Highlights

- Stocks of Scotiabank (TSX:BNS) and Royal Bank of Canada (TSX:RY) are gaining attention in the Canadian markets amid the trucker protests, especially following the invocation of the Emergency Act on Monday, February 14.

- The federal government’s latest move has extended banks and other financial institutions the power to freeze accounts and suspend insurances without a court order for anyone involved in the trucker blockades.

- Scotiabank (BNS) noted a trading volume of 2.3 million shares, and RBC (RY) reported a daily volume of 4.9 million shares on Monday.

Stocks of Scotiabank (TSX:BNS) and Royal Bank of Canada (TSX:RY) are gaining attention in the Canadian markets amid the trucker protests, especially following the invocation of the Emergency Act on Monday, February 14.

The federal government’s latest move has extended banks and other financial institutions the power to freeze accounts and suspend insurances without a court order for anyone involved in the trucker blockades.

Let us see how these top two Canadian lenders have been doing amid these developments.

Bank of Nova Scotia (TSX: BNS)

BNS stock, which climbed over 30 per cent year-over-year (YoY), closed at nearly C$ 93 apiece on Tuesday after noting a trading volume of 1.87 million shares.

On February 9, Scotiabank inked a 15-year agreement with Evolugen to purchase 100 per cent of renewable energy produced by the solar energy project (40 megawatts) in Alberta to minimize its carbon emission.

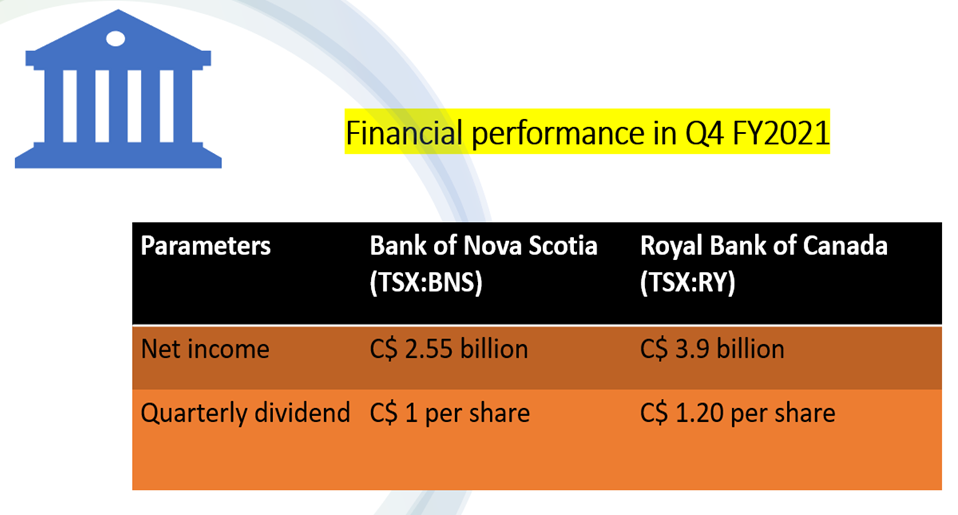

Scotiabank earned a profit of C$ 2.55 billion in Q4 FY2021, as compared to C$ 1.89 million in Q4 FY2020.

Also read: Canada Emergencies Act: Cryptos come under ‘terrorist financing’ laws

The Toronto-headquartered bank pays its shareholders a quarterly dividend (currently C$ 1 apiece). It will release its Q1 FY2022 earnings on March 1.

Royal Bank of Canada (TSX: RY)

RY stock gained roughly 37 per cent in the past 12 months and closed at C$ 145 apiece on Tuesday, posting a daily trading volume of 1.64 million shares.

The C$ 206-billion market cap bank is scheduled to disclose its first-quarter earnings for fiscal 2022 on February 24.

The bank is also set to dole out a quarterly dividend of C$ 1.20 apiece on February 24, up from the previous dividend of C$ 1.08 paid on November 24 last year.

Royal Bank saw its Q4 net income increase by 41 per cent YoY to C$ 16.1 billion in 2021.

Image source: © 2022 Kalkine Media®

Bottomline

In addition to the emergency power, the Canadian government is also expanding its anti-money laundering rules to monitor crowdsourcing platforms, including crypto, to follow the money trail linked to the protests.

Investors targeting bank stocks should note any such changes in the market and monitor economic parameters like inflation to try and avoid losing their money.

Also read: Inspirato going public or is it a publicly traded company?

Please note, the above content constitutes a very preliminary observation or view based on industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.