Highlights

- ATS Automation (TSX:ATA), one of the top industrial companies in Canada, saw its stocks clock a 52-week high of C$ 53 on Tuesday, February 1.

- The Cambridge, Canada-based automation company is known to offer fully integrated automation solutions tailored to the need of its customers across various markets, such as life science, transportation, etc.

- ATS stock galloped by nearly 137 per cent YoY.

ATS Automation (TSX:ATA), one of the top industrial companies in Canada, saw its stocks clock a 52-week high of C$ 53 on Tuesday, February 1.

This surge in its stock price came prior to the release of its latest earnings report, which came out on Wednesday morning.

The Cambridge, Canada-based automation company is known to offer fully integrated automation solutions tailored to the need of its customers across various markets, such as life science, transportation, etc.

Also read: Imperial Oil (IMO) records profit of $813M in Q4. An oil stock to buy?

Let us take a glance at ATS' financial performance for the third fiscal quarter that ended on December 26 last year.

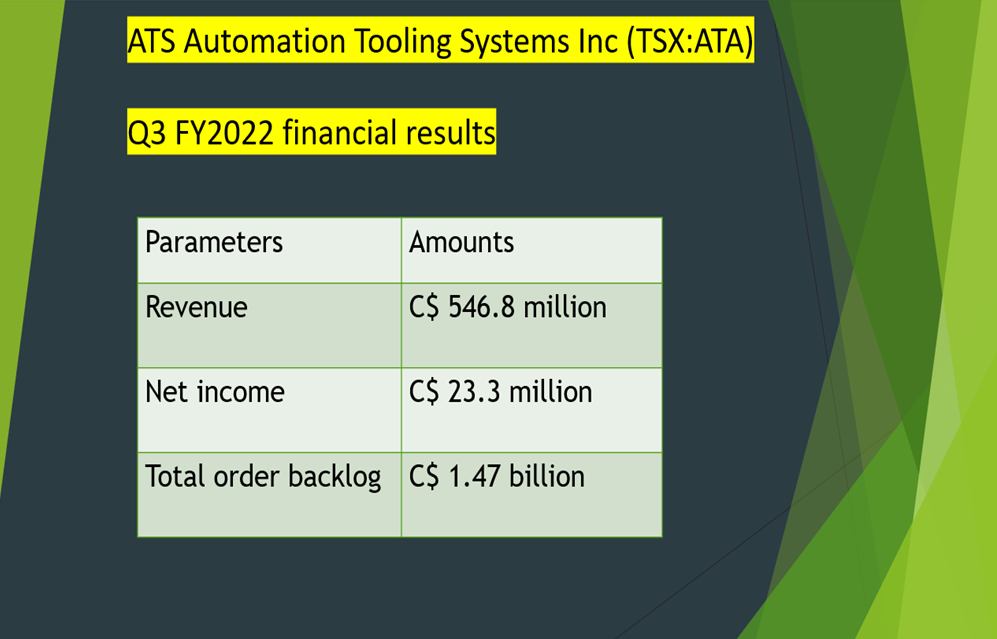

ATS Automation (TSX: ATA) Q3 FY2022 financial results

The Canadian automation company realized C$ 546.8 million in revenues in the latest quarter, which was up 47.9 per cent year-over-year (YoY).

ATS saw its profit stand at C$ 23.3 million in Q3 FY2021, as compared to C$ 18.9 million in the corresponding period of FY2021. This YoY profit surge of 23.3 per cent YoY, the company said, was mainly driven by increased earnings from operations.

The C$ 4.8-billion market cap company saw a total order backlog of C$ 1.47 billion as of December 26, 2021, as compared to C$ 985 million a year ago.

Image source: © 2022 Kalkine Media®

Data source: ATA Automation Tolling Systems Inc

ATS (TSX:ATA) stock performance

ATS stock galloped by nearly 137 per cent YoY.

The automation stock closed at C$ 52.99 apiece on Tuesday, having gained over five per cent year-to-date (YTD).

Bottomline

ATS Automation has stated that the pandemic-led global supply chain crisis increased lead time and costs associated with certain materials and components.

However, the company noted that it has significantly alleviated these disruptions.

The automation company has added that it is focused on realizing costs and revenue synergies by integrating its acquired businesses.

Also read: Top 5 TSX growth stocks to watch in February