UKâs Retail Sector Performance In December

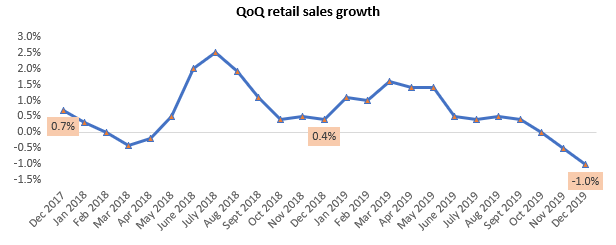

As widely reported, Retail sectorâs performance in the United Kingdom in 2019 had been the worst in the last 24 years, marked by a decline of 0.6 per cent in sales in the month of December. The office of National Statistics released sales data for the month of December for the retail industry, which previously were expected to be better due to the festive period, but turned out to be damp squib, as the data presented by the Office for National Statistics (ONS) showed a further 0.6 per cent month on month as well as 1 per cent in quarterly (QoQ period) decline in sales during the period. This slump has also been named as a major contributing factor to the fall in the Consumer Prices Index (including owner occupiersâ housing costs of 12 month) inflation rate, which was measured at 1.4 per cent in the month of December 2019, in comparison to the growth of 1.5 per cent in the month of November 2019. In the inflation data report presented by the ONS for the month of December, it was stated that consumer buying was lower from the organised retail sector, especially during the festive period, mainly due to the snap election announced in the month of December, as well as the uncertainties surrounding Brexit, which led to a significant downfall in the consumer confidence. The retail sales report highlighted the QoQ (quarter on quarter) sales decline of 1 per cent measured for the month of December, the lowest in the last two years. Further fuel to the fire was added with a number of retail firms either getting closed or put into administration after weak performances during the period.

(Source: Office for National Statistics)

The report also pointed that the quantity bought in food stores fell by 1.3 per cent for the month, which was the largest drop since December 2016, when it was measured at the same level at 1.3 per cent. In terms of different reported segments, the positives for the period came from fuel store sales which were reported at a growth of 1.6 per cent, non-store retailing was reported at a growth of 1 per cent, while other store sales grew by 0.1 per cent.

This slump has significantly impacted the overall economy, as seen by the drop-in inflation rates, which could further prompt the Bank of England to cut interest rates as a measure to spur growth in the retail sector as well as in the overall economy.

Â

Beales goes into administration â Jobs at Risk

There were various reports doing the round that retail store chain Beales had gone into administration. 22 stores of the company and 1300 jobs created by the retailer are under the threat of being lost as the company appointed KPMG as the administrator on 20th January 2020. Beales is one of the biggest retail store chains in the country and has been a leader in terms of high street markets. 2019 was an extremely difficult period for the company to trade in, as for the other companies within the sector, primarily because of consumers not willing to buy during the period and waiting for the uncertainty in the business environment to end. The company reported an increase in losses of £3.1 million last year and was unsuccessful in securing either rent reductions for the purpose of cutting costs or finding a suitable buyer for their business, as no investor was interested in deploying capital in slumping sector and amid a heightened environment of risk and uncertainty. Rents have been a major issue for all the high streets firms during the period as the decline in sales was increasing pressure on the companies to cut costs, and rent reduction was the only way out, which still has not happened.

This latest development has put 1300 jobs of Beales employees at threat, that will lead to a massive job loss over 22 stores of the company across the country. Though by the time the administrator assesses the option for the business, the staffs will be retained, and the business will keep working as a going concern.

Recently, Primark, which is a no-frills fashion retail chain, too saw a decline in underlying sales, following which it announced that it would open only one store in the country in 2020, the lowest number in decades. Other retailers that had a very bad Christmas period included the likes of Marks and Spencer, Superdry, J Sainsbury and Card Factory.

The year 2020 looks set to be an extremely important year for the retail industry in the United Kingdom as it is expected that the firms will have a do-or-die season during the year. The following stocks are likely to be on investorâs radar in the changed scenario, and it is important to look at their recent stock price performances.

McCollâs Retail Group (LON:MCLS) Share Price Performance

On 21st January 2020, at around 11:45 A.M (Greenwich Mean Time), at the time when this report was being written, McCollâs Retail Group Plcâs share price was reportedly at GBX 43.42 per share on the London Stock Exchange market, a drop in the price of 3.94 per cent or GBX 1.78 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 45.20 per share. At the time of writing, the share of McCollâs Retail Group Plc was reported to have been trading 17.34 per cent above the 52-week low share price, that was GBX 43.42 per share, which the company set on January 06, 2020. Also, the share price was reported to have been trading 52.29 per cent lower than the 52-week high price of GBX 91.00, that the company achieved as on March 08, 2019. The market capitalisation of McCollâs Retail Group Plc was reported to be at £52.07 million with regards, to the price at which the companyâs share was trading at the time of writing.

The companyâs stock beta was reported at a value of 1.38, which means the McCollâs Retail Group Plcâs share has been more sensitive in nature, in comparison to the sensitivity of the comparative benchmark index in the last one year.

Naked Wines Plc (LON:WINE) Share Price Performance

On 21st January 2020, at around 11:50 A.M (Greenwich Mean Time), at the time when this report was being written, Naked Wines Plcâs share price was reportedly at GBX 219.00 per share on the London Stock Exchange market, a fall in the price of 0.45 per cent or GBX 1.00 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 220.00 per share. At the time of writing, the share of Naked Wines Plc was reported to have been trading 6.72 per cent above the 52-week low share price, that was GBX 205.21 per share, which was set on December 13, 2019. Also, the share price was reported to have been trading 29.96 per cent lower than the 52-week high price of GBX 312.70, that the company achieved as on June 12, 2019. The market capitalisation of Naked Wines Plc was reported to be at £160.32 million with regards, to the price at which the companyâs share was trading at the time of writing.

The companyâs stock beta was reported at a value of 0.49, which means that the Naked Wines Plcâs share has been less sensitive in nature, in comparison to the sensitivity of the comparative benchmark index in the last one year.

WM Morrison Supermarkets (LON:MRW) Share Price Performance

On 21st January 2020, at around 11:55 A.M (Greenwich Mean Time), at the time when this report was being written, WM Morrison Supermarkets Plcâs share price was reportedly at GBX 187.55 per share on the London Stock Exchange market, a fall in the price of 0.90 per cent or GBX 1.70 per share, as opposed to the last trading dayâs closing price, that was reportedly at GBX 189.25 per share. At the time of writing, the share of WM Morrison Supermarkets Plc was reported to have been trading 7.08 per cent above the 52-week low share price, that was GBX 175.15 per share, which was set this price on August 15, 2019. Also, the share price was reported to have been trading 21.64 per cent lower than the 52-week high price of GBX 239.35, that the company achieved as on February 06, 2019. The market capitalisation of WM Morrison Supermarkets Plc was reported to be at £4.551 billion with regards, to the price at which the companyâs share was trading at the time of writing.

The companyâs stock beta was reported at a value of 0.70, which means that the WM Morrison Supermarkets Plcâs share has been less sensitive in nature, in comparison to the sensitivity of the comparative benchmark index in the last one year.

Â

Comparative share price chart of MCLS, WINE and MRW

(Source: Thomson Reuters) Daily Chart as on 21-January-20, before the closing of the LSE Market