Summary

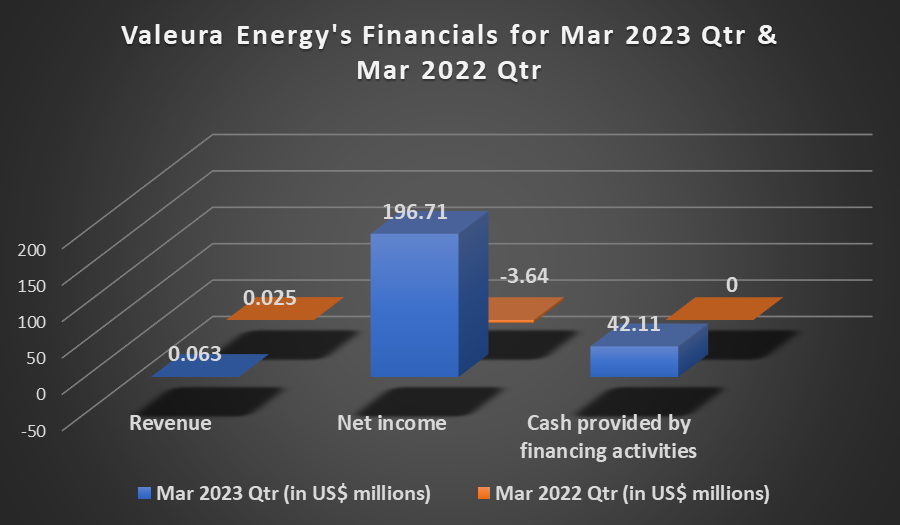

- Valeura Energy Inc. reported a basic EPS of US$2.17 and a diluted EPS of US$2.05 during Q1 2023.

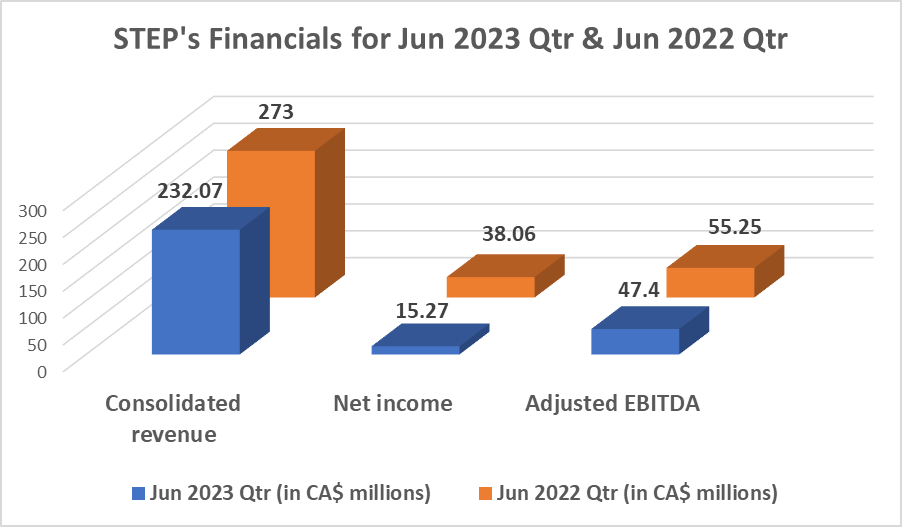

- STEP Energy Services Ltd. reported a consolidated revenue of CA$232 million for the June 2023 quarter.

