Summary

- The pandemic jitters and volatility have enhanced the global flow inflows into ETFs while mutual fund’s providers suspend redemption.

- S&P Global Rating Agency indicates that Australia and New Zealand’s Insurance Industry is well-positioned showing resistance to pandemic, although fiscal earnings expected to remain subdued.

- Significant drop in housing market sentiments indicate that growth in unemployment is pressing hard upon the property market despite the current low-interest rates.

The pandemic indeed has brought many businesses to their knees, with their stability and growth plans being tossed out at least until the crisis remains rampant across the world. With the ongoing wave of uncertainty and disruptions in our financial plans, the secret sauce of the investments to come out of the crisis healthy appears to be on top priority list.

However, given the current state of the economy, bracing a significant challenge of recession, the performance of many sectors appears to be in dilemma. The second surge in coronavirus cases, especially across Victoria, seems to further deepen the chaos and volatility across different markets. Federal Treasurer Josh Frydenberg indicated that the restrictions coming back pose “serious impediment to the speed and trajectory of the nation’s economic recovery”. He noted that the Victorian lockdown could cost 1 billion per week.

As the government looks for strategies to sail through the storm, Reserve Bank of Australia in its July meeting decided to hold cash rate to 0.25%, not willing to further slash down the rate after it already did at a record low level. Amid economic challenges and the low-interest rate scenario, financial sector and related investments being intricately fabricated with the economic development has come under investor’s radar.

The financial sector, despite our mental image, is not merely confined to Stocks Markets trading every day. It also incorporates a vast range of businesses carried consistently across banks, insurance firms, investment companies, real estate, consumer finance companies and mortgage lenders. The whole crux of operations in the sector is primarily governed through the interest-rate spreads and charges for financial services.

The current low-interest scenario is accompanied by a range of other factors, which pose a threat of creating a dent in the investor’s pocket. At the same time, financial and investment security is tough, as Aussies try balancing their living in the current landscape.

Investment Funds

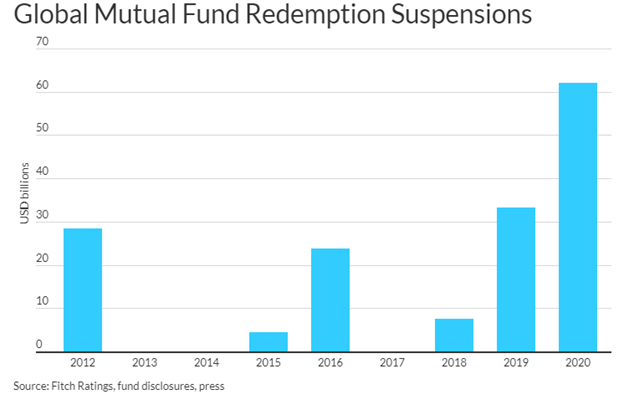

The growing market stress due to COVID-19 has led to the massive increase in the redemption suspension this year. According to the Fitch Rating Agency, at least USD 62 billion of global mutual funds have suspended redemptions as the liquidity risk hovers on the investment. The investor’s fear is very evident considering the state of volatility, and a step is taken to avoid the massive withdrawal chances faced by the industry. However, the suspension is expected to damage the investor’s confidence, especially concerning the investments in less liquid assets.

At the same time, Exchange Traded Funds also remained under the investor’s radar. Gold index funds particularly captivated the interest of the investors. According to S&P Global, a record year-to-date gold flows into ETFs. World Gold Council indicated that first-half global net inflows reached USD 39.5 billion, surpassing the full-year record of USD 23 billion in 2016.

ALSO READ: Mutual Funds vs. ETFs: Which Are Better?

Moreover, tech and growth ETFs despite economic conundrum also garnered the limelight. As on 10 July 2020, Vanguard Diversified Growth Index ETF (ASX:VDGR) rose by ~5% in the last three months. Meanwhile, Vanguard Investments Australia Ltd recently announced the final dividend distribution for various ETFs, with VDGR dividend to be 134.0028 cents per unit to be paid by 16 July 2020.

Insurance Industry

Australian insurance industry typically suffered the collateral damage from the Bushfire and climatic disruptions, which led to a significant rise in the claims. As per the data by Perils AG, Catastrophe Insurance data provider projected a total insurance and reinsurance claim of $1.3 billion concerning the Australian Bushfire.

S&P Global rating Agency indicated that the credit spread has widened owing to growing apprehensions triggered by COVID-19 induced economic downturns and other market jitters, the global insurers have “retained good market access at favourable rates”. At the same time, investors worldwide are finding the insurance bond as a lucrative investment owing to its relatively favourable yield, diversification, and security, as the average issuer credit rating lying in the ‘A’ category.

ALSO READ: Casting an eye on Insurance Industry

S&P Global Ratings also has indicated that Australia and New Zealand’s insurers are well-positioned to withstand the shock from the pandemic-led disruptions. However, the fiscal earnings of the sector would remain subdued. Although the growth in the unemployment rate can affect mortgage insurance players as the claims are expected to be higher.

Insurer, Suncorp Group Limited (ASX:SUN) predicts higher natural hazard costs for the year ending June 2021 compared to the previous year owing to high exposure to market volatility. The Company expects natural hazards allowance to increase by $90 million to $130 million for FY21. Suncorp indicated that excluding the investment market movements and bank impairment losses, it expects the pandemic effect on SUN’s FY20 P&L to remain neutral.

Meanwhile, it has also incorporated a new business model effective 20 July 2020, which would facilitate performance improvement in the core sector and catalyse the digital and data-driven transformation.

Real Estate Sector

The impact of employment losses and market volatility is weighing upon the property market as prospective investors are adopting a conservative approach. A recent survey conducted by National Australia Bank Limited (ASX:NAB) indicates that the housing market sentiment in the second quarter of 2020 has dropped by 71 points, from 38 points in the first quarter to -33 points in the second.

NAB chief economist Alan Oster indicated that although restrictions on the housing activities have eased, the economic contraction is impacting the market, with the recovery expected to take time. The spillover effect of the impact could be felt by the mortgage lenders, banks, and real estate brokers.

ALSO READ: Security of Dividends for Investors Looking at Real Estate Shares: LLC, GPT, DXS, MGR, SGP

Many experts considering the ongoing economic conditions believe that the property prices are likely to drop through 2020 and next year, forcing the prospective buyers to delay their property investment plans. Meanwhile, the current low-interest scenario could appear to be lucrative prospects for some, who are looking for financing their dream homes at a significantly lower cost. In the meantime, RBA Governor Phillip Lowe has indicated to maintain the cash rate until further progress in the unemployment scenario and is “confident that inflation would be sustainable within the 2–3 per cent target band”.

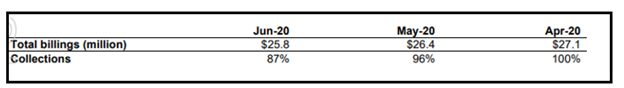

Australian-listed REIT company, Growthpoint Properties Australia (ASX:GOZ), which invests in industrial and office properties reported robust rent collection throughout the pandemic impacted period. The Company with the finalisation of the rent relief discussions was expecting a rise in collections for May and June.

Source: GOZ ASX Update

Source: GOZ ASX Update