New equity issued (released on 8th April 2020)

- NTOG raised GBP 318,055 by issuing 127,222,000 new shares at 0.25 pence per share of which 20,000,000 were new ordinary shares and 107,222,000 were new subscribtion shares.

- The Company issued a warrant for every two new shares issued. A total of 63,611,000 warrants with an exercisable period of two years at a price of 0.60 pence per share was issued.

- The fund raised will be used as working capital to support the Company’s operation.

Share Price Performance

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 16th, 2020, before the market close

The share price of Nostra Terra Oil & Gas Company was GBX 0.3566 per share (before the market close at 2:37 PM GMT+1). The stock had a 52-weeks High and Low of GBX 2.14 and GBX 0.20. The market capitalization of the Company was close to GBP 1.42 million.

Business Outlook

The Company has suspended operations at its high cost and low production wells. It has also put efforts to bring down its operating cost amid the scenario of low oil prices. The Company wants to gain the maximum from its current assets. It has also hedged a significant portion of its production. The Company intends to make additional capital expenditure only when oil price strengthens; however, it will continue to seek lucrative business opportunities.

Touchstone Exploration Inc (LON:TXP) - Positive production tests on Cascadura-1ST1 exploration well

Touchstone Exploration Inc is an oil and gas exploration and production company and has onshore oil and gas operation in the Republic of Trinidad and Tobago. The Company is listed on AIM index of London Stock Exchange and Toronto Stock Exchange.

TXP availed new loan - as reported on 16th June 2020

The Company closed USD 20 million of term loan from Republic Bank. The loan is for seven-year. It withdrew USD 15 million to repay the previous loan of C$20 million. It can avail balance USD 5 million before 15th June 2021.

Update on the Cascadura field - as stated on 15th June 2020.

The Company received independent confirmation of initial production flow of 40 - 50 MMcf/d of natural gas and 1,100 -1,400 boe/d of condensate from evaluator GLJ Ltd. The Company will require drilling additional wells before it can put Cascadura field on production.

Trading Update – Q1 FY2020 (as on 14th May 2020)

- The average daily oil production in Q1 FY20 was 1,589 barrels per day which was 25 per cent lower than the same period last year.

- The petroleum sales were USD 6.69 million in Q1 FY20, which was down by 39 per cent year on year.

- The Company reported a net loss of USD 9.24 million in Q1 FY20, which were primarily due to the low commodity prices.

- In February, it completed a private placement of 22,500,000 common shares in the UK for USD 10.85 million. The capital raised will be used for drilling activities of the Chinook field.

- At the end of March 2020, the Company had a cash balance of USD 12.22 million. The net debt was close to USD 5.24 million.

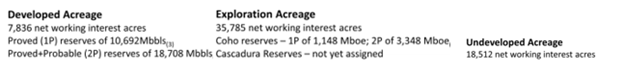

(Source: Company website)

Touchstone Exploration PLC’s Land Holdings

(Source: Company website)

Share Price Performance

(Source: Refinitiv, Thomson Reuters) -1-Year Chart as of June 16th, 2020, before the market close

The share price of Touchstone Exploration Inc was GBX 51.40 per share (before the market close at 2:55 PM GMT+1). The stock had a 52-weeks High and Low of GBX 56.65 and GBX 9.80. The market capitalization of the Company was close to GBP 92.71 million.

Business Outlook

The Company plans to bring its two discovered fields Chinook and Coho into production. The operation of areas will improve the cash flows of the Company. The Company has pipelined the exploration and drilling of Chinook in July 2020, and Coho is expected to start production in October 2020. It will perform an independent reserve evaluation of its Cascadura field in July 2020.