Highlights

- Whitecap Resources (TSX:WCP) stock rose by almost six per cent to close at C$ 9.75 on June 28

- The TSX oil and gas company disclosed an agreement to acquire XTO Energy Canada for about C$ 1.9 billion this day

- The midcap company also raised its monthly dividend by 22 per cent to C$ 0.0367

Whitecap Resources (TSX: WCP) stocks rose by almost six per cent to close at C$ 9.75 on Tuesday, June 28, as the company announced its plans to acquire XTO Energy Canada from joint owners Imperial Oil (TSX: IMO) and Exxon Mobile Canada (NYSE: XOM, XOM: US). WCP's stock price jump helped the S&P/ TSX Energy Index gain over four per cent during this session.

Whitecap has said that it is paying about C$ 1.9 billion in total cash consideration and that the transaction is expected to close before the third quarter of 2022.

What is in store for Whitecap and its shareholders?

According to Whitecap, the assets to be acquired cover 672,000 acres of land and currently produce about 32,000 barrels of oil equivalent a day from the Duvernay and Montney formations in northwestern Alberta.

The company said assets under the acquisition would expand its total acreage by over 500 per cent and add 1,772 drilling sites in Montney. Additionally, it would hold 74,000 acres of land with 252 identified drilling sites in ‘prolific’ Duvernay.

This mid-cap energy company said that significant free funds flow from these assets would result in free funds flow per share accretion of 20 per cent in the next two years (2023 and 2024).

Furthermore, Whitecap said that this acquisition provides incremental free funds flow per year of about C$ 200 million, allowing it to raise its monthly dividend by 22 per cent to C$ 0.0367, which is set to be effective from July for the dividend payable in August.

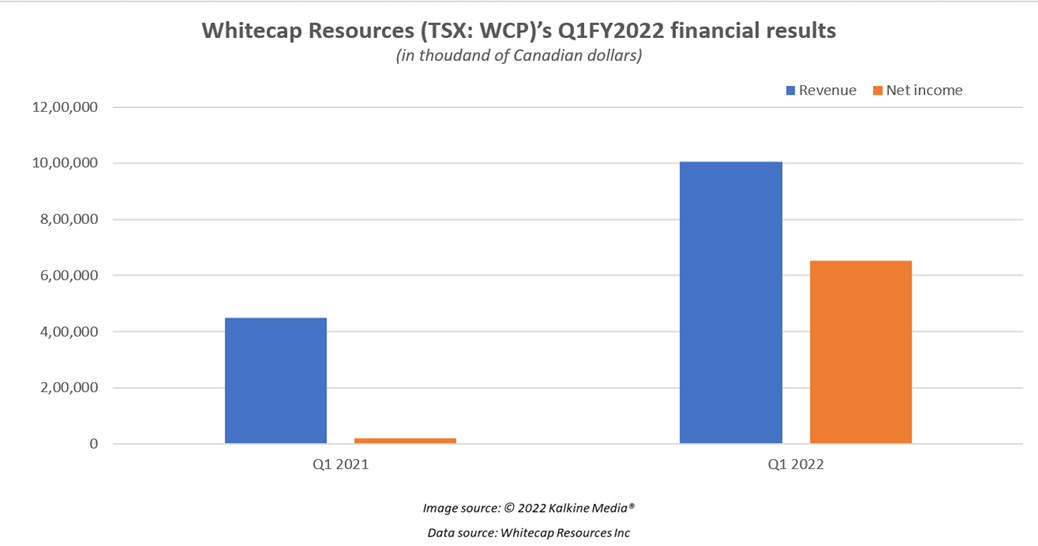

Whitecap Resources Inc (TSX:WCP)’s Q1FY2022 financial results

Whitecap generated revenue of C$ 1 billion in the first quarter of FY2022, significantly higher than C$ 448.89 million in Q12021. As a result, the oil and gas company posted a growing net profit of C$ 652.32 million in the latest quarter compared to C$ 19.63 million a year ago.

The C$ 6-billion market cap firm said its funds flow zoomed to C$ 505.69 million in the first three months of 2022, relatively higher than C$ 187.76 million in Q1 2021.

Whitecap’s stock performance

Whitecap Resources stock fell by nearly 57 per cent year-over-year (YoY). From a 52-week high of C$ 12.71 (June 8), WCP stock was down by over 23 per cent as of writing.

According to Refinitiv data, WCP recently breached its support level this month and appears to be on an upward trajectory with a rising Relative Strength Index (RSI) of 43.61 on June 28.

Bottomline

Apart from expanding its resource portfolio, Whitecap expects to have net debt of C$ 2.1 billion upon closing this acquisition transaction and see it decline to C$ 1.5 billion by the end of 2022. This, the company said, would mark a debt to EBITDA ratio of 0.6 times on current strip pricing.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.