Summary

- Insurance Australia Group has reported that no final dividend would be paid, as interim dividend has covered the high end of dividend pay-out policy.

- Supply Network has announced a fully franked final dividend of 9 cents per share, due for payment on 1 October 2020.

- Korvest has reported full-year results, declaring a final dividend of 13 cents per share for the year. Business conditions were underpinned by strong infrastructure activity over the years, and work pipeline for coming years also remains resilient.

In this article, we discuss companies that have announced updates related to dividends for the upcoming reporting season. These companies are from the financials, industrials and consumer discretionary sectors.

Dividends have been under pressure in the wake of COVID-19, as economic impacts are translating into cash flow shocks for the businesses. However, many companies that had deferred dividend payments have resumed payments, and businesses with sustainable cash flows are declaring dividends.

Insurance Australia Group Limited (ASX:IAG)

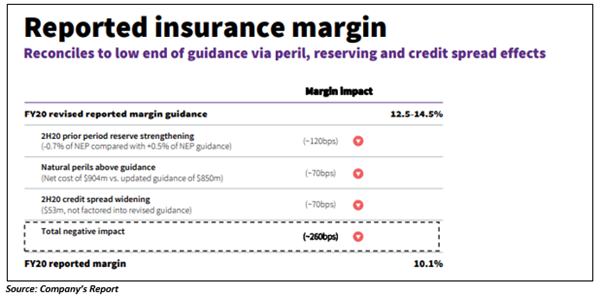

Insurance Australia Group, the parent company of a general insurance group with controlled operations in ANZ, has provided an update on its FY20 results. The Group is expecting to report low single digit growth of 1.1% in its gross written premium with an insurance margin of 10.1%, lower from the earlier guidance of 12.5% to 14.5%, primarily owing to factors like credit spreads, severe natural peril activity, and prior period reserving.

Good Read: Is Financial Sector Worth Your Finances

Some items that would impact the earnings include a pre-tax loss from fee-based business of $23 million, pre-tax loss of $181 million on shareholder’s funds income, customer refund provision of $246 million (pre-tax), and after-tax profit of $326 million from the sale of interest in SBI General Insurance Company.

Management noted that IAG remains well capitalised with an expected CET1 ratio of 1.23 at the end of June 2020. Given the level of uncertainty in the current environment, the Group is maintaining a conservative stance on capital allocation decisions.

IAG also unveiled that no final dividend would be paid at the end of the year since expected FY20 cash profit, after applying the top end of 60-80% of cash earnings pay-out policy, has serviced top end pay-out at the time of interim dividend payment in March 2020.

IAG continues to follow its ‘long-established’ pay-out policy and feels that it is important to maintain a position of strength during the crisis.

For FY20, the Group is expecting cash earnings to reach $279 million, with detailed results for the financial year due for release in the first week of August 2020. On 24 July 2020, IAG last traded at $5.32, down by 7.7% from the previous close, with annual dividend yield noted at 5.2%.

Must Read: Are Most Dividend Yields Flawed Now: 2 Areas Investors Should Look at; Balance Sheet and Cash Flows

Supply Network Limited (ASX:SNL)

Supply Network Limited, operating trading entities in Australia and New Zealand under the Multispares brand, has announced that full-year revenue stood at $136.8 million based on unaudited management accounts, for FY20 ended 30 June 2020. Profit after tax is expected to be $9.6 million and $10.2 million on a pre-AASB 16 basis.

Management has announced a final dividend of 9 cents per share, fully franked, up by 0.5 cents over the previous year’s final dividend. The dividend would be paid on 1 October 2020 to the shareholders in records on 17 September 2020.

The Company will release its final results for FY20 to the market in late August 2020. On 24 July 2020, SNL last traded at $4.5, up by 7.9% from the previous close, with dividend yield of 3.6%.

Also Read: Dividends versus Annuities: Why dividends are still important

Korvest Ltd (ASX:KOV)

South Australian company, Korvest is a provider of engineered solutions, holding enviable reputation for finishing projects on time and within budget. The Company, serving a range of industries, has announced full-year results for the period ended 30 June 2020. Korvest has announced a fully franked final dividend of 13 cents per share, after an interim dividend of 15 cents per share.

The final dividend has a record date of 21 August 2020 and would be paid on 4 September 2020. In FY20, Korvest recorded revenue of $63.08 million, up by 3.7% over the previous year. The Company was also benefitted by the JobKeeper scheme, which contributed $1.05 million to the results.

Profit after tax for the period was $4.02 million compared to $2.88 million in the previous year. In FY20, the business experienced an increased level of major projects with activity levels and margins registering growth across all business units.

Korvest provides services to a number of industries, including mining, food processing, power stations, oil and gas, commercial, infrastructure, mining, utilities, and heath. Over the past three years, the activity in infrastructure sector has been the impetus of sales revenue.

It was highlighted in the market update that work pipeline in the sector remains strong over the coming years, and the Company has secured a major infrastructure project, which is expected to continue throughout FY21 and into FY22. During the year, Korvest invested in manufacturing capacity and capability, and intends to invest more in the space over the coming years.

Annual dividend yield of the Company was noted at 6.8%, and on 24 July 2020, KOV last traded at $4.3, up by 4.36% from the previous close.

Interesting Read: An Annual Report a Day Keeps the Losses Away; Get the Most from Reading an AR

(Note: All currency in AUD unless specified otherwise)