Highlights:

- Link Group has received a revised acquisition proposal from Dye & Durham.

- The revised upfront cash payment is of AU$3.81 per share to Link’s shareholders.

- After assessing the proposal under several factors, Link board has informed it is unable to recommend the new proposal.

Financial ownership data manager, Link Administration Holdings Limited (ASX:LNK), on Monday (19 September 2022), shared an update on its proposed acquisition by Dye & Durham.

At 10:13 AM AEST, Link shares were spotted trading 3.46% lower than its previous close at AU$3.35 per share.

Dye & Durham’s revised proposal

Link Group informed the market that it had received a new proposal from Dye & Durham. The revised upfront cash payment to Link’s shareholders was AU$3.81 per share, plus a contingent payment (subject to certain circumstances). Reportedly, Dye & Durham would have paid AU$1.00 per share after the binding conclusion of the FCA (Financial Conduct Authority) active enforcement investigation into LFS (Link Fund Solutions Ltd.), within 24 months of closing.

Matthew Proud, CEO, Dye & Durham, said:

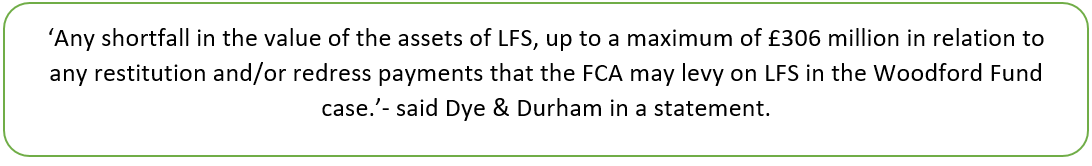

The enforcement investigation by FCA was regarding the management of the collapsed LF Woodford Equity and Income Fund by LFS. In the beginning of September, FCA notified that it would not approve the proposed acquisition unless Dye & Durham takes the responsibility to cover:

If LFS would not have been found liable for redress payment to FCA, then AU$1.00 per share would have been paid to the shareholders. On other hand, if LFS was found liable to pay less than £306 million, then Dye & Durham would have paid the difference of actual redress amount and £306 million.

Meanwhile, according to Link Group’s release, the new proposal was subject to conditions like, agreement of Dye & Durham financiers, satisfactory documentation between the parties, court approval etc.

What did Link Group say on the revised proposal?

Via today’s release, Link Group informed that it has taken multiple factors into consideration with regards to the revised proposal, such as structure, value and alternatives available if the transaction does not take place. After evaluating all the factors, the board has decided to reject the revised proposal.

The company added that now it intends to examine alternatives for the business, it includes an in-specie distribution of up to 80% of Link Group’s shareholding in PEXA.