Investments in penny stocks tag along a pack of pros and cons. While it can be truly rewarding for some, for others investing in penny stocks remain highly speculative. This is primarily because share prices of penny stocks can be volatile, either because they are low-valued businesses or due to their vulnerability to market developments.

In this article, you will have a quick glance at two penny stocks - Alumasc Group PLC (LSE:ALU) and Pod Point Group Holdings PLC (LSE:PODP) with details about their performance around recent developments.

Alumasc Group PLC (LSE:ALU)

FTSE AIM All share listed Alumasc Group is involved in production and supply of sustainable building products, solutions, and systems across the United Kingdom. The company runs its business across three divisions: Building Envelope, Water Management, and Housebuilding Products.

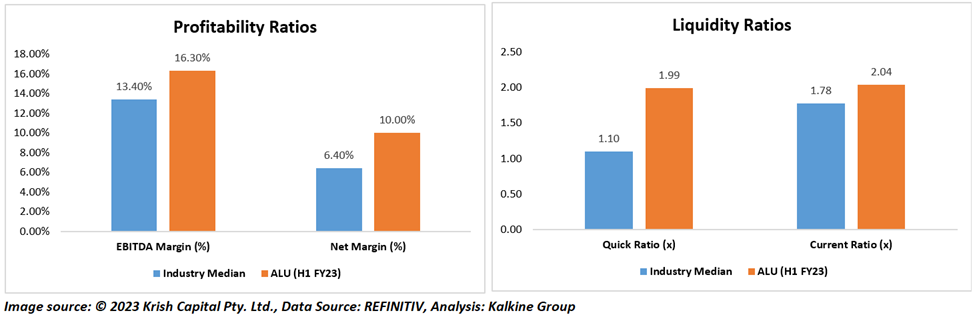

For the first six months of the fiscal year 2023, the company posted a quick ratio at a higher level of 1.23x, against the industry median of 1.10x. ALU’s current ratio stands at 2.04x for H1 FY23, higher than the industry median of 1.78x.

Also, the EBITDA margin in H1 FY23 has been recorded at 16.3% versus the industry median of 13.4%. ALU’s net margin of the group surged to 10.0% during the reporting period, more than the industry median of 6.4%.

The company’s stock price increased by 8.14% in the last three months, while it rose by over 4.7% over the last six months. The stock’s 52-week high and 52-week low price stands at GBX 186.00 & GBX 130.00, respectively.

Pod Point Group Holdings PLC (LSE:PODP)

FTSE All-share Index listed Pod Point Group is a provider of electric vehicle (EV) charging solutions. The UK-based company operates its business across four sections, namely Home, Commercial, Recurring, and Owned Assets.

During the fiscal year 2022, the company secured a revenue of GBP 71.4 million in FY22, marking a 16% growth from GBP 61.4 million in FY21. Also, there was a 3% improvement in the sales from the home segment, 31% in the commercial revenue and 108% in the sales from the Owned Asset segment in FY22.

Notably, the number of home units installed and able to communicate totaled 173,754 units in the reported period, up 43% from 121,415 units in FY21. On the commercial front, the number of units installed and able to communicate increased by 33% to 21,342 units in FY22, versus 16,005 units in FY21.

There has been a drop of about 28.57% in the stock price of the company in the last three months, while it has witnessed a fall of approximately 19.91% over the last six months. The stock’s 52-week high and 52-week low price stands at GBX 119.80 and GBX 46.00, respectively.