Summary

- The 2019-2020 financial year proved rough for Australian Stock Market with first half influenced by US-China trade war and a declining global GDP while the second half experienced the wrath of bushfires and SARS-COV-2

- Industries including Healthcare, Information Technology, and Consumer Staples fared better than the S&P ASX 200, the representative index of the Australian share market, by demonstrating less sensitivity to economic cycles

- The current economic scenario is not as positive as it looks with lockdowns being extended due to resurgence of COVID-19 cases at Australia

- Amid such uncertainties, investors are eyeing defensive stocks, recession-proof industries and ETFs to provide a safe long-term investment

The 2019-2020 financial year had been tumultuous for investors with stock markets in Australia and worldwide experiencing ups and downs throughout the year. While first half was influenced by US-China trade war and a declining global GDP warning an impending recession, the second half of the year experienced the lowest moment with bushfires intensifying and SARS-COV-2 being the final nail in the coffin.

S&P/ASX 200, the representative index of the Australian share market, reached 7,162.49 on 20th February 2020, the highest in last ten years, only to fall to 4546.03 on March 23rd, as COVID-19 struck the economy. Since then, the S&P/ASX 200 index gained a progressive trajectory.

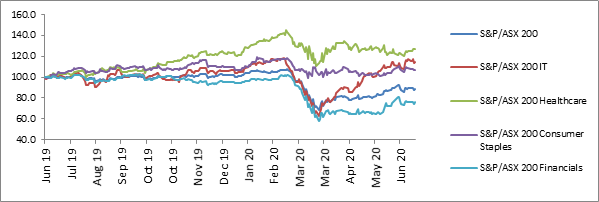

Casting eye on ASX indices performance during FY 2019-2020

While comparing the S&P ASX 200 index with other sectorial indices, except financials, Healthcare, Information Technology, and Consumer Staples fared better than the S&P ASX 200. On a closer look, the Consumer Staples glided through (relative to other sector moves) the March Low with hardly any trough experienced, and healthcare index and IT index making a quick recovery. Staples and healthcare sectors are typically known to show less sensitivity to economic cycles.

Source: ASX

Consumer Staple companies include organizations that are into manufacturing and distribution of food, and beverages, personal and perishable goods, including supermarkets and hypermarkets and food retailing companies. Consumer staple companies such as a2 Milk Company Ltd (ASX: A2M) have seen robust growth in revenues across Australia and international market such as China during the Pandemic. GrainCorp Limited (ASX: GNC), a food ingredient and agribusiness Company, showcased a robust balance sheet with zero core and showed strong resilience during the pandemic.

Healthcare companies such as CSL Limited (ASX:CSL) and Mesoblast Limited (ASX: MSB) are engaged in developing COVID-19 centric products. While CSL is developing plasma-based treatment for COVID-19, Mesoblast is running clinical trials based on stem cell therapy to fight SARS-COV-2, the causative agent of COVID-19.

Technology industry played a pivotal role during the pandemic, enabling online education, smooth work from home environment through online business solutions and contactless payment. Emerging Businesses such as Buy Now Pay Later (BNPL) player Afterpay Ltd (ASX:APT) and Splitit Payments Ltd (ASX:SPT) experienced staggering growth in their share prices and businesses because of increased merchants on board and customers globally.

Also read: 5 Tips for dealing with reopening of the economy during COVID-19

On that backdrop, let us see how the market is expected to perform in the future economic scenario.

Current Economic conditions

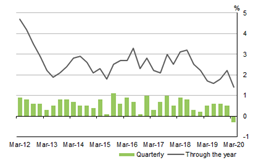

The Australian economy demonstrated negative quarterly growth in the March quarter of 2020, pushing Australia into a recession for the first time in over three decades. The pain seems unending with second quarter being expected to be no exception. March Quarter GDP fell by 0.3% because of decline in household consumption, private and public capital formation. In 2020, the GDP is expected to contract by 4.5% as per IMF, 29 years after 1991, when GDP contracted by 0.397%.

Source: ABS

Most of the contraction in the economy was driven by lack of business activities due to COVID-19 related restrictions on Australia which started from 1st February, 2020 starting with restriction on international travel. By March end, restrictions increased to closure of non-essential services, gatherings and other social distancing measures. According to ABS, the restrictions led to a retail turnover decrease by 17.7% M-o-M in April and Australia recorded 60% Y-o-Y decline in overseas travel in March 2020, thus severely affecting the tourism sector.

Also Read: Is it Too Early to Reopen Businesses? A Take on Economy vs Public Health

Tips for Investors for the New Financial Year

Warren Buffet’s Berkshire Hathaway did not make any major investment during the market crash of March 2020, with the market crashing down by over 20%. The no-buy approach of Warren Buffet for specific sectors, considered one of the world’s best investor, during a crash in share market is signalling a warning regarding the recovering stock market. With second wave of coronavirus outbreak resurging, future market performance may not be as hunky-dory as expected.

The story holds true for Australia which is reopening its economy and applying economic reforms to help industries sail through the Coronavirus crisis. Resurgence of COVID cases in June is making RBA’s forecast a negative GDP growth of 6% in second half of 2020 look tad optimistic.

In such uncertain economic milieu, investing in stock market is treacherous. However, with research and precautions, one may identify long-term profit making stocks. Few thought-provoking tips (while investment analysis is specific to one's portfolio and interests):

- Investment in Defensive stocks i.e. High dividend yield with a positive EPS: A high dividend payout indicates stability in operations. A positive EPS means the company has positive net profit or not running in loss. A combination of both means a company is stable and running in profit. With Australian economy reopening gradually, though resurgence of cases may delay the lockdown, companies with long history of dividend payment and high dividend yield backed by strong balance sheet may prove to be a safe long-term investment.

- Investing in recession-proof stocks: Defensive stocks are companies with business model that is less impacted by economic cycles. Industries such as Consumer Staples, Education, and Healthcare generally meet the basic necessities of a household with demand that gets affected minimally when market underperforms.

- Exchange Traded Funds (ETF): ETFs provide diversified returns on low capital investment and returns that are similar to the benchmark index or a commodity. ETFs offer passive income opportunity. In Australia, more than 200 ETFs are listed. An ETF, which is following an index or a commodity that have shown low market sensitivity, is considered safe for long-term investment.

- Diversified portfolio: Investment in stocks from different sectors diversifies the risk. With uncertainty expected to prevail till coming June 2021, it is difficult to ascertain which sector will outperform or will recover substantially. Investment in different sectors makes your portfolio less exposed to risk and at the same benefit from resurgence in some pockets within the economy.

- Run a Desk Research: Run a research on the companies whose shares you are eyeing on. Try to measure the growth anticipated in industry they are operating, and competition within the industry. At micro level, check the balance sheet quality by using ratios such as debt-equity ratio, working capital ratios, study the cash in hand available. Keeping an eye on valuation is also essential and the investor can get a quick sense of the same by using metrics such as forward P/E ratio, price to book value, and dividend yield.

.png)