Summary

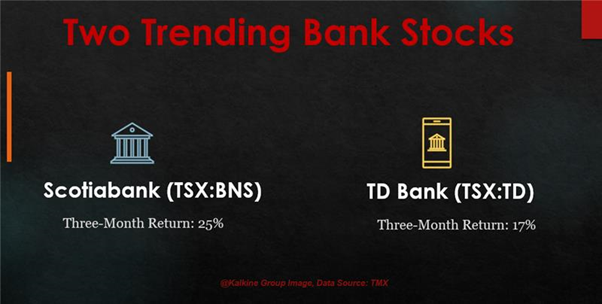

- Bank of Nova Scotia scrips have soared 25 per cent in the last three months. The blue-chip stock has a positive return on equity (ROE) of 10.11 per cent.

- Toronto-Dominion stocks have increased by 17 per cent in the same period. The stock offers an ROE of 13.17 per cent.

- Both bank stocks have outperformed the benchmark index in the last three months.

Canada’s biggest banks reported better than estimated quarterly earnings in the first week of this month. The S&P/TSX Capped Financial Index has gained over 14 per cent the last three months on the back of strong stimulus support signals from the federal government amid the ongoing pandemic. Bank stocks are rebounding from their COVID-19 led March slumps.

Let us delve into the following trending banking stocks that are leading the rebound rally:

Bank of Nova Scotia (TSX:BNS)

Current Stock Price: C$ 67.87

The Canadian bank stocks have consistently been a part of TMX’s top price performers with the largest gains across the TSX and the TSXV in the last 30 days. The lender stocks are up nearly 25 per cent in the last three months and has recovered by almost 45 per cent from its March lows. The blue-chip firm pays a quarterly cash dividend of C$ 0.90 per unit, with a substantial current dividend yield of 5.304 per cent.

The bank stock also ranks among TMX’s top volume and top financial stocks. Its 10-days average stock trading volume stands at approximately 5 million units. Its present market cap is C$ 82 billion.

The units offer a positive return on equity (ROE) of 10.11 per cent and earnings per share (EPS) of C$ 5.43. The stock has a price-to-earnings (P/E) ratio of 12.50 and a present debt-to-equity ratio of 0.17 as per TMX data.

Scotiabank’s Global Banking and markets registered record adjusted earnings of C$ 2,034 million in 2020, an increase of 33 per cent, representing strong performance in trading, lending, and underwriting operations. The lender recorded a net income of C$ 1,899 million in Q4 2020 against C$ 2,308 million in the same period the prior year.

Toronto-Dominion Bank (TSX:TD)

Current Stock Price: C$ 71.50

TD stocks have surged over 17 per cent in the last three months. This bank stock has also rebounded over 45 per cent from its March meltdown. The asset management giant has a current dividend yield of 4.42 per cent. The Board of Directors approved a quarterly cash dividend of C$ 0.79 per stock.

The lender stock is also placed among TMX’s top financial services and top volume stocks. The blue-chip stock has a 10-day average trading volume of 6.23 million units.

The bank stock offers an EPS of C$ 6.42 and a positive ROE of 13.17 per cent. Its P/E ratio is 11.20, and the P/B ratio is 1.445 as per TMX data.

In the fourth quarter of 2020, the bank registered an adjusted net income of C$ 2,970 million, versus C$ 2,946 million in Q4 2019. Due to the latest rise in COVID-19 cases, the bank is projected a downside risk to the interim Canadian outlook.