Gambling with credit cards has become a serious problem affecting the Banking industry in the United Kingdom. Gamblers are often found to be using the heightened limits on their cards to place high bets, and the banks are left to make good their obligations to the gambling companies should the gambler lose on his bets. This has led to a turf war between these two industry bodies, with a call from many in the industry and the countryâs legislature to ban gambling using credit cards.

The banks have since long charged high rates of interests for the transactions they consider linked to gambling and view them as equivalent to cash withdrawals. However, with the increasing numbers of customer defaults, the risk tolerance capacity of the banking system has now come to a breaking point. Prominent parliamentarians like Jeremy Wright have also voiced their concerns about this twin assault on the common British citizen, suffering from the addiction of gambling on the one hand and being slapped with heavy interest by the banks on the other.

The United Kingdom Gambling Commission (UKGC), taking cognizance of the above situation called for a 12-week consultation process starting in August of 2019, where it will be reviewing all the evidence presented before it, in support of the assumption that gambling practices using credit card are hurting the banking industry as well as the common British citizen. UKGC executive director Paul Hope has said they are aware of the problem but are in a fix as to what would constitute the right remedial measure. He further stated that should an outright ban on gambling using credit cards be imposed; there are other ways a gambler may use to circumvent this ban. They may use their credit cards to recharge their E-wallets which in turn could be used to place gambling bets, with the effect remaining the same. In addition, there are also other direct means to use bank credits like overdraft and loans to fund gambling transactions.

Paul Hope further stated that the outright ban on the usage of credit cards for gambling transactions would hurt the gambling industry very badly. The move, it fears, will dissuade many of its customers from gambling, which would shrink the size of the industry significantly. The industry is already suffering from the harsh effects of the Remote Gambling Duty imposed by the government last year in October. The lawmakers on their part are of the view that there should be a complete ban on gambling with credit cards as they argue that as much as 20 per cent of the customer deposits with gambling firms are made up of money their clients do not own. Additionally, it will also address the slow progress of the various self-exclusion schemes that the government had initiated from time to time to help addicted gamblers to de-addict them from gambling.

Barclays Plc

Barclays Plc (BARC) is a British multinational bank having a worldwide presence. The bank has four core divisions, namely, corporate banking, personal banking, wealth management and investment management.

The bank is one of the oldest corporations in the United Kingdom, with its origins going back 328 years when it was incorporated on 17 November 1690. The bank is credited to be the first bank in the world to deploy cash vending machines.

The bank has its shares listed on the London stock exchange, where its shares trade with the ticker name BARC, and on the New York Stock Exchange, where its shares trade with the ticker name BCS. The banksâ shares are constituent of the FTSE 100 index, and its largest shareholder is Qatar Holdings, the investment arm of the Government of Qatar.

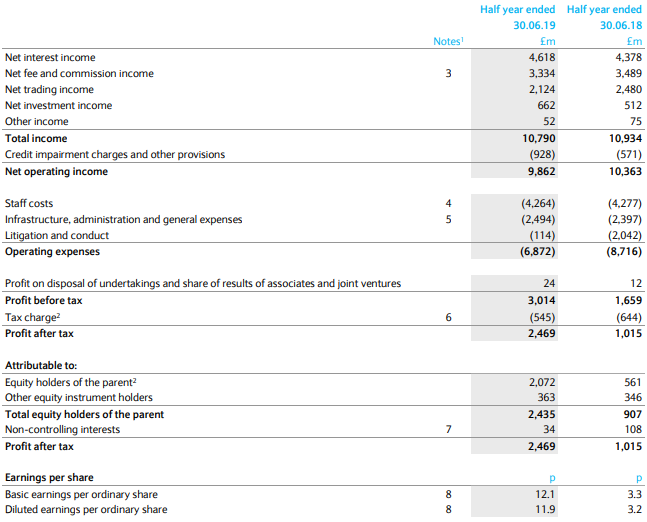

Financial Update of Barclays Plc for H1 2019 half-year period ending June 2019 (壉millions)

Source â Company Annual report publication for H1 2019

The company for the half-year ended 30 June 2019 reported net interest income of £4.618 billion compared to a net interest income of £4.378 billion for half-year ended 30 June 2018. The Total Income for the half-year ended 30 June 2019 was £10.790 billion, whereas it was a total income of £10.934 billion for the period ended 30 June 2018. The profit before tax for the half-year ended 30 June 2019 was £3.014 billion, compared to a profit before tax profit of £1.659 billion for the half-year period ended 30 June 2018. The net profit for the half-year ended 30 June 2019 was £2.469 billion, whereas it was a net profit of £1.015 billion for the half-year ended 30 June 2018. The higher profits for the half-year were on account of lower litigation and conduct costs during the period as compared to the last year. The earnings per share (diluted) of 11.90 pence was for the H1 ended 30 June 2019, whereas for the period ended 30 June 2018 it was 3.20 pence per share. The Company has declared a dividend of 3.0 pence per share for the half-year ended 30 June 2019, whereas for the half-year period ended 30 June 2018 it was 2.5 pence per share.

