Highlights:

- Canadian Natural Resources (CNQ) has a market cap of C$ 83.06 billion.

- BCE Inc. (BCE) paid a quarterly dividend of C$ 0.92 per share.

- Adjusted EBITDA of BCE Inc. in Q3 2022 was C$ 2,588 million.

Most investors prefer dividend stocks because they provide a steady stream of income. Dividend stocks are those companies that pay out a portion of their profits to shareholders regularly. There is a general perception that dividend-paying companies are stable, growth-oriented, and always prioritize their shareholders.

However, the present situation in the stock market is different. This year has probably seen the most volatility in the equity market. Investors are wary of putting their money in any kind of stock this year, as some of the top sectors and popular stocks plunged badly, causing huge losses to investors.

Amid this discussion, we look at two dividend stocks- Canadian Natural Resources Limited (TSX:CNQ), and BCE Inc. (TSX:BCE) and their recent performances:

Canadian Natural Resources Limited (TSX:CNQ)

Canadian Natural Resources is among western Canada’s largest oil and natural gas producers. It has operations in the North Sea and offshore Africa. The C$ 83.06 billion company deals in light and medium oil, heavy oil, synthetic oil, bitumen, natural gas, and natural gas liquids.

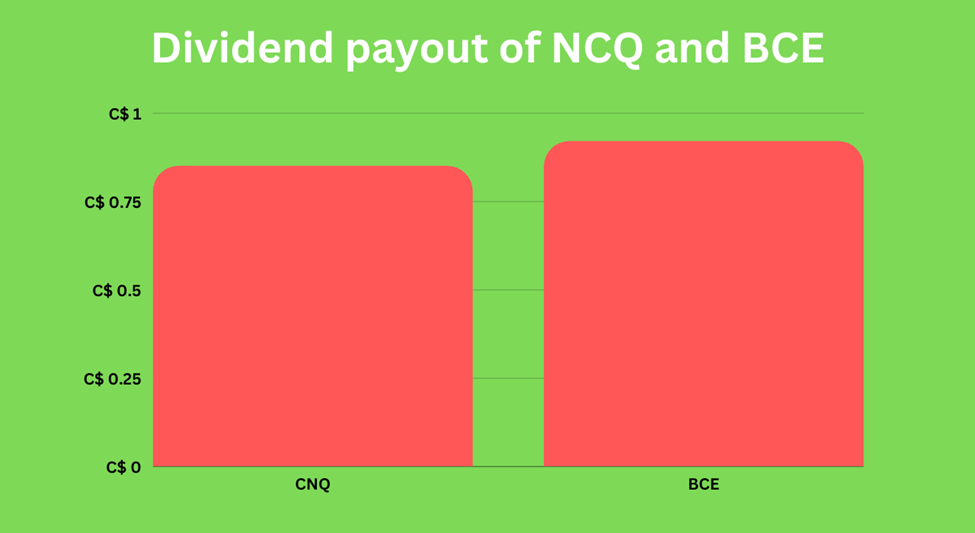

With a dividend yield of 4.532 per cent, the company announced a quarterly dividend of C$ 0.85, which is next payable on January 5, 2023.

In the quarter that ended September 30, 2022, Canadian Natural Resources reported net earnings of C$ 2,814 million lower than C$ 9,417 million in the same comparable period in 2021.

Despite this, the company mentioned in its Q3 2022 results that it has managed to reduce its debt while maintaining a strong balance sheet and financial flexibility. It’s net capital expenditure in the reported quarter was C$ 1,249 million versus C$ 4,154 million in the year-ago quarter.

BCE Inc. (TSX:BCE)

BCE is a wireless as well as an internet service provider that captures 30 per cent of the market in Canada. It offers a range of services including wireless, broadband, television, and landline phone facilities in the country. BCE has a market valuation of C$ 58.04 billion among the three national carriers.

The dividend of BCE Inc. is 5.782 per cent, and the company announced a quarterly dividend of C$ 0.92 per share. The next payable date is January 16, 2023 and its three-year dividend growth was 4.38 per cent as of writing.

In the third quarter of fiscal 2022, BCE reported net earnings of C$ 771 million, which fell by 5.2 per cent compared to C$ 813 million in the year-ago quarter.

Meanwhile, its adjusted EBITDA in Q3 2022 was C$ 2,588 million versus C$ 2,558 in the same comparable period the year ago. The company’s free cash flow was C$ 642 million in the reported quarter compared to C$ 566 million in the same quarter in 2021.

Kalkine Media® / Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line

As an investor, it is a challenging time with so many macroeconomic headwinds causing volatility in the equity market. However, with a long-term strategy and in-depth analysis of companies’ financials, traders can protect their portfolios until the situation becomes normal again. So, do thorough market research before investing your money until the volatility subsides.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.