Highlights

- Tax-Free Savings Account (TFSA) owners are known to enjoy significant tax-free returns on their savings or any other income based on their TFSA contribution room.

- A midstream energy company mentioned here has a three-year dividend growth rate of 42.61 per cent.

- A C$ 60-billion market cap telecom operator listed below raised its annual dividend for 2022 by 5.1 per cent to C$ 3.68 apiece.

Tax-Free Savings Account (TFSA) owners are known to enjoy significant tax-free returns on their savings or any other income based on their TFSA contribution room.

Inventors who are yet to reach the maximum limit on their TFSA account can explore adding some quality dividend-paying stocks that can provide growing tax-free income in the future years.

Here are some TSX-listed options:

1. Enbridge Inc (TSX: ENB)

The midstream energy company has a three-year dividend growth rate of 42.61 per cent. In December last year, the C$ 110-billion market cap energy giant raised its quarterly dividend by three per cent to C$ 0.86 apiece, which is now scheduled for March 1.

Enbridge expects its 2022 EBITDA to stand between C$ 15 billion and C$ 15.6 billion. The North American company also expects its distributable cash flow in the range of C$ 5.2 and C$ 5.5 (on a per-share basis).

On January 26, Enbridge agreed to collaborate with Lehigh Cement to advance its carbon capture, utilization and storage solutions for its cement manufacturing facility in Alberta.

Enbridge stock clocked a new 52-week high of C$ 54.75 and closed at a value of C$ 54.59 apiece on Wednesday, February 2, with 22.7 million shares exchanging hands.

This energy infrastructure scrip galloped by nearly 24 per cent in the last one year.

Also read: ATS Automation's (ATA) Q3 profit soars 23%. An industrial stock to buy?

2. BCE Inc (TSX: BCE)

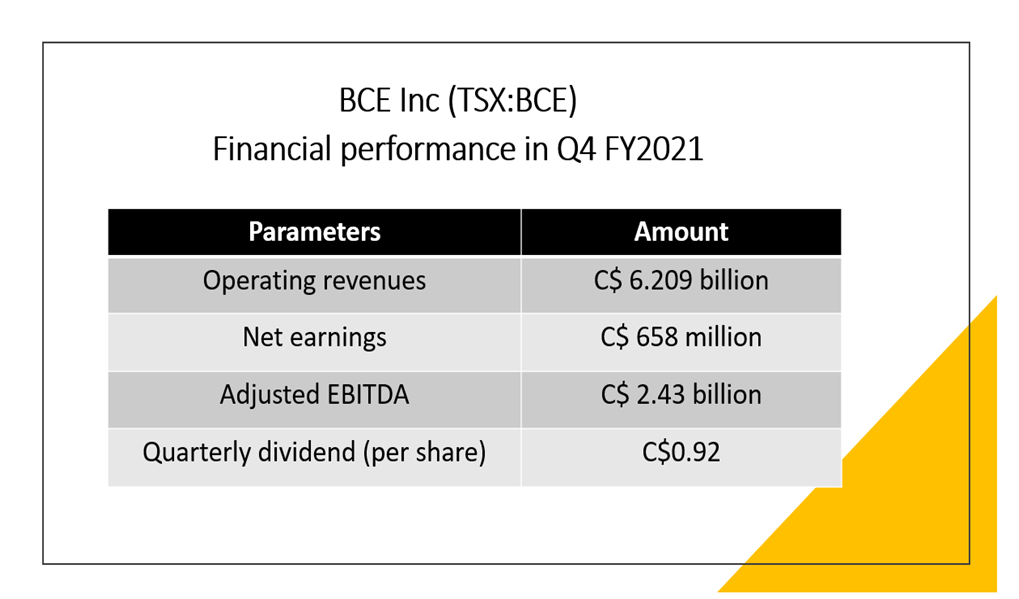

BCE is one of the biggest communication companies in Canada. The C$ 60-billion market cap telecom operator posted a dividend yield of 5.23 per cent on Wednesday.

The Montreal-based company saw its fourth-quarter operating revenues total at C$ 6.2 million in fiscal 2021, representing a 1.8 per cent increase year-over-year (YoY).

Although the telecom company noted a YoY decline of 29.4 per cent in its net earnings of C$ 658 million in the latest quarter, it raised its annual dividend for 2022 by 5.1 per cent to C$ 3.68 apiece.

BCE is scheduled to dole out a quarterly dividend of C$ 0.92 on April 15.

Image source: © 2022 Kalkine Media®

Data source: BCE Inc

BCE stock closed at C$ 66.84 apiece on Wednesday, with a trading volume of 2.7 million. The communication stock grew by over 21 per cent in the past one year.

Bottomline

Interest rate hikes, tech stock selloffs and the coronavirus pandemic may continue to affect stock markets in the near future. However, with some quality stocks going at a discount, this could be a chance for long-term investors to add them to their TFSA basket.

Also read: Resolute (RFP) & Western Forests (WFP): 2 lumber stocks to buy