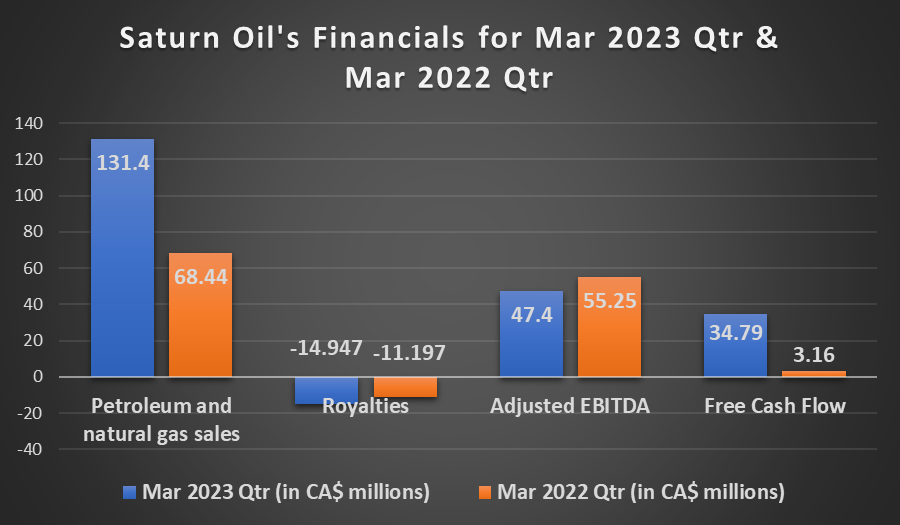

- Saturn Oil & Gas Inc. reported petroleum and natural gas sales of CA$131.4 million in Q1 2023.

With a small initial investment required, penny stocks can be considered an opportunity to earn big. Meanwhile, some of the risks surrounding these stocks include low liquidity, lack of public information and absence of financial track record.

Despite the risks associated with penny stocks, these stocks continue to remain one of the most interesting segments available in the market. These stocks have the potential to offer multifold returns, provided the right selection is made.

On that note, here are three TSX-listed penny stocks that can be looked at:

Valeura Energy Inc. (TSX:VLE)

Valeura, an upstream oil and gas company, has a market cap of CA$242.04 million. The stock closed at CA$2.38 on August 3, 2023.

For Q1 2023, Valeura reported revenue of US$63,000, as compared to US$25,000 in Q1 2022. Meanwhile, the company reported a basic EPS of US$2.17 and a diluted EPS of US$2.05. The total net income for the 2023 quarter was US$196.71 million, compared to a net loss of US$3.64 million in Q1 2022.

Image source: ©2023 Kalkine®; Data source: Company Reports

Meanwhile, the company’s current assets amounted to US$439.24 million for the three months ended March 31, 2023.

Based on Thursday’s closing price of US$2.38, VLE has a P/E ratio of 0.85x. Meanwhile, the stock price saw a YTD increase of 357.69% and a monthly increase of 28.65% as at the close of trade on August 4, 2023.

STEP Energy Services Ltd. (TSX:STEP)

STEP Energy provides fracturing and coiled tubing solutions that are innovative and environmentally responsible. The company has a market cap of CA$284.52 million.

For the June 2023 quarter, STEP Energy reported a consolidated revenue of CA$232 million, which was lower than previous corresponding period’s CA$273 million. Meanwhile, STEP’s net income was CA$15.27 million, which represented a basic EPS of CA$0.21.

Image source: ©2023 Kalkine®; Data source: Company Reports

STEP’s cash and cash equivalents at the end of the June 2023 quarter were CA$5.708 million. It reported an adjusted EBITDA of CA$47.404 million for the 2023 quarter.

Based on Thursday’s closing price of CA$3.94, the stock has a P/E ratio of 2.62x. The stock price rose by 19.76% on a monthly basis but was lower by 26.36% on a YTD basis as at the end of trade on August 3, 2023.

Saturn Oil & Gas Inc. (TSX: SOIL)

Saturn Oil acquires and explores petroleum and natural resources deposits in Canada. It has a market cap of CA$370.15 million.

Image source: ©2023 Kalkine®; Data source: Company Reports

Saturn Oil reported petroleum and natural gas sales of CA$131.4 million in Q1 2023, compared to CA$68.44 million in Q1 2022. The cash flow from operating activities was CA$46.79 million in Q1 2023, as against CA$10.34 million in Q1 2022.

Based on Thursday’s closing price of CA$2.67, SOIL has a P/E ratio of 0.45x. The stock price saw a monthly gain of 21.92% and a YTD increase of 4.3% as at the close of trade on August 3, 2023.

_08_04_2023_17_10_32_619402.jpg)