Summary

- Canada is slowly gaining back the lost jobs, but numbers are still below pre-pandemic levels

- Continued federal dole outs will carve a hole in the country’s reserves

- Canada is staring at a protracted growth because the scars from coronavirus will linger

- The road ahead is patchy and bumpy because the nature of coronavirus shock has left permanent losses; people and businesses have to be patient.

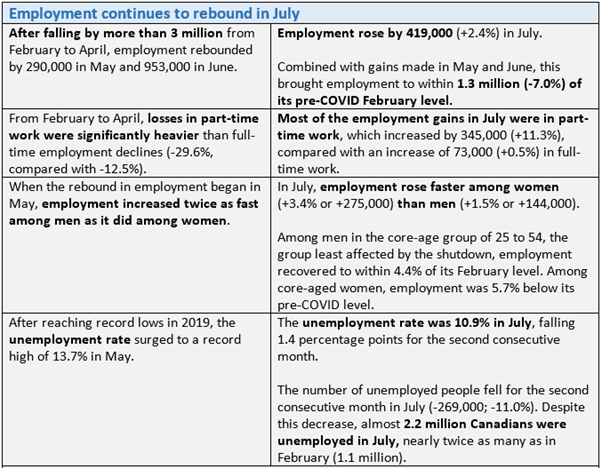

Canada's job growth is trickling back, inch by inch. In July, the economy added 419,000 jobs while the jobless rate dropped to 10.9 per cent. A total of 1.66 jobs were regained in the last three months.

Yet, the employment numbers are nowhere close to the 3 million jobs lost between February to April, during the onset of the coronavirus pandemic.

Snapshot of Labor Market in July, 2020

Source: Labor Force Survey, Statistics Canada

To support millions of people who were either forced out of jobs or suffered business losses (including companies) due to the pandemic, the federal government infused a fiscal stimulus package to the tune of C$ 212 billion. Under this, Canadians without an income could claim C$ 2,000 for a four-week period under the Canada Emergency Response Benefit (CERB) while small- and medium-sized businesses could seek C$ 40,000 loan under Canada Emergency Business Account (CEBA) that is interest-free until December 31, 2022.

Soon, the CERB will cease to exist, and individuals still without income will shift to the Employment Insurance (EI) program. For those failing to qualify under the EI plan, such as temporary or contract workers, government will launch of a “parallel benefit” plan in the coming weeks, details of which are unclear at the moment.

What Jobs Report Says About Economic Recovery

Jobs are coming back slowly, there’s no denying that. But the latest figures show 1.3 million people are still unemployed and dependent on federal payouts. On top of it, over 148,000 thousand businesses faced closures in the months of April and March this year, figures from Statistics Canada shows.

Trudeau government’s biggest task on hand now is to gradually take the benefit receivers off the monthly aid without hurting any interests. And for this the government is banking on the Canada Emergency Wage Subsidy (CEWS), which encourages businesses to restart and qualify for wage subsidies program to pay staff. The program has started bearing fruits, with just 19,767 insolvencies (6,864 bankruptcies and 12,903 proposals) being filed in the second quarter, down 45.4 percent from a year before.

But the CEWS too comes to an end in December. And the Bank of Canada has already predicted full economic recovery is not happening before 2022.

In the meantime, economists have expressed fears that the market hiring appetite has stabilized and will soon plateau due to lack of demand and strict distancing rules amid COVID scenarios.

Continued federal dole outs will carve a hole in the country’s reserves, depleting the national wealth.

If the country manages to avoid a second national lockdown, the economy will grow 6.7 percent in 2021 and 4.8 percent in 2022, predicts national think tank Conference Board of Canada.

But Canada is looking at a protracted growth because the scars from coronavirus will linger, says global market intelligence firm S&P. A string of insolvencies and bankruptcies will continue till 2021 as social distancing rules will limit capacity utilization, that will have a direct impact on the economic growth, it adds.

Under the current pandemic-induces market stress, we seem to have forgotten that Canada was already susceptible to a downturn at the beginning of 2020 due to high household debt, low consumer spending, labor disruptions and plant closures, adds S&P. Saudi-Russia oil price war made things worse.

The road ahead is patchy and bumpy because the nature of coronavirus shock means permanent losses.

Canadian Economy’s Recovery Shape

Canada’s economy is in the midst of the worst recession seen since the Great Depression of 1930s.

Economic recovery will be staggered and divided into stages if monetary policy and federal measures continue being accommodative.

Assuming that Canada successfully avoids a second shutdown coming winter, economic recovery will primarily depend on two factors:

- Demand

- Employment & Purchasing Power

With a bounce in demand, the market will begin to heal and slowly recover the losses accrued so far. But without purchasing power, that is gained through employment, consumer spending will continue to be low.

Every sector has been impacted by the novel coronavirus pandemic.

The pandemic shock to travel, tourism, arts and service sectors will have a long-term effect, making the economy’s road to recovery even more uncertain.

Canada’s banking sector too has been under tremendous pressure as it continues to balance declining asset quality and maintain creditworthiness amid bad loans and increasing demand for lending. The virus has also severely disrupted supply chains, including oil and other commodities, hampering trade with international partners.

COVID-19 has reshaped every industry, the consumer behavior and market future. The road to economic recovery is long and people and businesses have to be patient.

Canada is on the slow mend as the pandemic eases. But amid fears of a second wave of virus cases, fingers are still crossed.