Highlights

- The Canadian benchmark index seems to be going through a rough patch amid rising concerns over the omicron variant of COVID-19.

- The S&P/TSX composite index fell by nearly one per cent on Wednesday, December 1, with most sectors in red.

- The financial sector, however, grew almost two per cent on December 1 as top banks in Canada continued to release their latest earnings reports and hike dividends.

The Canadian benchmark index seems to be going through a rough patch amid rising concerns over the omicron variant of COVID-19.

The S&P/TSX composite index fell by nearly one per cent on Wednesday, December 1, with most sectors in red.

The financial sector, however, grew by almost two per cent on December 1 as top banks in Canada continued to release their latest earnings reports and hike dividends.

Also read: RBC (RY) hikes dividend by 11%, National Bank's (NA) up 23%. Buy call?

Let us have a look at some Canadian bank stocks.

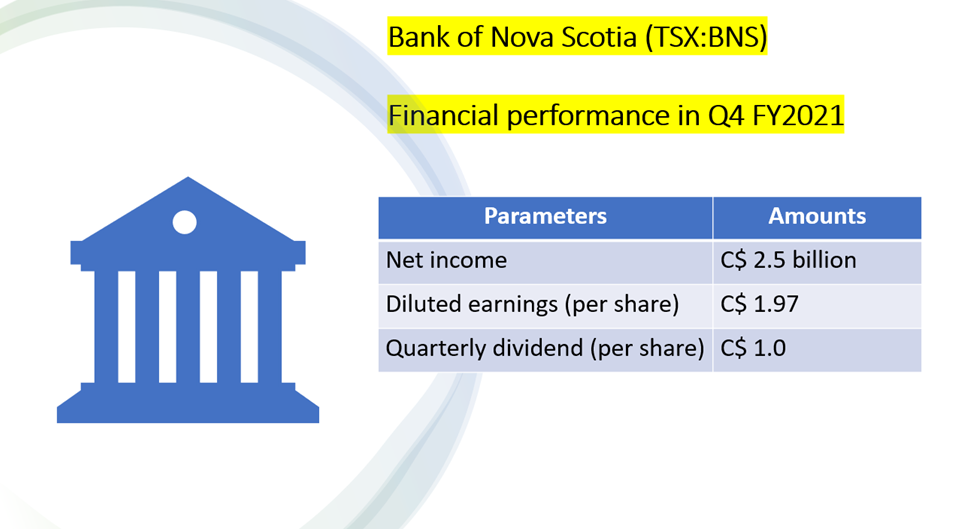

Bank of Nova Scotia (TSX: BNS)

Bank of Nova Scotia, also known as Scotiabank, posted net income of C$ 2.5 billion in the fourth quarter of fiscal 2021, up from that of C$ 1.8 billion in the same quarter year ago. Its diluted earnings per share increased to C$ 1.97 in the latest quarter, as compared to C$ 1.42 in Q4 FY2021.

The bank also announced a quarterly dividend of C$ 1 per share, which will be payable on January 29, 2022, marking a year-over-year (YoY) rise of 11 per cent.

Image source: © 2021 Kalkine Media Inc

Data source: Bank of Nova Scotia

In FY2021, BNS reported net income of C$ 9.9 billion, which was significantly up from C$ 6.8 billion a year ago.

The bank stock jumped by almost six per cent in the past six months and expanded by nearly 27 per cent in the last year. Its stock clocked a 52-week high of C$ 83.99 on November 25, 2021.

After hitting a day high of C$ 83.4, BNS stock closed at C$ 82.51 apiece on December 1, up by more than three per cent.

It had a market capitalization of C$ 100 billion and a return on equity (ROE) of 14.11 per cent on Thursday, December 2.

1. Royal Bank of Canada (TSX: RY)

Royal Bank of Canada, which holds a market capitalization of C$ 179 billion, is one of the top Canadian lenders.

The bank saw its earnings surge by 20 per cent YoY to C$ 3.9 billion in the fourth quarter of fiscal 2021, primarily due to low provision for credit losses (PCL). Its earnings before provision and tax rose by four per cent YoY to 4.8 billion in the latest quarter.

RBC also hiked its quarter-based dividend to C$ 1.2 per share, up by 11 per cent. Payable on February 24 next year, its ex-dividend date is January 25, 2022.

RY stock zoomed by more than 20 per cent so far this year. The bank stock clocked a day high of C$ 128.14 on December 1, before closing at C$ 125.74 apiece.

It held a price-to-earnings (P/E) ratio of 11.9 and an ROE of 18.68 per cent on December 2.

Also read: Can Canada’s Big Six banks be gearing up for epic dividend hikes?

Bottom line

Canadian bank stocks are often the preferred by investors due to the lenders’ robust financials and fundamental background. The top bank stocks also provide regular dividend payouts, which can be another helpful factor to look at.