Summary

- Soaring bad loans amid the pandemic has forced big Canadian banks to create significant provisions for credit losses (PCL).

- The Toronto-Dominion Bank’s provision for credit loss was C$ 2.18 billion in its third quarter, while Bank of Montreal set aside C$ 1.05 billion.

- TD Bank stocks have recovered almost 10.4 per cent since the pandemic-led market collapse on March 20.

- Bank of Montreal’s stocks have surged 34 per cent since the pandemic-led market crash.

The Canadian economy is set to contract by 7.1 per cent in 2020, according to the International Monetary Fund (IMF) projection. Bank of Canada’s latest Business Outlook Survey suggests that the business sentiment is pessimistic across regions and sectors due to the impact of the coronavirus pandemic. Despite the gloomy outlook, Canadian banks have managed to survive the pandemic-led market crash and are witnessing a slow recovery. To better understand this, let us look at two Canadian bank stocks – the Bank of Montreal (TSX:BMO) and the Toronto-Dominion Bank (TSX:TD).

Soaring bad loans amid the pandemic forced both the big Canadian banks to create significant provisions for credit losses (PCL). Bank of Montreal set aside C$ 1.05 billion in third-quarter 2020, an increase of 244 per cent compared to C$ 306 million in Q3 2019. The Toronto-Dominion Bank’s PCL figure swelled to C$ 2.18 billion in its third quarter, up 232 per cent as compared to C$ 655 million in Q3 2020. The S&P/TSX Capped Financial Index, with 26 constituents, is currently down over 14 per cent this year.

Bank of Montreal (TSX:BMO)

Current Stock Price: C$ 80.94

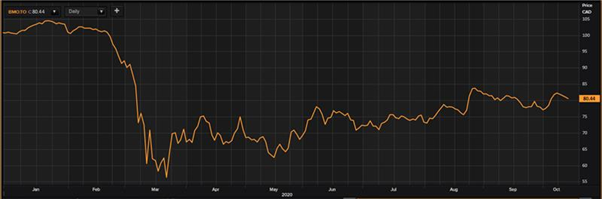

Bank of Montreal’s stocks have lost over 19 per cent value year-to-date (YTD). Since the pandemic-led market collapse on March 20, the stocks have bounced back 34 per cent. In the last three months, BMO stocks have gained 7.3 per cent.

This Canadian bank has a current market cap of C$ 51.4 billion. It paid out a quarterly dividend of C$ 1.06 on November 26, 2020. The stocks have a current dividend yield of 5.23 per cent.

Bank of Montreal’s Year-To-Date Stock Performance; Source: Refinitiv, Thomson Reuters

The banking stock’s profit-to-earnings (P/E) ratio is 11.50. The BMO stock provides return on equity (RoE) of 9.44 per cent and return on assets of 0.49 per cent. The profit-to-book (P/B ratio) is 1.057, and its earnings per share (EPS) is 7.06, as per the TMX Money data.

In the third quarter of the current fiscal year, the lender reported net income of C$ 1232 million, a dip of nearly 20.9 per cent compared with C$ 1557 million in Q3 2019. Reported earnings per share was C$ 1.81, a plunge of 22.6 per cent compared with C$ 2.34 in Q3 2019. The total revenue was C$ 7,189 million, down over 165 per cent from C$ 19,200 in the previous year.

Bank of Montreal is a multinational investment bank offering diversified financial services across the business facets such as wealth management, capital markets, commercial, corporate, governmental, international, personal banking, and trust services.

Toronto-Dominion Bank (TSX:TD)

Current Stock Price: C$ 60.03

One of the largest Canadian banks, Toronto-Dominion Bank has a current market cap of C$ 108.9 billion. The bank stocks are down nearly 17.6 per cent YTD. The scrips gained back almost 10.4 per cent since the pandemic-led market collapse on March 20. In the last six months, the TD stocks are up 5.40 per cent.

The bank pays quarterly dividend of C$ 0.79 (to be issued on October 31, 2020). The stocks currently hold a dividend yield of 5.26 per cent.

The Toronto-Dominion Bank operates in general banking segment across Canada and abroad. The banking leader works in the following three business facets: Canadian retail banking, U.S. retail banking, and wholesale banking. It owns a 42 per cent stake in TD Ameritrade, a discount brokerage.

The banking giant’s last 10-day average volume stands at 10.37 million. TD stocks’ price-to-earnings (P/E) ratio is 11.70, profit-to-book (P/B ratio) is 1.255, and earnings per share (EPS) is 5.16, as per the TSX key data. It provides return on equity (RoE) at 10.75 per cent and return on assets at 0.58 per cent.

In the third quarter of the current fiscal year, the TD posted a net income of C$ 2,248 million, a dip of nearly 30.8 per cent compared with C$ 3,248 million in Q3 2019. Adjusted diluted earnings per share were C$ 1.25, down from C$ 1.79 in Q3 2019. The revenue dipped to C$ 10665 million from 66.46 per cent compared to C$ 31802 in the previous year. The bank’s reported earning was $2.2 billion while the price-earnings ratio was stayed flat at 11.1 in Q3 2020 and Q3 2019.

The TD Economists forecast a 4.3 per cent decline in the global real gross domestic product (GDP) this year.

The bank recently received the most innovative digital banking award for second consecutive year by Global Finance.