Highlights:

- Quadriga’s Gerald Cotton’s widow has come out with a new book on their time together

- QuadrigaCX was once a big crypto exchange in Canada, and 40 per cent of its investors were Ontarians

- The regulator has called it a Ponzi-type fraud in an investigation report published last year

That the value of any crypto asset can change drastically in the blink of an eye is what most investors are now aware of. That a large crypto exchange can be a just-another Ponzi scheme is what many of us may have forgotten.

‘Bitcoin Widow’ book

The new book ‘Bitcoin Widow’ is co-written by the widow of Gerald Cotten. It reveals some disturbing details. In her book, Jennifer Robertson is said to have distanced herself from the multi-million-dollar fraud perpetrated by Cotten through his Quadriga Fintech Solutions.

Robertson is also said to have claimed that Gerald Cotten led different personal and professional lives, and she wasn’t aware of what lay beneath the wealth Cotten had accumulated.

Also read: Best crypto exchange in Canada: Here are the top contenders

Quadriga crypto exchange

The exchange QuadrigaCX was once believed to be the biggest of its kind in Canada. It started in 2013, much before Canadians thronged to risky crypto assets like Bitcoin and Dogecoin in huge numbers. In December 2018, the founder CEO Cotten died in India at age 30.

In its investigation, the Ontario Securities Commission (OSC) found that QuadrigaCX was nothing but a ‘modern technology’ wrapped Ponzi scheme that ran on a pyramid structure. The bubble was destined to go burst when the exchange could no longer cover payments to older users through money from new depositors.

The loss of millions of dollars

Cotten, who is said to have documented a ‘get-rich-quick’ scheme when he was just a teenager, had the password to unlock the money that is said to have vanished after his death.

Nearly US$200 million in cryptocurrency holding were owed to hundreds of thousands of unsuspecting investors, most of whom were Ontario residents. The OSC expressly stated in its detailed report that a key element in Cotten being able to pull such a large fraud was not registering with the regulators.

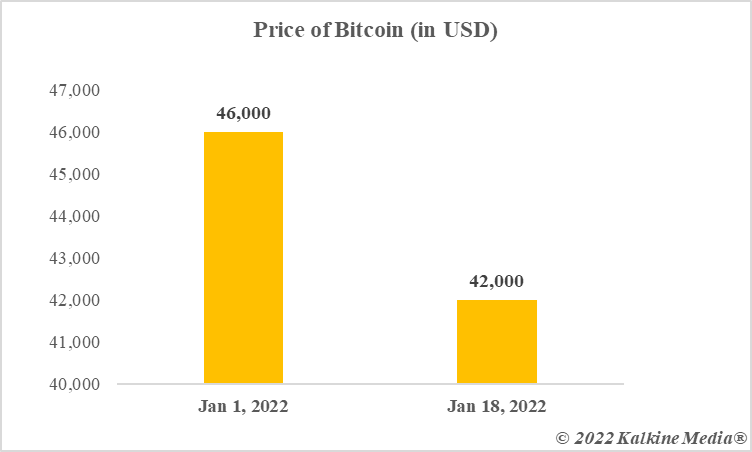

Data provided by CoinMarketCap.com

Data provided by CoinMarketCap.com

Recent crypto frauds

There have been multiple crypto frauds besides the infamous Quadriga crypto scam.

A token named Squid Games crypto reached a price of US$2,800 before plummeting to zero and wiping out all the investor wealth. These instances shine the spotlight on how the popular new investment asset class is also a breeding ground for fraudsters.

Also read: The top crypto gainers of 2021, and a couple of underperformers

Bottom line

Before investing using an exchange in any crypto asset, it is advisable to undertake research. Investing only if the blockchain project seems legitimate and of value may be the road ahead for crypto investors.