Highlights

- Xebec Adsorption Inc.’s revenue in Q2 2022 was reported at C$ 44.5 million compared.

- Algonquin distributed a quarterly dividend of US$ 0.181 per share.

- Polaris recently announced completing its third acquisition of an operational hydro project.

The approach of world economies is changing as they are making a shift towards green energy amid rising greenhouse gas emission concerns. The impact of this shift can be seen in clean energy stocks.

Meanwhile, Prime Minister Justin Trudeau has also guaranteed that Canada meets its latest climate target. The next target for emission reduction is 2030 which requires Canada to get emissions down by 55 to 60 per cent.

As an investor, keep a close watch on the factors governing the market. Let’s explore a few green stocks and look at their recent performances:

Xebec Adsorption Inc. (TSX:XBC)

Xebec Adsorption Inc. is engaged in manufacturing and designing products that are used for dehydration, purification, and separation of gases and compressed air.

In Q2 2022, Xebec Adsorption’s revenue was C$ 44.5 million compared to C$ 32.7 million in Q2 2021. The adjusted EBITDA of the company increased to C$ 12 million from C$ 5.2 million in the same period in 2021.

For the quarter that ended June 30, 2022, the net debt of Xebec Adsorption Inc. decreased to C$ 37.8 million from C$ 43.4 million on December 31, 2021. In the same period, the assets and liabilities increased to C$ 190.4 million and C$ 154.5 million from C$ 166.8 million and C$ 85.8 million respectively.

For the June 2022 quarter, Xebec announced a PSA supply agreement with Haffner Energy for the cost-effective production of green hydrogen.

Ballard Power Systems Inc. (TSX:BLDP)

Ballard Power Systems Inc. deals in proton exchange membrane fuel cell and the development of power systems. Principally, the company is into manufacturing sale and service and developing PEM fuel cell products.

In Q2 2022, the total operating expenses for Ballard Power Systems Inc. rose by 58 per cent and were posted at US$ 38.5 million compared to Q2 2021. In addition, the cash operating costs also increased by 59 per cent and were noted at US$ 32 .1 million for the same comparative period.

In the June 2022 quarter, the company saw a decrease in its cash reserves, which were noted at US$ 1,004.6 million as against US$ 1,246.8 million in the year-ago quarter.

On May 9, 2022, BLDP made a declaration about its strategic collaboration with Bravo Transport Services Limited, Templewater Group, and Wisdom Motor Company Limited, to speed up the adoption process of fuel cell commercial vehicles.

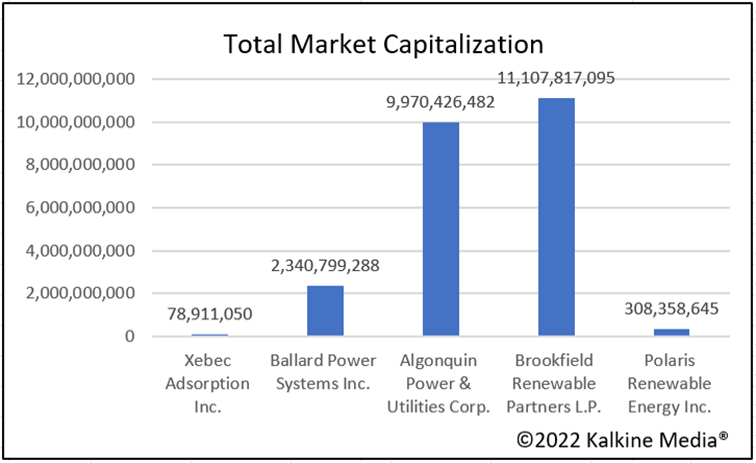

The below graph depicts the total market capitalization of the mentioned stocks.

Algonquin Power & Utilities Corp. (TSX:AQN)

Algonquin Power & Utilities Corp. is a diversified distribution utility. There are two business groups under the company- the Renewable Energy Group and the Regulated Services Group. Further, the company is engaged in offering cost-effective, safe, and reliable water and energy solutions.

In Q2 2022, the total revenue of Algonquin Power grew by 18 per cent and was reported at US$ 624.3 million compared to US$ 527.5 million in Q2 2021. The adjusted EBITDA also increased by 18 per cent to US$ 289.3 million relative to US$ 244.9 million in the corresponding quarter in 2021.

In the same comparative period, the adjusted net earnings witnessed an increase of 19.7 per cent and were noted at US$ 109.7 million.

Further, Algonquin announced a quarterly dividend of US$ 0.181 to the shareholders. The five-year dividend growth was reported at 8.85 per cent. The earnings per share (EPS) was US$ 0.39.

On August 16, 2022, the company’s subsidiary Liberty LLC completed its acquisition of Sandhill Advanced Biofuels, LLC.

Brookfield Renewable Partners L.P. (TSX: BEP.UN)

Brookfield Renewable Partners L.P. is a multi-technology owner and operator of clean energy assets. Storage facilities, the solar, wind, and hydroelectric are a part of the company's portfolio.

As of June 30, 2022, the cash and cash equivalents grew to US$ 823 million from US$ 764 million on December 31, 2021. For the same period, there was an increase in the assets too which were reported at US$ 57,030 million from US$ 55,867 million.

There was an increase in the revenue for Brookfield Renewable Partners L.P. which was posted at US$ 1,274 million in Q2 2022, compared to US$ 1,019 million in Q2 2021.

Brookfield Renewable Partners paid a quarterly dividend of US$ 0.32 to its shareholders, and its dividend yield is 4.083 per cent.

On October 11, 2022, Brookfield Renewable Partners L.P. along with Cameco Corporation declared their strategic partnership with a further plan of acquiring Westinghouse Electric Company.

Polaris Renewable Energy Inc. (TSX:PIF)

Polaris Renewable Energy Inc. deals in hydroelectric and geothermal energy products. Further, it is into the acquisition, exploration, development, and operation of these projects.

For the quarter that ended June 30, 2022, Polaris Renewable Energy generated US$ 15.2 million in revenue. For the same comparative period, the adjusted EBITDA also grew to US$ 11.2 million from US$ 10 million a year ago.

On September 7, 2022, the company made an announcement regarding its completion of the third acquisition of an operational hydro project in Ecuador.

Bottom Line:

While analyzing your clean energy and hydrogen stocks, go beyond the solvency and other financial ratios. Focus on the vantage view and understand the core idea behind it. Moreover, your portfolio should not be devoid of diversification as it is crucial.

The rising concerns over greenhouse gas emissions have made investors more alert. Also, it has given a reminder of the need to make a shift to clean sources. This increasing dependence on clean energy sources may be a vital factor to look for in the long run.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.