Summary

- Barrick Gold stocks have gained with gold’s bull run, luring investors seeking safe assets in pandemic markets

- Barrick has little debt, maintains low-cost production, and has paid out consistent dividends, making it an investors’ favorite.

- Hot stock Barrick Gold has surged nearly 57 per cent this year.

Once upon a time, Warren Buffett’s Berkshire Hathaway looked down upon the metal industry, warning investors of the non-income generating assets. But all that changed with the COVID-19 pandemic. For the first time in its decades-long history, Berkshire Hathaway added a gold stock to its portfolio with Barrick Gold Corp (TSX:ABX), the world’s second-largest miner of yellow metal.

The record bullion prices have lured general investors, who are now switching their bets from finance and REITS to the metal sector. Stocks of Barrick Gold have surged nearly 57 per cent year-to-date and investors expect it will further soar with the continued rally in gold prices.

Barrick Gold Corp’s Allure

Founded in 1980 by Peter Munk, the company started in the fossil fuel segment and went by the name Barrick Petroleum Corporation. It debuted on the Toronto Stock Exchange in 1983. Slowly, the company began acquiring mines and formally adopted the name Barrick Gold Corporation in 1995. At the time, it had just one mission: become the largest gold producer of North America.

Over time, the metal miner fulfilled its mission, establishing itself among the world's largest and most profitable gold producers.

Today, the company has expanded its gold and copper mining operations, with presence in thirteen nations including America, Canada, Africa, Papua New Guinea and Saudi Arabia.

READ: 3 Trending Gold Stocks on TSX

Barrick Gold Corp’ Businesses Across World

(Details as on January 1, 2020/ Source: Barrick Gold Corp)

Barrick Gold Corp’s Financials

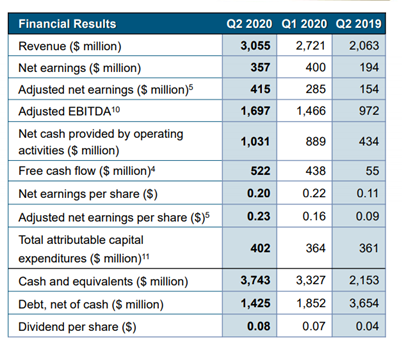

Barrick Gold’s second quarter 2020 earnings report exceeded all expectations. The company posted US$ 3 billion revenue, up from US$ 2 billion in Q2 2019. Net earnings surged by US$ 163 million year-over-year (YoY) to touch US$ 357. Free cash flow increased by whopping 840+ per cent YoY, from US$ 55 million in Q2 2019 to US$ 522 million in Q2 2020.

Net debt in Q2 2020 went down 25 per cent quarter-over-quarter to USD 1.4 billion, with no significant public debt maturities till 2033.

Riding on the back of solid quarterly earnings and high gold prices, Barrick Gold distributed increased quarterly dividend of US$ 0.08 per share in the second quarter of 2020, up 14 per cent QoQ.

Barrick Gold Corp’s Financial Results At A Glance

(Source: Barrick Gold Corp)

Barrick’s Production Forecast For Gold

(Source: Barrick Gold Corp)

Barrick’s Production Forecast For Copper

(Source: Barrick Gold Corp)

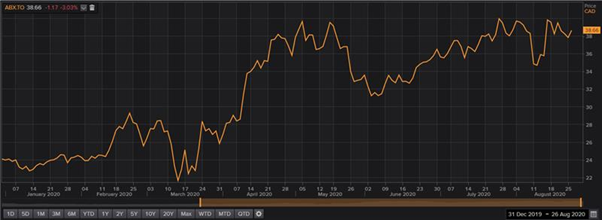

Barrick Gold’s Stock Performance

Unlike most gold miners, Barrick has little debt, maintains low-cost production, and has paid out consistent dividends. These facts bode well in the equity markets, as investors make a beeline for its stocks.

The company has seen various cycles of the stock markets – from the dotcom bubble of 2000s to the financial crisis of 2007 to 2008. It weathered many market blows, emerging victorious in the long run.

Barrick Gold stocks have advanced by nearly 57 per cent this year amid pandemic market. The stocks have yielded 2.82 per cent quarter-to-date returns. The day Berkshire Hathaway announced its stake in Barrick, the scrips jumped by 12 per cent (August 17), leading to a rally in gold markets on the TSX.

The company’s current valuation is C$ 68.7 billion with an earnings per share of C$ 3.30. Its current dividend yield is 1.11 per cent.

Here are some fundamental stats of the stock:

52-week High: C$ 41.09

52-week Low: C$ 17.52

P/E Ratio*: 35.70

P/B Ratio*: 2.37

P/Cash Flow Ratio*: 13.77

Enterprise Value/Revenue*: 5.51

Enterprise Value/EBITDA*: 9.84

EBITDA / Interest Expense*: 9.03

EBITDA / Capital Expenditure*: 6.61

Return on Equity*: 23.41 %

Return on Assets*: 14.13 %

Return on Invested Capital*: 8.7 %

Dividend Yield*: 0.78 %

FOCF Yield*: 3.61

Dividend Growth (3-year): 16.43

Dividend Growth (5-year): 5.00

10-Day Average Volume: 5.33 million

30-Day Average Volume: 5.022 million

50-Day Average Volume: 4.9 million

* Last Twelve Month (As on 30 June, 2020) / Data from Refinitiv, Thomson Reuters.

Barrick Gold Corp Stock’s YTD Performance

(Source: Refinitiv, Thomson Reuters)

Outlook of Barrick Gold Corp Stock

Driven by investors’ hunt for safe assets amid unprecedented fiscal situations created by the COVID pandemic, spot gold prices surged to an all-time high of US$ 2,073 per ounce in August 2020.

Bullion’s rally has been supported by a pandemic that rages on, high fiscal debt, and simmering geopolitical tensions between US and China. Analysts believe gold could surge as high as US$ 3,000 per ounce in the coming months.

Meanwhile, the US is inching closer to the November presidential polls. Canada could also head for polls in September, subject to the House confidence vote of Liberal’s post-pandemic recovery plan. In short, markets will see more volatility and the gold rally will continue.

Investors are drawn to companies with structural advantages that can escape market crashes and seek higher prices. Barrick Gold, with its strong earnings and zero debt, seems to be checking all the tick boxes for investors.