Highlights:

- Invictus recently published its September-quarter reports

- The company kicked off a two-well exploration campaign at its Cabora Bassa Basin project in Zimbabwe during the quarter

- The company identified numerous drill-ready prospects in the Basin Margin Area

- Around AU$25 million have been raised via placement to fund the drilling of the Baobab-1 and Mukuyu-1 wells

An independent oil and gas exploration company, Invictus Energy Limited (ASX:IVZ), is working towards opening one of the last untested large frontier rift basins in onshore Africa – the Cabora Bassa Basin – in Zimbabwe. The ASX-listed firm made impressive progress at the project site during the first quarter of the ongoing fiscal year 2023. Its latest report for the three months ended 30 September 2022 brings forth the related updates with all essential details. Have a read!

Image Source: Company Website

Two-well drilling program at Cabora Bassa

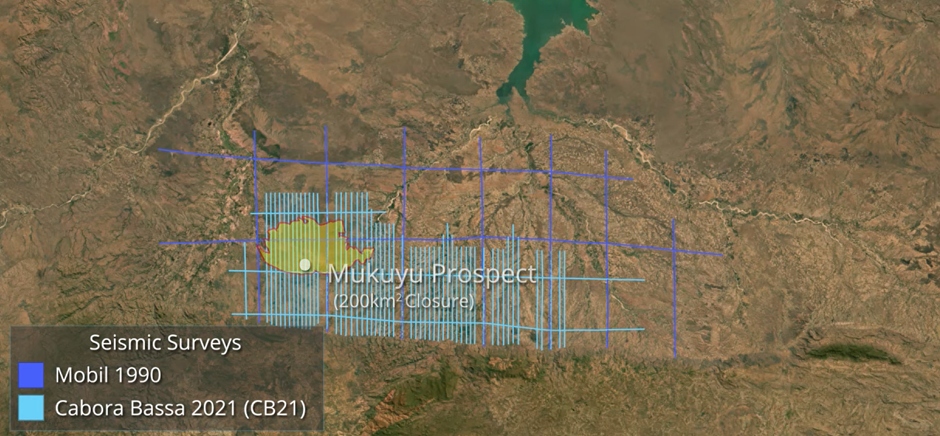

Invictus began its first oil and gas exploration drilling campaign at its 80%-owned-and-operated Cabora Bassa project in Zimbabwe during the September quarter. IVZ started off the campaign with the spudding of the Mukuyu-1 well on 23 September. Mukuyu-1 will be followed by the Baobab-1 well.

The Mukuyu-1 well will target several stacked Triassic and younger sandstones within a 200km2 four-way dip closure on the basement high trend. The Baobab-1 well is designed to target 243 million barrels of prospective resources# in stacked Cretaceous and younger sandstones, within four-way and three-way dip closures, in an independent play against the southern basin-bounding rift fault. Baobab shows structural characteristics similar to the play opening Ngamia discovery in Kenya’s Lokichar Basin, which resulted in subsequent discoveries in “String of Pearls” along the basin margin.

Image Source: Company Website

Read: Invictus Energy (ASX:IVZ) shares jump ~159.52% on highly encouraging observations at Mukuyu-1 well

Several drill-ready prospects mapped in Basin Margin Area

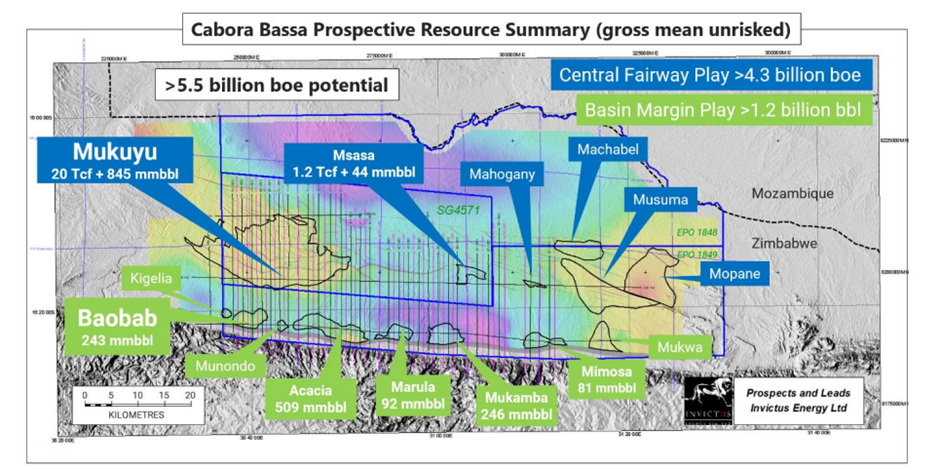

Numerous drill-ready prospects have been identified in the Basin Margin play along the southern basin-bounding fault. Also, Invictus has received an updated Independent Technical Report from ERCE estimating the gross mean recoverable conventional potential of the Basin Margin Area at a combined 1.17 billion barrels of conventional oil on a gross mean unrisked basis#.

Additional large leads on trend with the Mukuyu prospect have also been identified along the basement high in the Central Fairway play, providing follow-on prospectivity, which can be matured at low cost.

Cabora Bassa Prospective Resource Summary and Play Map

Invictus holds basin master position in Cabora Bassa

After the assignment of the exploration rights to the expanded licence area was gazetted, the Cabora Bassa Basin area now includes the entire conventional oil and gas play fairway.

A combined area of around 360,000 hectares is covered under Exploration Licences. This includes EPOs 1848 and 1849, each with a stretch of about 130,000 hectares, and the current Special Grant 4571 licence area with a further 100,000 hectares.

Invictus targets world’s first carbon-neutral oil and gas project

In August, Invictus and the Forestry Commission of Zimbabwe (FCZ) signed an agreement to develop the Ngamo-Gwayi-Sikumi (NGS) REDD+ project to save native forests through programs that can diminish deforestation activities. The 30-year contract can be renewed for another three decades, following Invictus’ sustainable plan for controlling emissions.

With the NGS REDD+ project, the firm believes it will be able to offset all Scope 1 and 2 emissions across the lifecycle of the Cabora Bassa Project. If discovered, this would potentially make it the world’s first cradle-to-grave carbon-neutral project (on a Scope 1 & 2 basis).

The NGS REDD+ project holds the potential to produce over 30 million carbon credits during its initial 30-year life, as per the biomass assessment concluded in a pilot REDD+ project in Ngamo and Sikumi and comparable REDD+ projects operating in the region.

As per Invictus, there will be an additional revenue stream for the Company if the carbon credits generated are sold on the voluntary carbon market.

Key Commercial Developments

- Successful capital raise for drilling program

Invictus’ Board and Management has elected to solely fund the initial stages of its high-impact drilling campaign at the Cabora Bassa project. The decision was taken after a complete assessment of various options, such as farm-in bids from numerous parties involved.

For more on this capital raise, click here.

Capital raised from the placement will be sourced to fund the drilling program for the Mukuyu-1 well, testing the Central Fairway play, and the Baobab-1.

- IVZ won DTC eligibility

In July, Invictus received approval from Depository Trust Company (DTC) for its OTCQB-quoted ordinary shares through the Depository Trust & Clearing Corporation (DTCC).

With this DTC eligibility, the electronic trade functioning of the company will be streamlined for North America-based investors. For more on this, read here.

Image: © 2022 Kalkine Media®, Data: Company Announcement