The share price performance of Barclays Plc at the London Stock Exchange

Daily Chart as on 20 August 2019, before the market close (Source: Thomson Reuters)

On 20 August 2019, at the time of writing the report (before the market close, GMT 01.28 PM), BARC shares were trading on the London Stock Exchange at GBX 139.14, down by 1.038 per cent over the previous day's closing price of GBX 140.6. The stock has a 52- week High of GBX 185.90, and a 52-week low of GBX 136.47. The total market capitalization of the company was £24.25 billion

Barclays Plcâs stand on Credit card use in gambling

The bank has been passively aiding its customers to de-addict from gambling, by letting them block gambling transactions on their credit cards. Though it can be reversed if the customer wants, however the very fact that it is blocked initially will lead the customerâs psychology to resist himself from gambling further. The bank has a similar blocking facility available for payments made in restaurants and pubs as well.

Tesco Plc

Tesco Plc (TSCO), the largest retailer in the United Kingdom also issues credit cards through its banking division Tesco Bank. The bankâs services range includes personal banking, business banking, mortgage lending, credit cards, insurance and foreign exchange transactions. One of the ways the bank has managed to garner market share from its competitors is to give its customers Tesco Club points whenever they use its banking services, and which can be later redeemed when shopping at Tesco outlets.

Tesco bank operates under the Umbrella of the Tesco Group and is a non-listed entity. Tesco group shares are listed on the London Stock Exchange, trading with the ticker name TSCO. The shares of the retailer are also listed at the Amsterdam Stock Exchange with ticker name TCO, and the shares of the company form part of the FTSE 100 index back in the United Kingdom.

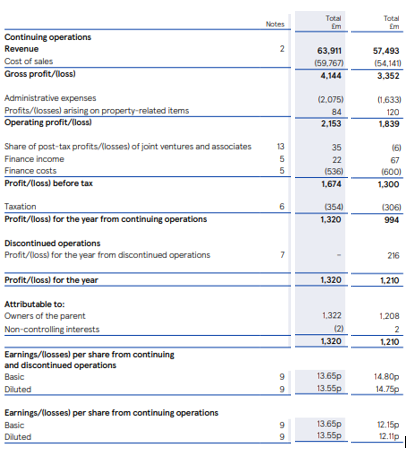

Financial Update Tesco Plc for FY 2019 ending February 2019 (壉millions)

Source â Company Annual report publication for FY 2019

The company for the year ended 23 February 2019 reported revenues of £63.911 billion compared to revenue of £57.493 billion for the year ended 23 February 2018. The Gross profit for the year ended 23 February 2019 was £4.144 billion, whereas it was a gross profit of £3.352 billion for the period ended 23 February 2018. The operating profit for the year ended 23 February 2019 was £2.153 billion, compared to an operating profit of £1.839 billion for the period ended 23 February 2018. The net profit for the year ended 23 February 2019 was £1.320 billion, whereas it was a profit of £1.210 billion for the year ended 23 February 2018. The higher profits for the year were on account of higher revenues. The earnings per share (diluted) of 13.55 pence was for the FY ended 23 February 2019, whereas for the period ended 23 February 2018, it was 12.11 pence per share. The company has declared a dividend of 5.77 pence per share for the year ended 23 February 2019, whereas it was 3.00 pence per share for the year ended 23 February 2018.

The share price performance of Tesco Plc at the London Stock Exchange

Daily Chart as on 20 August 2019, before the market close (Source: Thomson Reuters)

On 20 August 2019, at the time of writing the report (before the market close, GMT 02.27 PM), TSCO shares were trading on the London Stock Exchange at GBX 216.10, down by 1.63 per cent over the previous day's closing price of GBX 219.70. The stock has a 52- week High of GBX 260.10, and a 52-week low of GBX 187.05. The total market capitalization of the company was around £21.56 billion.

Tesco Plcâs stand on Credit card use in gambling.

Tesco bank has been charging its customers higher fees for the use of credit cards to place gambling bets. The bank considers it as cash withdrawal using credit cards and charges a hefty interest thereupon.