Highlights:

- BlackBerry will sell its non-core patent assets in a deal worth US$ 600 million.

- According to the company statement, BlackBerry's products, solutions, and services will remain unaffected due to this transaction.

- BlackBerry is set to receive US$ 450 million in cash after the deal is closed.

BlackBerry Limited (TSX:BB) announced on Monday, January 31, that it will sell its non-core patent assets in a deal worth US$ 600 million. The company will be selling the patents to Catapult IP Innovations Inc., a technology company based in Delaware.

The Canadian cybersecurity and technology company said that the patents essential to its operations are not included in this transaction.

According to the company statement, BlackBerry's products, solutions, and services will remain unaffected due to this transaction. BlackBerry is set to receive US$ 450 million in cash after the deal is closed.

Notably, the remaining US$ 150 million will be in the form of a promissory note. The completion of this deal would be subjected to regulatory conditions in Canada and the United States.

BlackBerry will file a Current Report regarding the patent sale agreement with the Securities and Exchange Commission (SEC) in the US.

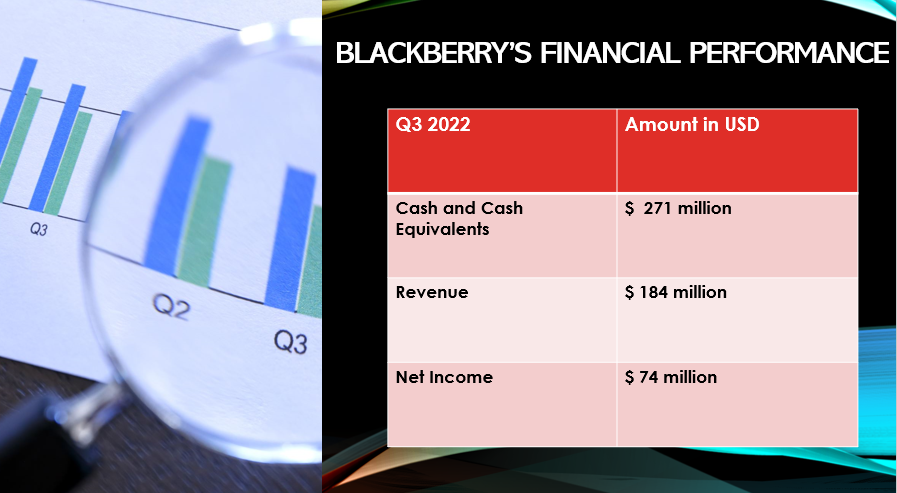

Does BlackBerry (TSX:BB) stock have some potential?

The BlackBerry stock was once very famous among investors as its smartphones became quite popular due to its security and private messenger features.

However, the popularity of the company's smartphones faded away after the rise of Apple's iPhone and Android devices. As a result, the company had to shut down its smartphone business and move to cybersecurity.

Now, BlackBerry is emerging as one the leading providers of intelligent security software to government and non-government customers worldwide.

©2022 Kalkine Media®

©2022 Kalkine Media®

The Ontario-based company uses artificial intelligence (AI) technologies to deliver innovative cybersecurity solutions, and its QNX® software is used by several automakers like BMW, Ford and Mercedes-Benz, among others.

As EVs are expected to become popular in future, BlackBerry could benefit from it and record increased profits. As of June 2021, BlackBerry's QNX® software was embedded in more than 195 million vehicles. This software is used in systems like Advanced Driver Assistance Systems (ADAS), a feature often seen in electric vehicles like Tesla.

Also Read: Tech stocks in 2022: Will they create wealth for investors?

If the patent sale deal is completed, it will strengthen the balance sheet of BlackBerry as it is set to receive US$ 450 million in cash. The company could use the money for further expansion and developing more innovative solutions.

Bottom line

When a group of retail investors on social media platform Reddit started inflating the prices of companies with poor fundamentals, such stocks were called meme stocks.

Companies like BlackBerry, GameStop, and AMC Entertainment witnessed stock price surge despite poor financial performances. However, BlackBerry seems to be more than just a meme stock.

BlackBerry appears to have growth potential as it is working to enter into partnerships with different companies. On January 27, the company announced that Portugal-based Critical Software selected BlackBerry for safety improvements in Portugal's railway network.

Earlier on January 5, BlackBerry announced partnership with PATEO to provide digital cockpit solution for the Chinese market.

Also Read: What’s next for BlackBerry (TSX:BB) stock after Q3 earnings results?