Summary

- On August 7, 2023, the S&P/ TSX Composite Index rose by over 115 basis points and S&P/TSX Capped Industrials Index was higher by 0.74 basis points.

- Waste Connections Inc., a traditional solid waste and recycling services provider, reported a revenue of US$2.021 billion in Q2 2023.

- Algoma Central Corporation, a dry and liquid bulk carrier operator, reported a revenue of CA$202.406 million in Q2 2023.

On August 7, 2023, the S&P/ TSX Composite Index rose by over 115 basis points. Meanwhile, the S&P/TSX Capped Industrials Index was higher by 0.74 basis points on the same day.

The Canadian market’s performance is actively dependent on mining and energy stocks. However, recent financial strength of industrial stocks has once again shed light on this evergreen sector.

ALSO READ: Is it worth looking at these three TSX-listed penny stocks?

The industrial sector is considered to receive active capital inflow as its operations run throughout the year. With that, let us look at two stocks that have recently reported their earnings for Q2 of fiscal 2023. These stocks have also seen an uptick in revenue on a y-o-y basis.

Waste Connections Inc. (TSX: WCN)

Waste Connections provides traditional solid waste and recycling services across North America. It merged with Progressive Waste in 2016, after which it entered the Canadian markets. The stock has a market capitalization of CA$48 billion.

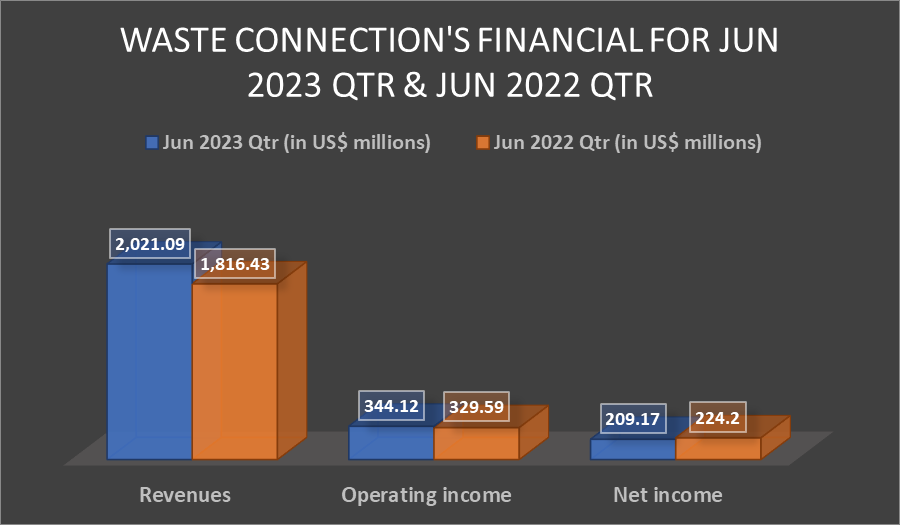

Image source: ©2023 Kalkine®; Data source: Company Reports

Waste Connections recently reported a revenue of US$2.021 billion in Q2 2023, which was higher than its outlook for the quarter and was 11.3% more than the previous corresponding period. Meanwhile, the company’s net income was US$209.2 million and adjusted EBITDA was US$628.9 million in Q2 2023. The EPS for Q2 2023 was US$0.81.

WCN’s full year 2023 revenue guidance is approximately US$8.025 billion, which is US$25 million lower than its original outlook. The reduced outlook reflects a reduction in fuel and material surcharges of US$ 35 million because of lower fuel costs.

However, WCN increased its 2023 adjusted EBITDA outlook for full year 2023 from its original value of US$2.5 billion to US$2.525 billion.

Powered By: TradingView

Based on Monday’s closing price of CA$190.15, WCN has a P/E ratio of 43.67x and a dividend yield of 0.73%. As at the close of trade on August 7, 2023, WCN saw a monthly gain of 2.83% and a YTD gain of 8.06%.

ALSO READ: Three TSX-listed gold stocks to keep an eye on

Algoma Central Corporation (TSX: ALC)

Algoma Central is engaged in the operation of dry and liquid bulk carriers, with its major revenue coming from marine operations. Algoma has a market capitalization of over CA$595 million.

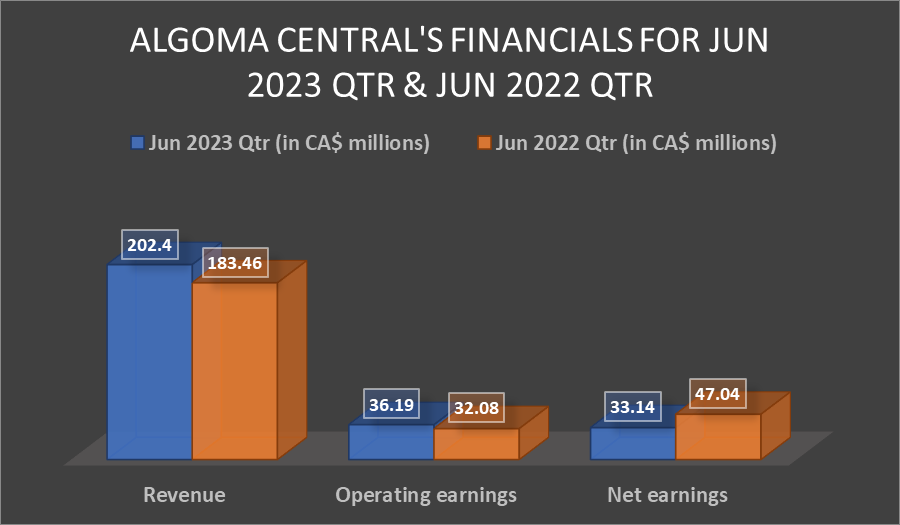

For Q2 2023, Algoma reported a revenue of CA$202.406 million, as compared to CA$183.46 million in Jun 2022 quarter. The company’s net earnings during for the three months ended June 30, 2023, were CA$33.144 million.

Powered By: TradingView

Based on Monday’s closing price of CA$190.15, WCN has a P/E ratio of 43.67x and a dividend yield of 0.73%. As at the close of trade on August 7, 2023, WCN saw a monthly gain of 2.83% and a YTD gain of 8.06%.

ALSO READ: Three TSX-listed gold stocks to keep an eye on

Image source: ©2023 Kalkine®; Data source: Company Reports

At the same time, Algoma generated an EBITDA of CA$65.204 million during the June 2023 quarter. This was higher than previous corresponding period’s EBITDA of CA$61.412 million.

The company has announced a dividend payment of CA$0.18 per common share, which will be disbursed on September 1, 2023 to shareholders of record as on August 18, 2023.

Powered By: TradingView

Based on Monday’s closing price of CA$15.50, ALC has a P/E ratio of 6.05x and dividend yield of 4.65%. As at the close of trade on Monday, August 7, 2023, the stock rose 1.31% intraday and 2.31% monthly.