Highlights

- Investment in value stocks can deliver significant returns to investors.

- However, not all undervalued stocks can fetch high profits. Hence, investors need to evaluate the fundamentals and financials carefully.

- A Canadian financial service company saw its stock price grow by roughly 128 per cent in the past year.

Wise investors often prefer to keep a close eye on value stocks as these can be capable of delivering significant returns over a period of time. Value stocks belong to the companies that are presently undervalued as compared to their actual value.

Value stocks are generally known to be low priced due to certain market setbacks. However, in terms of their fundamentals and financials, it can reflect a relatively healthier picture of their business health.

Also read: Top 5 TSX value stocks to buy

If decided on carefully, value stocks can harness notable returns. On that note, let us explore two TSX-listed value stocks.

Manulife Financial Corporation (TSX: MFC)

Toronto-headquartered financial service provider Manulife Financial Corporation saw its stock close at C$ 24.30 apiece, up by 0.788 per cent, at market open on Monday, November 1.

At this level, it had declined by more than 12 per cent from a one-year high of C$ 27.675 reached on March 18, 2021. It had also plunged by about one per cent in the previous month and decreased by more than 10 per cent in the last six months.

However, MFC stock noted a surge of more than three per cent for the past nine months and a growth of more than 34 per cent for the last twelve months. Moreover, its year-to-date (YTD) return stood at approximately seven per cent.

VersaBank (TSX:VB)

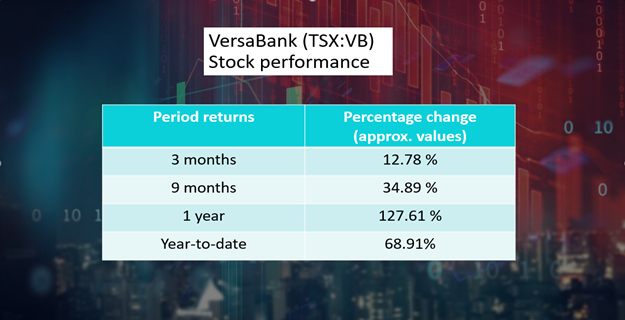

Canadian Schedule I chartered bank VersaBank saw its stock price climb up by 1.488 per cent and close at a value of C$ 15 apiece at market open on November 1.

At this point, it had declined by nearly 15 per cent from the 52-week high of C$ 17.64 it hit on February 25, 2021.

Image source: © 2021 Kalkine Media Inc

The financial stock had, however, spiked by almost eight per cent in the span of a month and grown by nearly 13 per cent in the previous three months.

In the past nine months, VB stock had surged by almost 35 per cent, while marking a one-year return of roughly 128 per cent.

Also read: 2 Canadian penny stocks under $1 to buy in November

Bottom line

Some Canadian value stocks often offer notable returns in the medium to long term. However, not all undervalued stocks can fetch higher profits. Some companies are valued low due to their incapacities to maintain their business profitable.

So, to avoid losses, it is essential that investors go through the company’s fundamentals, financials, growth and expansion plans to evaluate the correct value of the stocks and accordingly invest their money.