Highlights:

- ASX 200 resilient post-Australia Day, rising by 37.9 points.

- Penny stocks present growth opportunities despite niche status.

- Focus on ASX-listed penny stocks with strong financials.

The ASX 200’s recent gain of 37.9 points serves as a testament to the broader market's ability to weather fluctuations, particularly those originating from overseas tech sell-offs. Within this environment, penny stocks continue to generate attention due to their comparatively affordable share prices and potential for significant value appreciation. Several penny stocks on the ASX exhibit promising characteristics, especially when evaluating metrics such as debt management, earnings growth, and financial health.

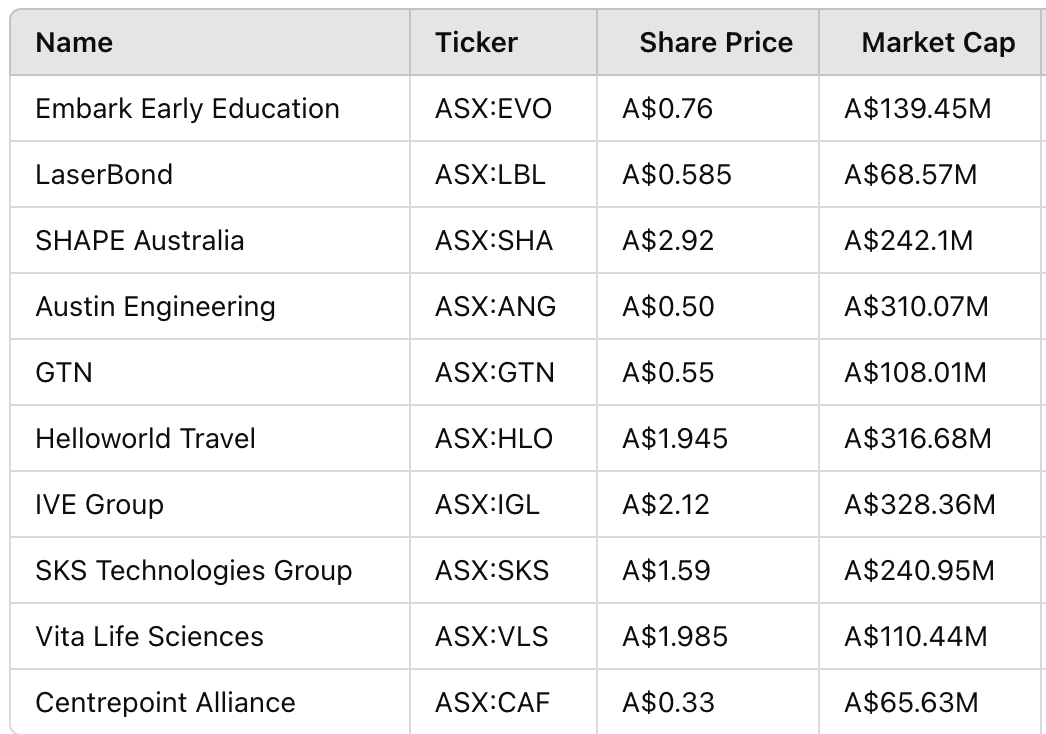

Leading Penny Stocks with Notable Financial Ratings

These penny stocks illustrate how smaller-capitalization companies can potentially strengthen portfolios through carefully managed debt, healthy cash flow, and growing market presence. Each of these entities operates in unique sectors, from early childhood education services (Embark Early Education, ASX:EVO) to printing and marketing (IVE Group, ASX:IGL). Close attention to each company’s unique metrics and industry trends can shed light on how they navigate challenges and sustain their competitiveness.

Noteworthy Mentions Beyond the Top List

Ballymore Resources (ASX:BMR)

Ballymore Resources has attracted attention due to its robust financial footing, where short-term assets boost liquidity ratios. Notably, the company holds more cash than total debt, suggesting disciplined fiscal practices. While share price movements can be influenced by market sentiment, Ballymore’s attention to maintaining a healthy balance sheet continues to stand out.

FOS Capital (ASX:FOS) and Midway (ASX:MWY)

FOS Capital (ASX:FOS)

FOS Capital operates in the lighting industry and has demonstrated steady earnings growth over the past five years. While a one-off financial hurdle occurred recently, overall debt management remains within a positive range. This positioning may indicate that the company is adapting effectively to sector-specific challenges such as shifts in technological standards and competitive pricing pressures.

Midway (ASX:MWY)

Midway’s core operation lies in woodfibre production, and it recently entered a profitable phase. A special dividend announcement underscores its financial developments, and the prospect of an acquisition bid by River Capital Pty Ltd. places Midway under additional market interest. Despite occasional stock volatility, many observers track Midway’s capital structure and operational consistency to gauge whether valuation metrics align with its ongoing performance and strategic developments.

Exploring a Wider Field of Penny Stocks

Penny stocks cover a broad spectrum of industries, from resource extraction to innovative technology solutions. Approximately 1,026 penny stocks trade on the ASX, each holding unique strengths, challenges, and growth trajectories. Whether adding diversity or looking for overlooked value, these companies offer multiple layers of possibility for those who examine their business models, leadership strategies, and industry headwinds with care.

A thorough examination of fundamental financial indicators, including the ratio of debt to equity, cash reserves, and earnings growth trends, can help gauge the resilience and future direction of each company. Regular market monitoring, coupled with an understanding of operational catalysts, often provides a clearer perspective on which penny stocks align with different investment objectives.

Final Thoughts

Strong fundamentals, steady earnings growth, and prudent financial management can position penny stocks as appealing segments within the ASX. While volatility is an inherent aspect of these smaller and often younger companies, a deeper analysis of balance sheets, cash flow statements, and industry conditions tends to illuminate potential resilience or vulnerabilities. With numerous penny stocks populating the Australian market, ongoing research, awareness of sector-specific developments, and mindful interpretation of metrics remain central to uncovering potential in this dynamic space.