Highlights

- The TSX main equity index has plummeted by about 12 per cent in 2022

- DOO stock was down by nearly 35 per cent from its 52-week high

- GSY stock plunged by about 53 per cent from a 52-week high

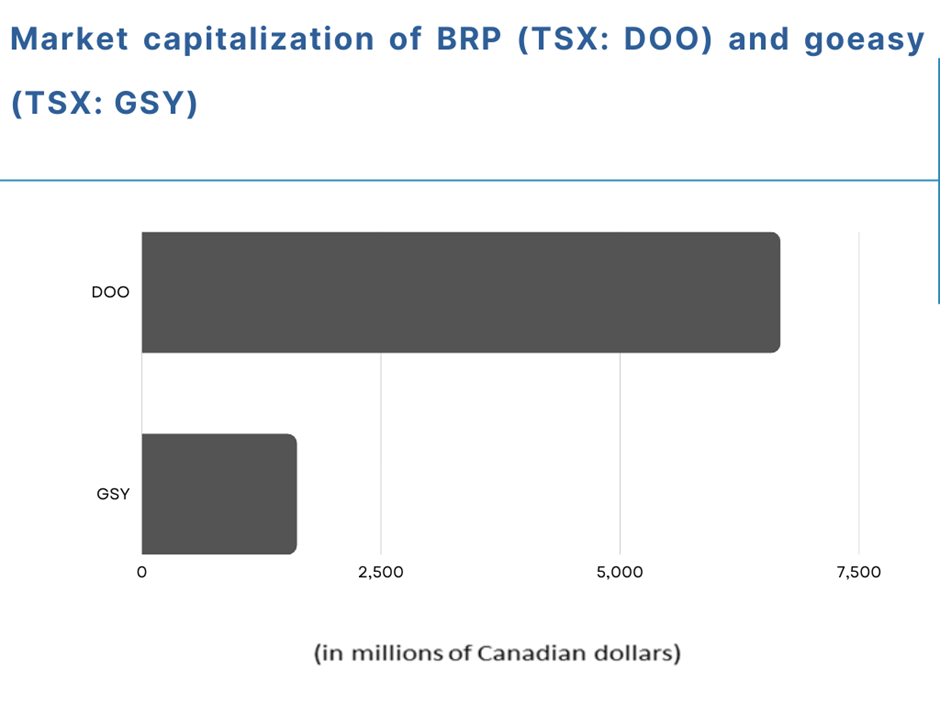

The TSX main equity index has plummeted by about 12 per cent in 2022 amid macroeconomic concerns, which could lead investors to focus on value investing. Investors could consider TSX stocks like BRP (TSX: DOO) and goeasy (TSX: GSY) if they looking for long-term value.

These Canadian companies are acquiring businesses and strategically partnering to strengthen their footprints. Additionally, these companies could enhance your portfolio income by offering quarterly dividend income.

Keeping these points in mind, let us explore these two TSX value stocks.

BRP Inc (TSX:DOO)

Canadian vehicles and parts company BRP announced on Thursday, July 7, that it agreed to acquire a Great Wall Motor subsidiary, Great Wall Motor Austria GmbH, based in China.

In the light of this development, the mid-cap company saw its stock rise by over six per cent to C$ 86.01 on July 7.

However, DOO stock was still down by almost 35 per cent from a 52-week high of C$ 129.98 (September 7, 2021). According to Refinitiv, BRP had a moderate Relative Strength Index (RSI) of 49.23 on July 7.

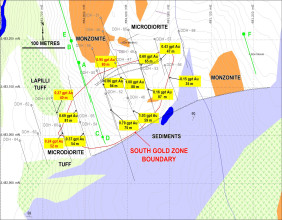

©Kalkine Media®; ©Garis Studio via Canva.com

goeasy (TSX:GSY)

goeasy recently announced a commercial partnership with the nation’s online car shopping platform Canada Drives, which offers door delivery service. Under the agreement, the small-cap financial technology company agreed to acquire a minority equity stake in Canada Drives by investing C$ 40 million.

GSY stock plunged by about 53 per cent from a 52-week high of C$ 218.35 (September 24, 2021). According to Refinitiv findings, GSY stock seems to be on a downward trajectory, with an RSI of around 47 on July 7.

Bottomline

Investors could consider BRP and goeasy stock as these stocks, in addition to the regular dividend, could offer significant value in future when they match or cross their new 52-week high.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.