Highlights:

- Education sector organisation iCollege has seen a surge of around 1,700% in last five years on ASX.

- The company has been on a gaining spree since last few years as the market around education industry has been swelling up.

- ICT has registered record revenue of AU$46.8 million in FY22.

One of Australia’s private tertiary education firms, iCollege Limited (ASX:ICT) was seen trading 8.571% higher at AU$0.190 per share at 12:12 PM AEST on ASX on 7 September 2022. The consumer services stock was seen outperforming its broader benchmark index S&P/ASX 200 Consumer Discretionary sector (INDEXASX:XDJ) which was 1.271% lower at 2,773.8 points around the same time.

ICT shares have gained 68.18% in last one year on ASX. The year-to-date gain stands at 54.17%. The stock has gone up 68.18% in last six months and has gained 32.14% in last thirty days. Notably, the shares have moved up 15.62% in last five trading days on ASX (as of 11:32 AM AEST, 7 September 2022).

Why was ICT in news lately?

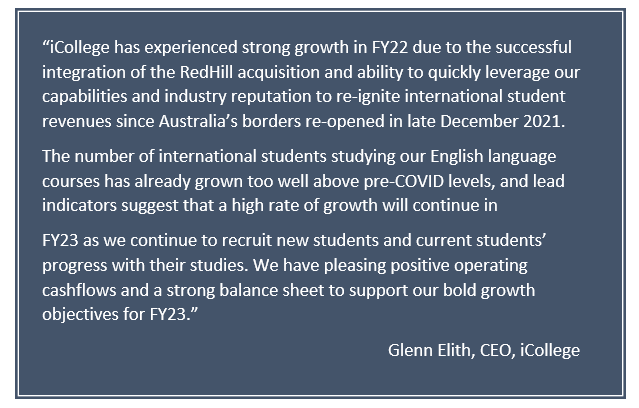

- ICT, on 29 August 2022, shared its ‘transformative’ FY22 results as per which the company has clocked record revenues of AU$46.8 million, up 187%, compared to the same period last year.

- ICT also completed acquisition of RedHill Education Limited that in return unlocked annualised cost synergies of more than AU$1.5 million. Also, it expanded ICT’s range of courses, campus network, industry and supply chain relationships, addressable markets, and government funding accreditations.

- ICT’s EBITDA for the year was AU$3.6 million, up AU$1.0 million on last year.

- At the end of June 2022, the company had AU$30.2 million cash on hand.

The future, as per ICT

For the next financial year, the company expects:

- Robust recovery of international student numbers as Australia’s international borders are now open.

- An upbeat attitude of government to reconstruct the education export industry.

- Robust balance sheet and operating cashflows to invest in growth.

- Annualised cost synergies from RedHill acquisition.

- Revenue and profit to materially rise in FY23.