Highlights

- Canadians can prepare themselves for retirement by making regular investments and holdings stocks in their Tax-Free Savings Account (TFSA).

- A stock mentioned here swelled by about 622 per cent in 12 months.

- A company listed below announced a 20 per cent base dividend increase starting from dividend declaration in June.

Canadians can prepare themselves for retirement by making regular investments and holdings stocks in their Tax-Free Savings Account (TFSA). All income earned in the TFSA, be it interest, dividend, or capital gains, are known to be tax-free.

Investors can begin their investment journey from 18 years of age and above. One way to do that would be by including TSX stocks in their TFSA portfolio.

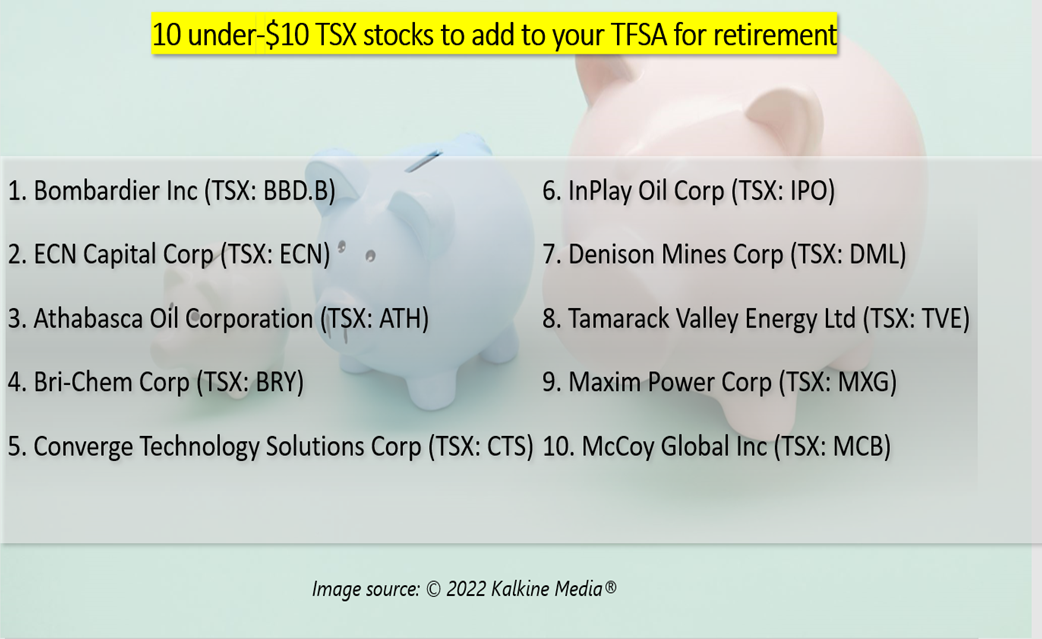

So, let us discuss 10 under-C$10 TSX stocks that you can add to your TFSA for your retirement life.

1. Bombardier Inc (TSX: BBD.B)

Bombardier Inc recently designated its Wichita facility as its new US headquarters. The facility accommodates an expanding service centre for its complete family of business jets, including Learjet, Challenger, and Global and will continue to operate as a flight test centre.

Bombardier’s net income significantly zoomed to US$ 238 million in Q4 FY2021 compared to a loss of US$ 337 million posted in quarter of 2020.

Bombardier’s stock shot up by about 41 per cent in 52 weeks.

2. ECN Capital Corp (TSX: ECN)

ECN Capital Corp is a Toronto-based credit service company. The C$ 1.4 billion market cap company recorded originations of US$ 300 million in quarter of FY2021 compared to US$ 197 million a year ago.

It posted an adjusted EBITDA of US$ 28.8 million in Q4 FY2021, up from C$ 11.4 million in the same period of the previous year.

The financial service company saw its net profit reach US$ 913.3 million in the latest quarter against a loss of US$ 29.5 million incurred in Q4 2020. It also had a dividend yield of nearly one per cent as of writing.

Stocks of ECN Capital jumped by roughly 90 per cent in 12 months.

