Highlights

- Some assets traded on the stock market carry a lower level of capital risk, and some come along with a higher risk.

- BCE is one of Canada's largest communications services providers and serves around 10 million customers.

- Sun Life is among Canada's big insurance companies and has customers in North America and Asia.

The stock market is volatile and despite the prospect of multiplying the money, investing in the market is inherently risky. This is something that all investors should keep in mind.

Some assets traded on the stock market carry a lower level of capital risk, and some come along with a higher risk. Investors with a low-risk tolerance choose to put their money into assets with a better track record in the stock market.

Also Read: 5 top TSXV clean tech and life sciences stocks to buy in June

Therefore, we have selected five stocks that appear safe in the present economic situation. Let's look at them:

BCE Inc. (TSX:BCE)

Despite rising inflation, it is highly unlikely that people would stop using telecommunication services. BCE is one of Canada's largest communications services providers and serves around 10 million customers.

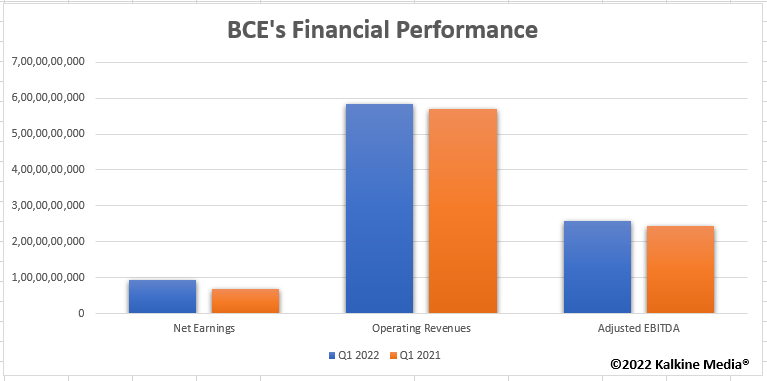

BCE provides a 5G network, and as it is expected to boom in future, the company could benefit from it. Notably, in Q1 2022, BCE's net earnings grew to C$ 934 million, representing an increase of 36 per cent from the same period of the previous year.

Also, the company claimed that it became the first major operator to provide 3 Gbps symmetrical speeds. Investors could also consider the BCE stock for its dividend yield of 5.4 per cent if they are looking for steady passive income.

Royal Bank of Canada (TSX:RY)

One of the largest banks in Canada, Royal Bank is known for its returns to shareholders and continues to remain on the list of top stocks in the country.

Compared to its 52-week high of C$ 149.59 per share, the RY stock is currently trading at a discounted price. On Friday, the bank stock had closed at C$ 131.95 apiece.

Notably, Royal Bank of Canada had announced a quarterly dividend of C$ 1.28 per unit to shareholders, which is a significant amount for a passive income-generating stock. Also, it has a dividend yield of about 3.9 per cent, and its dividend has grown 5.6 per cent in the last five years.

Sun Life Financial Inc. (TSX:SLF)

Some analysts believe that when interest rates rise, financial companies benefit from them and exploring their stocks might be an option for retail investors.

Sun Life is among Canada's big insurance companies and has customers in North America and Asia. The company recently announced the completion of its acquisition of DentaQuest, a dental benefits provider.

In Q1 2022, the insurance sales were worth $799 million compared to $730 million in Q1 2021. Meanwhile, the reported earnings per share were $1.46 in the first quarter of this year.

Enbridge Inc. (TSX:ENB)

Enbridge is one of the largest oil and gas companies in Canada, and its stock attracts the attention of investors throughout the year. ENB is one of the top volume active stocks, and on June 3, 5.3 million ENB shares had exchanged hands on the Toronto Stock Exchange.

At market close, the ENB stock had closed at C$ 58.93 per share, and it holds a dividend yield of 5.8 per cent. Notably, the market cap of Enbridge is C$ 119.4 billion.

In Q1 2022, Enbridge's cash provided by operating activities was C$ 2.9 million, up from C$ 2.6 billion in the first quarter of 2021.

Loblaw Companies Limited (TSX:L)

Due to rising consumer prices, Loblaw might benefit from it as it is a consumer defensive company. It is a major supermarket, pharmacy, and general merchandise retailer in Canada, with the largest store footprint in Ontario and a significant presence in Quebec and British Columbia.

Recently, the consumer company completed Lifemark Health Group's acquisition to expand its presence in the healthcare sector. On June 3, the L stock had climbed around two per cent and closed at C$ 117.63 per share.

Also Read: Can Cenovus (TSX:CVE) be next Suncor as it restarts West White Rose?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.