Highlights

- In Q3 2022, Badger Infrastructure’s gross profit margin rose to 27.4 per cent.

- On June 21, 2022, SNCL completed its acquisition of Flex Process.

- In Q2 2022, Stantec Inc.’s revenue grew by 22.9 per cent to C$ 1.1 billion.

The construction sector had been adversely impacted by COVID-19 lockdowns. But post-pandemic, with the economy in a recovery mode, the sector has seen signs of recovery. The companies had to be adaptive to the changing business models to stay relevant and competitive.

Previously, the construction sector was hampered by several reasons and labor shortage was one of them. Reportedly, Canada’s labor market added 108,000 jobs in October 2022 as the wage gains accelerated. The construction sector contributed to the employment gains which added 24,600 jobs in the month. The net new employment in October 2022 saw a year-over-year gain to 472,000.

Amid all these developments, let us explore five stocks listed below with their recent financial highlights:

-

Badger Infrastructure Solutions Ltd. (TSX:BDGI)

Badger Infrastructure Solutions Ltd. is engaged in providing non-destructive excavating services and is based in North America. Badger Hydrovac is the key technology of Badger Infrastructure. This is used for safe excavation non-destructive excavating services and around critical infrastructure.

In Q3 2022, the gross profit margin of Badger Infrastructure rose to 27.4 per cent compared to 25.7 per cent in Q3 2021. The revenue grew by 20 per cent to US$ 163.5 million compared to US$ 136.2 million for the same comparative period. The adjusted EBITDA also rose to US$ 35.3 million which is an increase of 36.3 per cent from US$ 25.9 million. The net earnings soared to US$ 14.51 million from US$ 9.83 million.

Badger Infrastructure pays a quarterly dividend of C$ 0.165 per share. It has a dividend yield of 2.308 per cent. The EPS (earnings per share) is at C$ 0.18.

-

SNC-Lavalin Group Inc. (TSX:SNC)

SNC-Lavalin Group Inc. is a project management firm and is headquartered in Montreal. The company offers integrated professional services that include procurement, consulting, financing, construction, operations, engineering, and maintenance. The clientele of the company includes industries from infrastructure, project management, engineering design, and nuclear sectors.

In Q3 2022, SNC-Lavalin Group’s revenue was reported at C$ 1.88 billion versus C$ 1.8 billion Q3 2021. The net income was reported at C$ 44.7 million versus C$ 18.6 million for the same period. The company pays a quarterly dividend of C$ 0.02 per share. The EPS was reported at C$ 3.01 with P/E (price to earnings) ratio of 7.80.

On June 21, 2022, SNC-Lavalin Group completed its acquisition of Flex Process.

-

WSP Global Inc. (TSX:WSP)

WSP Global Inc. is engaged in providing design and engineering services to its clients Energy and power, transportation & Infrastructure, Environment, Property, and Buildings Industry sectors. The company operates with an employee strength of 55,000 in four segments-Americas-US and Latin America, Canada, APAC-Asia Pacific, constituting New Zealand, Australia, and Asia, and EMEIA-Europe, Middle East, India, and Africa.

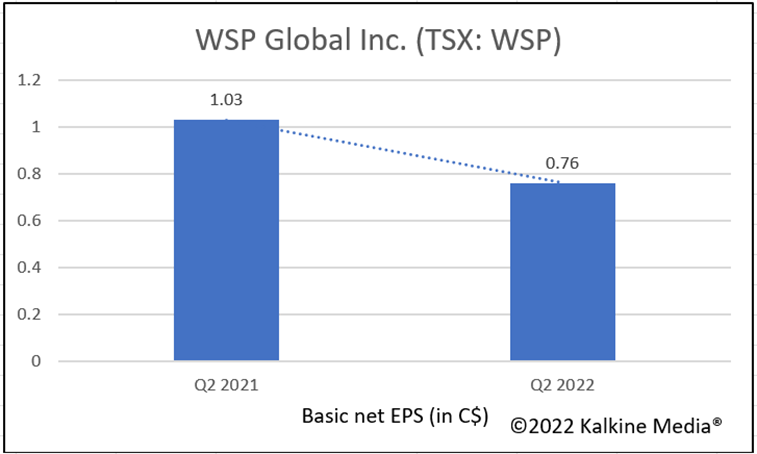

In Q2 2022, the revenues of WSP Global Inc. grew by five per cent to C$ 2.8 billion compared to C$ 2.63 billion in Q2 2021. The adjusted EBITDA jumped to C$ 352.2 million from C$ 342.6 million for the same period. The cash flow from operating activities fell to C$ 125.4 million from C$ 147.4 million in the year-ago quarter.

The net earnings also declined to C$ 89.6 million compared to C$ 120.1 million in the same comparative period. The cash and cash equivalents soared to C$ 621.6 million from C$ 526.8 million.

On September 23, 2022, the WSP announced the acquisition of Capita plc.’s two businesses-GL Hearn Ltd. and Capita Real Estate.

-

Stantec Inc. (TSX:STN)

Stantec Inc. is an architecture, environmental consulting, and sustainable engineering company. The company operates in Canada, the US, and globally offering services in various sectors including environmental services, infrastructure, buildings, water, and energy and resources.

In Q2 2022, the net revenue of Stantec Inc. grew by 22.9 per cent (C$ 208.4 million) to C$ 1.1 billion compared to Q2 2021. The adjusted EBITDA rose by C$ 40.1 million (27.4 per cent) to C$ 186.7 million compared to 16.1 per cent in the prior period. For the same comparative period, the net income decreased by four per cent (C$ 2.5 million) to C$ 60.7 million.

With a dividend yield of 1.104 per cent, Stantec pays a quarterly dividend of C$ 0.18 per share. The dividend growth of the last five years was reported at 7.02 per cent. The EPS is at C$ 1.73.

On October 12, 2022, Stantec signed a letter of intent to acquire L2P.

-

Aecon Group Inc. (TSX:ARE)

Aecon Group Inc. operates in Concessions and Construction and is based in Canada. The Construction segment majorly caters to the transportation sector and includes public and private infrastructure projects. Its concessions segment is engaged in infrastructure projects and their construction, development, and financing.

In Q3 2022, the revenue of Aecon Group was noted at C$ 1,321 million with an increase of C$ 157 million (14 per cent) compared to Q3 2021. The adjusted EBITDA declined and was reported at C$ 92.6 million from C$ 95.5 million for the same period. The gross profit also decreased to C$ 108.2 million from C$ 111.4 million.

There was an increase in the total assets of Aecon which were reported at C$ 3.7 billion from C$ 3.3 billion.

The company reported a dividend yield of 7.798 per cent and pays C$ 0.185 per share to its shareholders on a quarterly basis. The dividend growth in the past three years of Aecon Group was posted at 9.4 per cent.

Bottom Line:

In the recent past, the construction sector has been through a slowdown. With the sector showing a rise. While picking up your stocks, do not depend on a single factor. Try to assess several other factors such as financial performances, company valuations, past performances, etc.

With proper analysis, your portfolio may be less prone to risk in the market. Along with multi-factor checking, add the element of diversification as well. This way, if one stock is prone to loss, the other can make it up for you. The risk is spread out and minimized in the long run.

Additionally, keep a tap on the changing market trends and factors that affect its movements. Being alert is the right way to stay relevant and safe in the market.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.