Summary

- JP Morgan, Citibank, Morgan Stanley, and Goldman Sachs have announced that share repurchases would resume in the first quarter of 2021.

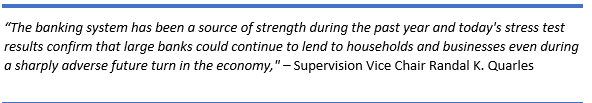

- The latest stress test by the Federal Reserve showed that banks are well capitalised to extend support to the economy in the event of severe downturns.

Share repurchases or share buybacks are heavily preferred by US companies as a part of shareholder returns. Federal Reserve has given a green signal on share repurchases by US bank for the first quarter of 2021.

The decision comes after the latest stress test results showed banks are well capitalised to withstand severe economic shocks and continue to lend to businesses and households in an effort to support the economy.

Image Source: Megapixl

Federal Reserve tested hypothetical scenarios over nine future quarters in the latest stress test. Earlier this year, the Board placed a restriction on bank’s share repurchases and dividends to shore up capital reserves.

While US large banks have kept around $100 billion in loss reserves, they have built strong capital recently.

Under the two scenarios, the unemployment rate was spiked to 12.5% and 11%, followed by a decline of around 7.5% and 9%, respectively.

Federal Reserve found that large banks would incur over $600 billion in total losses collectively, but the collective capital ratios would fall from 12.2% to only 9.6%, which is well above the minimum 4.5%.

It also indicated that risk-based capital ratios for all firms would remain above the minimum requirement of the Federal Reserve.

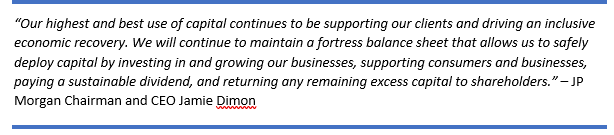

Federal Reserve said that dividends and repurchases would be limited to the average quarterly profits for the four preceding quarter.

After the announcement by Federal Reserve, JP Morgan Chase approved a new share repurchase program of $30 billion, which would kickstart in 2021.

Citibank and Goldman Sachs also reported that share buyback would resume in 1Q 2021. Likewise, Morgan Stanley also confirmed that the firm would resume share repurchases in January 2021.