Highlights

- BB stock is gaining investors’ attention ahead of the Q3 2022 earnings report.

- Over the years, BlackBerry has emerged as one of the leading cybersecurity and software companies in the world.

- BlackBerry holds a market capitalization of C$ 6.7 billion.

BlackBerry Limited (TSX:BB), the Waterloo-based cybersecurity company is set to release its financial results for the third quarter of fiscal 2022 and it is gaining investors' attention due to this reason.

On December 7, BlackBerry announced that it would release its earnings reports on December 21, after the end of the trading session.

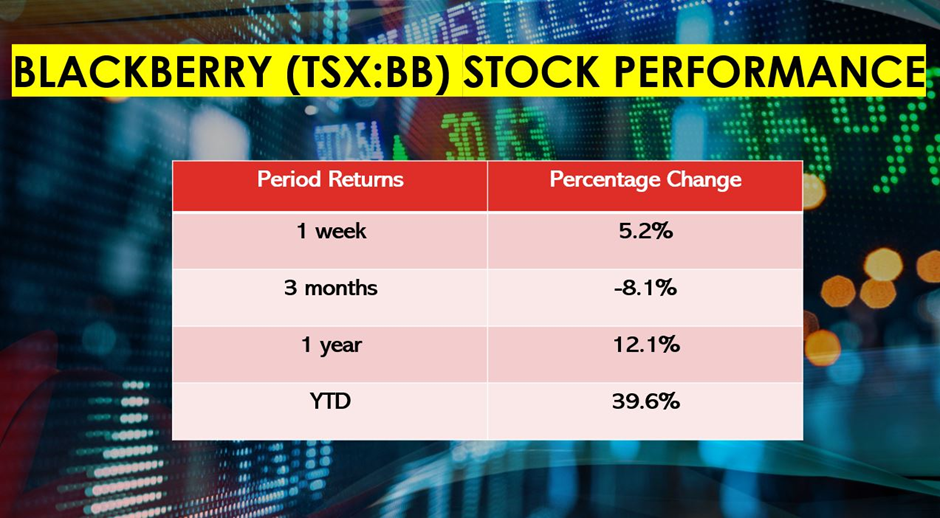

Investors are keeping an eye on the stock of this cybersecurity company, and it experienced renewed investors' attention last week. At market close on Friday, December 17, BB stock was up 5.2 per cent and priced at C$ 11.78 per share.

What's next for BlackBerry (TSX:BB) after Q3 2022 earnings results?

BlackBerry was once very famous across the world due to the high demand for its smartphones. However, the excitement for its phones faded away from the market and the company faced a tough time.

Also Read: Tanium IPO: Can you buy this Kirkland-based cybersecurity firm's stock?

Over the years, BlackBerry has emerged as one of the leading cybersecurity and software companies in the world. Despite its lower stock price, BlackBerry never fails to attract traders and it still holds a market capitalization of C$ 6.7 billion.

© 2021 Kalkine Media®

According to reports, BlackBerry is expected to post revenue growth of one per cent in Q3 2022 and its earnings estimates are in line.

It is believed that after releasing the earnings report, BlackBerry's patent sale will go through in Q4 2022. The cybersecurity company could sell its mobile device, wireless and messaging patent, and the value of this deal could range between US$ 1 billion to US$ 1.6 billion.

If the deal goes through, BB stock is expected to attract investors and its price could surge further in the coming months.

Bottom line

Apart from patents and cybersecurity operations, BlackBerry seems to have a high growth potential due to its involvement in the electric vehicles (EVs) business.

The Waterloo-based company is involved in the EV market as it develops the IVY software in partnership with QNX technology and Amazon Web Services.

Also Read: ForgeRock IPO: How soon can you buy this cybersecurity firm’s stock?

BlackBerry's IVY software is believed to provide the most innovative driving experience and unlock the vehicle's full potential.