Highlights

- Penny stocks may be coupled with more stable stocks of big companies to give a portfolio balance

- These stocks have more than doubled in 12 months

- A stock here has a price-to-earnings ratio of four

Penny stocks are stocks of relatively smaller companies looking to grow. They may be coupled with more stable stocks of big companies to give a portfolio balance.

These sorts of investments are usually highly speculative, so an investor should consider their risk appetite appropriately. However, with volatility also comes the possibility for faster gains.

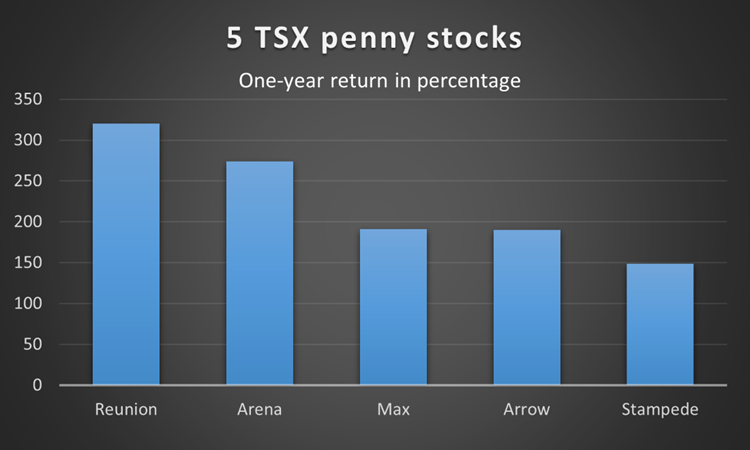

Multibagger stocks are those that have returned over 100 per cent. Here, let’s look at five TSXV stocks that have more than doubled in 12 months.

Reunion Gold Corp (TSXV:RGD)

The miner explores South American assets and its stock closed at C$0.315 Monday, May 30. The stock has gained 320 per cent in 12 months.

In the last week, it has surged 31 per cent and its growth in 2022 stands at 125 per cent. On May 4, the company said it received “strong” drill results from its Oko West project in Guyana.

Arena Minerals (TSXV:AN)

Arena also operates in South America and its stock closed at C$0.58 on Monday. AN has gained 274 per cent in a year and over 18 per cent in the last week.

It is 480 per cent better than it was on June 23, 2021, when it touched a one-year low of C$0.10. Both these stocks do not boast of great valuation metrics. But mining is highly cyclical.

Max Resource Corp (TSXV:MAX)

MAX closed on Monday at C$0.67 and it has surged 191 per cent in one year. Year-to-date (YTD) it has gained 173 per cent.

Its growth over nine months stands at C$283 per cent. On April 6, the company said it found a new copper-silver discovery at its URU project in Colombia.

Also read: BB, VQS, TCS, ABST & MDF: 5 technology stocks for June 2022

Arrow Exploration Corp (TSXV:AXL)

An oil and gas stock, AXL closed on Monday at C$0.29. Its one-year gain stands at 190 per cent and YTD it has returned 152 per cent.

On May 25, it touched a new 52-week high of C$0.335. It is over 13 per cent lower now. Its price-to-earnings (P/E) ratio is four. This means that every four dollars invested, merits one dollar in profit.

Stampede Drilling Inc (TSX:SDI)

The company offers its services in the Western Canadian Sedimentary Basin (WCSB). SDI at market close Monday was at C$0.46.

YTD, it has zoomed 171 per cent almost. Its one-year return stands at 149 per cent. Its P/E ratio is 23.4.

Image source: © 2022 Kalkine Media®

Bottom line

These are multibagger stocks that have returned more than 100 per cent in a year. The S&P/TSX Venture Composite Index has sunk 21.44 per cent YTD and so far, this year, it seems like the bears have ruled.

But these stocks have gained this year. Also, they are the top five TSXV stocks going by one-year returns.

Also read: Can summer cheer boost these 5 TSX midcap stocks?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.