Highlights

Australian shares opened lower on Wednesday.

The ASX 200 index fell 11.20 points or 0.17% to 6,595.10 at the open.

The ASX All Ordinaries index fell 0.178% to 6,774.7.

Australian shares fell at the open on Wednesday after Wall Street closed lower in overnight trade. The benchmark ASX 200 index fell 11.20 points or 0.17% to 6,595.10 at the open.

The ASX All Ordinaries index fell 0.178% to 6,774.7, while the A-VIX was up 1.565% at 18.242 at open. The index is virtually unchanged, but it is down 11.42% on a year-to-date (YTD) basis.

The Australian benchmark index declined 12.80 points or 0.19% to 6,593.50 in the first 10 minutes of the trade on Wednesday.

Meanwhile, on Tuesday, the benchmark ASX 200 index closed 4.1 points higher at 6,606.3.

Global equity indices

Global stocks ended mixed on Tuesday as investors awaited the latest US inflation data. The market appears to be calculating the prospects of further central bank tightening following the release of the US CPI data. The oil prices and bond yields also dipped on Tuesday.

In US, the Dow Jones fell 0.6%, the S&P 500 slipped 0.9%, and the NASDAQ declined 0.95%.

In Europe, the Stoxx 50 surged 0.4%, the FTSE gained 0.2%, the CAC rose 0.8%, the DAX advanced 0.6%.

Market action

US Treasury yields fell on Tuesday as investors were concerned about the looming recession in the US amid continued aggressive tightening by the Fed. The yield on 10-year Treasury notes slipped to 2.960%.

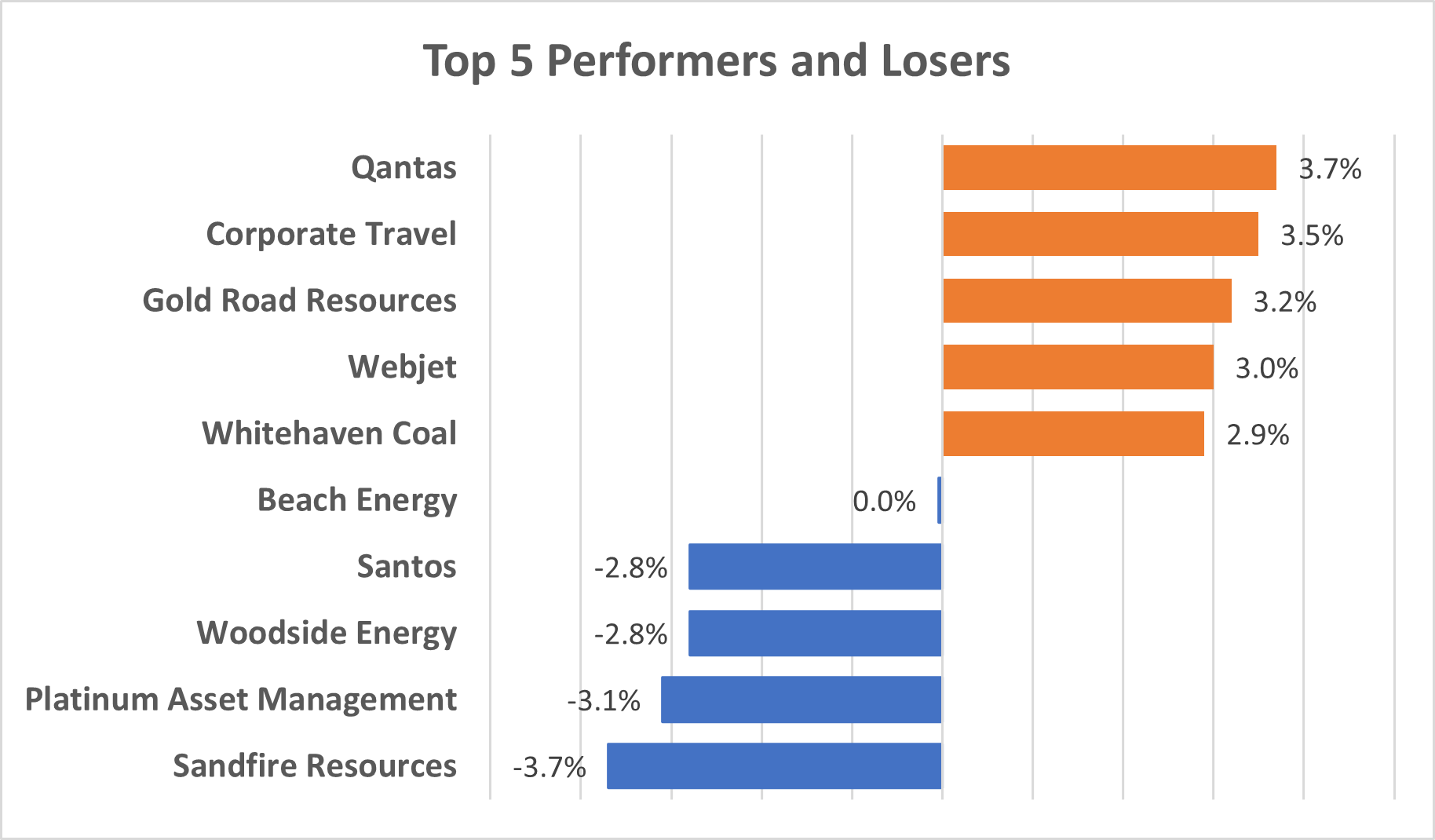

Data Source: ASX (as of 13 July 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

While Qantas (ASX:QAN) and Corporate Travel (ASX:CTD) were the top gainers, Sandfire Resources (ASX:SFR) and Platinum Asset Management (ASX:PTM) were the top laggards.

Energy, materials, and utilities all fell in the range of 1.1% to 2.2%. Real estate, tech and consumer discretionary were trading over 1% after first half-an-hour of trade.

Newsmakers

- ANZ said that it was in discussion with Kohlberg Kravis Roberts about MYOB’s potential acquisition.

- Mirrabooka reported a 4.4% rise (up to 30 June) in full-year profit at AU$6.7 million.

- KMD Brands said that its Kathmandu brand has reported “record performance” in its winter period.

- Platinum Asset Management recorded another month of outflows.