Summary

- TD offered diluted earnings per share of C$ 6.43 for fiscal 2020 versus C$ 6.25 for fiscal 2019.

- BMO delivered earnings per share of C$ 7.55 in FY20, against C$ 8.66 in FY19.

- RY posted a diluted EPS of C$ 7.82 in the financial year 2020, a decline of 11 per cent year-over-year.

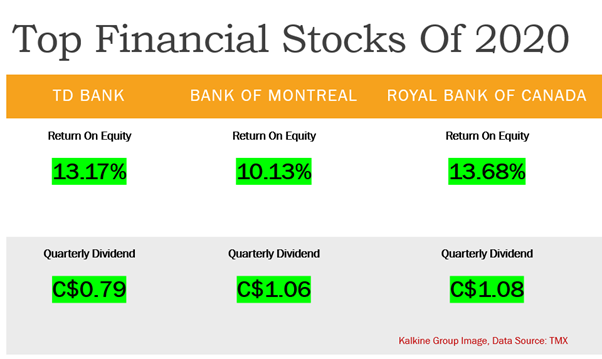

- All three financial stocks offer a double-digit return on equity.

Canadian bank stocks, which recently released their fourth-quarter financial reports, have been trending in the markets since Monday. Most top banks posted better than expected earnings report, despite the impact of the pandemic and the subsequent credit loss provisions that depleted profits.

In this article, we will analyze the following three trending Canadian Banks’ performances in 2020: Toronto-Dominion Bank, Bank of Montreal, and Royal Bank of Canada.

Toronto-Dominion Bank (TSX:TD)

The largest Canadian bank registered diluted earnings per share of C$ 6.43 for fiscal 2020, compared with C$ 6.25 per share for fiscal 2019. The bank reported a net income of C$ 11,895 million in FY20, against C$ 11,686 million in FY19.

Its global economic outlook for 2021 projected that if the COVID-19 vaccine is widely reached everyone by the summer, the Bank anticipates global real GDP to bounce back by 6.2 per cent in calendar 2021.

The stock has recovered by over 44 per cent from its March lows. The blue-chip stock is trading up by nearly 13 per cent in the last three months. However, the stock is slightly down by almost 3 per cent year-to-date (YTD).

Its current market cap stands at approximately C$ 129 billion.

The banking stock provides earnings per share (EPS) of C$ 5.61 and present price-to-earnings (P/E) ratio of 13.70. The stock offers a positive return on equity (ROE) of 13.17 per cent, and its price-to-book (P/B) ratio is 1.485, as per the TMX website.

The lender holds a current dividend yield of 4.448 per cent. The bank pays a quarterly cash dividend of C$ 0.79 per stock. Its three-year dividend growth is 8.85 per cent.

TD is ranked among TMX’s top price performers that have outperformed the TSX and TSXV with the highest gains in the last 30 days.

Bank of Montreal (TSX:BMO)

One of the leading banking leaders registered a net income of C$ 5,097 million in FY20, compared with C$ 5,758 million in FY19.

The bank offered EPS of C$ 7.55 in FY20, against C$ 8.66 in FY19, as per its exchange filing.

The company maintained an uncertain forward-looking stance due to the ongoing COVID-19 pandemic.

BMO stocks have soared nearly 21.5per cent in the last three months. However, the banking stock has marginally declined by 3 per cent year-to-date (YTD). The blue-chip stock has rebounded by over 73 per cent from its March lows.

Its current market cap is nearly C$ 63 billion.

Its current price-to-earnings (P/E) ratio is 12.80. The stock provides an ROE of 10.13 per cent, and its price-to-book (P/B) ratio is 1.259, as per TMX data.

TD also made it to TMX’s top price performers stocklist.

The bank has a current dividend yield of 4.354 per cent. It distributes a quarterly cash dividend of C$ 1.06 per stock. Its present three-year dividend growth stands at 13.28 per cent.

Royal Bank of Canada (TSX:RY)

The bank’s net income was C$ 11,437 million for the financial year ended October 31, 2020, a decline 11 per cent from the prior financial year. Diluted EPS was C$ 7.82 in the financial year 2020, a fall of 11 per cent year-over-year.

The lender stocks have regained by nearly 46 per cent from its March lows. RY stocks have added approximately 10 per cent growth in the last three months. The financial stock has improved by almost 2.5 per cent YTD.

RY’s present market cap is C$ 150.54 billion.

The stock delivers earnings per share of C$ 7.84, and its current P/E ratio is 13.50. The stock offers a return on equity of 13.68 per cent, and its price-to-cashflow ratio is 1.10. Its price-to-book ratio is 1.864, as per the TMX portal.

The bank is offering a current dividend yield of 4.086 per cent. The Board of Directors approved a quarterly cash dividend of C$ 1.08 per stock for its unitholders. Its three-year dividend growth stands at 7.30 per cent.

The stock seems to finish its 2020 at a high note as it is placed highly on the TMX’s following stocklists: Top price performer, Top Volume, and Top Financial.

The stock is trading actively with a 50-day average volume of 4.66 million units. The lender has surpassed its peers with the largest price gains across the TSX and TSXV in the last 30 days.