Highlights:

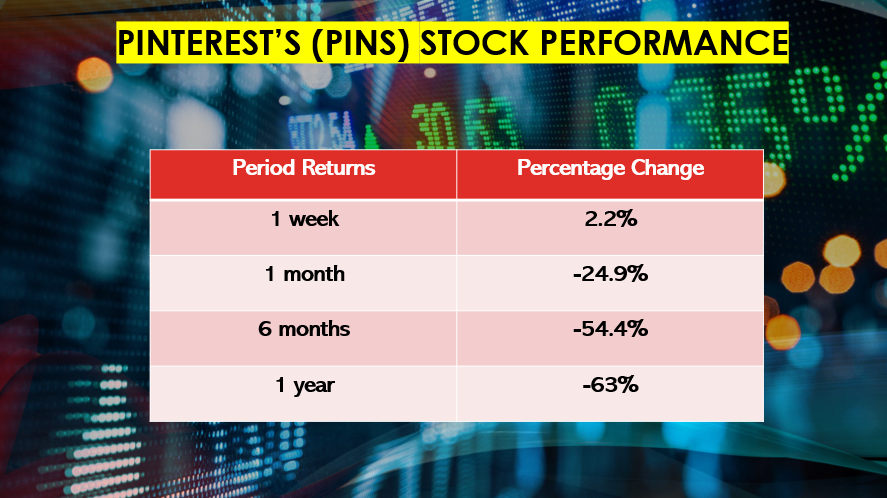

- PINS stock price has been declining, and it fell 63 per cent in the last 12 months.

- Pinterest is expected to announce its financial results for the fourth quarter of the fiscal year 2021 on Thursday, February 3.

- In Q3 2021, Pinterest's revenue surged 43 per cent year-over-year (YoY) to US$ 632.9 million.

Stocks of Pinterest Inc. (NYSE:PINS) were down about eight per cent during pre-market hours before the company's earnings release. At the end of the trading session on Wednesday, February 2, the PINS stock had declined around nine per cent to close at US$ 27.33 per share.

Pinterest is an image sharing and social media service, and it appears to be popular among millennials. The company is expected to announce its financial results for the fourth quarter of the fiscal year 2021 on Thursday, February 3, after the market closes for the day.

Why is PINS stock declining?

It is being reported that Pinterest's top executives continue to leave the organization, and this week its Chief Revenue Officer Jon Kaplan has reportedly left the organization.

Mr Kaplan has been with Pinterest since 2016, and he had previously worked with companies like Google.

Published reports claim that Bill Watkins is set to replace Jon Kaplan, and he is Pinterest's chief of small-business sales.

©2022 Kalkine Media®

©2022 Kalkine Media®

In the last several weeks, many top executives have reportedly left the organization, and the PINS stock could be declining due to this reason.

The exodus comes after Evan Sharp, co-founder of Pinterest, stepped down from his position and joined LoveFrom, a design company launched by former Apple executive Jony Ive.

Also Read: Has BuzzFeed (BZFD) stock 'recovered' after nosediving since its debut?

Mr Sharp served as the chief creative and design officer and part of Pinterest's board of directors. According to reports, he continues to serve the company's board.

Apart from employees leaving the company, the Pinterest stock could also be declining due to the uncertain market since the beginning of this year. Investors are wary of taking risks amid reports that the Federal Reserve could hike interest rates next month.

Bottom line

PINS stock price has been declining, and it fell 63 per cent in the last 12 months. Pinterest's shares have plunged about 25 per cent year-to-date (YTD).

If the market uncertainty continues, it appears that the stock could continue to face turbulent times. On February 2, the PINS stock ended the day 69.6 per cent lower in comparison to its 52-week high of US$ 89.9 per share on February 16, 2021.

In Q3 2021, Pinterest's revenue surged 43 per cent year-over-year (YoY) to US$ 632.9 million. Meanwhile, it posted a net income of US$ 93.99 million in comparison to a net loss of US$ 94.2 million in Q3 2020.

Notably, the adjusted EBITDA surged 117 per cent YoY to US$ 201.4 million in Q3 2021.

Also Read: Is Discord IPO finally happening?