Also read: 8 reasons why you can save your retirement income in TFSA

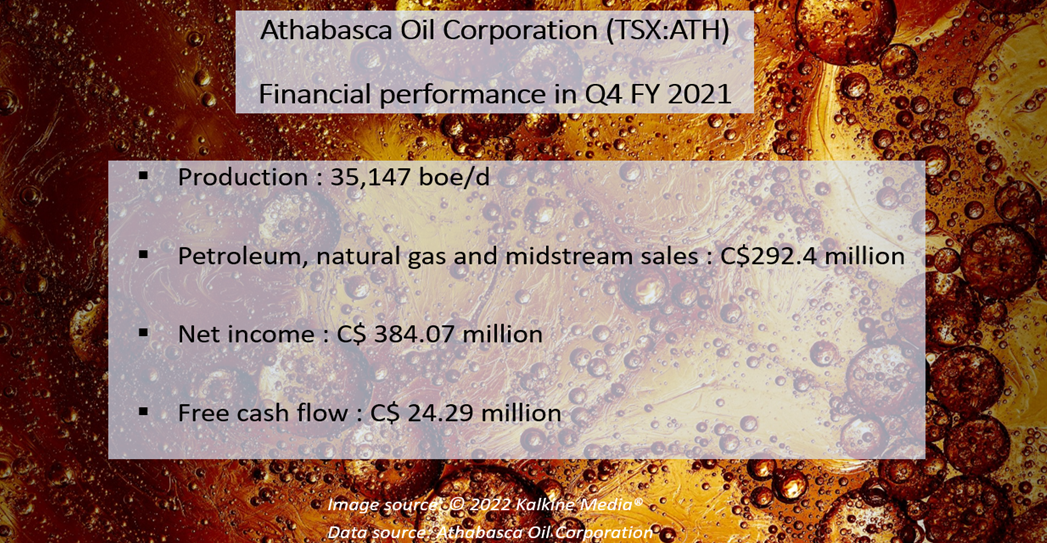

3. Athabasca Oil Corporation (TSX:ATH)

Athabasca Oil is a Canadian small-cap company operating in the oil and gas industry. The Calgary-headquartered energy producer posted C$ 292.4 million in petroleum, natural gas and midstream sales in Q4 FY2021, up from C$ 155.1 million in Q42020.

Its free cash flow (FCF) also expanded to C$ 24.29 million in the latest quarter from a negative balance of C$ 6.44 million a year ago.

ATH stock zoomed by about 396 per cent in one year.

4. Bri-Chem Corp (TSX:BRY)

Bri-Chem Corp is an Alberta-based firm engaged in the distribution and blending of oilfield chemicals. The North American drill fluids supplier saw its sales rise by 96 per cent year-about-year (YoY) to C$ 18.54 million in three months of FY2021.

Notably, the firm reported revenue growth of 151 per cent YoY to C$ 784 million in the latest quarter.

BRY scrip galloped by about 350 per cent in 52 weeks.

Also read: Teck (TSX: TECK.B) stock takes off after Q1 results. Buy call?

5. Converge Technology Solutions Corp (TSX:CTS)

Converge Technology Solutions is a C$ 1.9 billion market cap company building hybrid Information Technology (IT) infrastructure.

The Quebec-based software company noted a YoY surge of 74 per cent in its total revenues to C$ 504.98 million in Q4 FY2021.

The technology company posted a net profit of C$ 7.08 million in the latest quarter, up from C$ 950 million in Q4 2020.

CTS scrip climbed roughly 61 per cent in one year.

6. InPlay Oil Corp (TSX:IPO)

InPlay Oil is a Canadian oil and gas player with a market capitalization of about 336 million (as of writing).

The oil development firm posted oil and natural gas sales of C$ 37.25 million in Q4 FY2021, substantially up from C$ 12.82 million a year ago.

InPlay Oil also recorded an average annual production of 5,768 barrels of oil equivalent (boe/d) in 2021, a 45 per cent increase from 2020.

IPO stock swelled by about 622 per cent in 12 months.

7. Denison Mines Corp (TSX: DML)

Denison Mines discovered high-grade uranium mineralization from the final three drill holes at the Waterfound site under the winter 2022 exploration program.

The firm acquired a 50 per cent stake in JCU (Canada) Exploration Company from UEX Corporation in August 2021.

Denison Mines reported a net profit of C$ 18.97 million in 2021 compared to a loss of C$ 16.28 million a year ago.

DML stock gained by some 35 per cent in 12 months.

8. Tamarack Valley Energy Ltd (TSX:TVE)

Tamarack Valley Energy signed a definitive agreement to buy a private oil firm, Rolling Hills Energy Ltd, on April 21.

In addition, it announced strategic Clearwater consolidation and a 20 per cent base dividend increase to C$ 0.010 apiece per month starting from dividend declaration in June.

The Canadian energy company earned a net profit of C$ 140.44 million in Q4 FY2021 against a loss of C$ 0.01 million in Q4 2020.

TVE stock grew by about 111 per cent in a year.

9. Maxim Power Corp (TSX:MXG)

Maxim Power Corp is a utility company with independent power production operations.

The Calgary-headquartered company saw its revenue jump from C$ 17.28 million in Q4 2020 to C$ 37.41 million in quarter of FY2021.

Its quarterly net income amounted to C$ 4.4 million in Q4 2021, down from C$ 8.92 million. However, its annual income expanded to C$ 78.5 million in 2021, notably up from C$ 9.26 million in 2020.

MXG scrip expanded by about 50 per cent in 52 weeks.

10. McCoy Global Inc (TSX:MCB)

McCoy Global is an Alberta-headquartered firm that provides equipment and technologies to enhance tubular running operations and the wellbore. The company also assist the energy industry in critical data collection.

McCoy Global posted total revenue of C$ 9.45 million in Q2 FY2021 compared to C$ 9.36 million a year ago.

Notably, the energy service company reported net earnings of 2.46 million in the latest quarter, an improvement from a loss of C$ 2.15 million in Q4 2020.

MCB stock increased by some 39 per cent in a year.

Bottomline

Investors planning for a well-financed retirement life can explore the stocks mentioned above for their TFSA. Investors should, however, analyze a stock personally before investing in it and evaluate the best-fitted option based on their own financial goals.

Also read: Lion Electric (LEV) partners with US Energy Dept: An EV stock to buy?

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.