Why to invest in diversified stocks?

If you are interested in making investment in the stocks, you must be aware of the positive and negative aspects of the investment. Investing across multiple assets, sectors, classes and geographies help an investor to manage the risks effectively. It helps to narrow down a range of outcomes between expected and best obtained return. Also, it aids in reducing the dependency of an investor on any one investment.

Investment in diversified stocks would reduce the risk by allocating the resources into different sectors. At times, investment in a stock does not provide the kind of return as is expected from it. Investment in the diversified stocks help in not just relying on a single source of income, but rather paves the way for more returns from the investment in the numerous stocks. In case, one of the investments give negative return, the investor would not be affected, if he had invested in diversified stocks, since the other investments in the stocks could provide a positive yield. Besides, an investor saves capital for making future investments, and diversification of stocks in a portfolio, would aid in preserving capital.

In this article, the three stocks from different sectors have been discussed and are as follows:

Incitec Pivot Limited

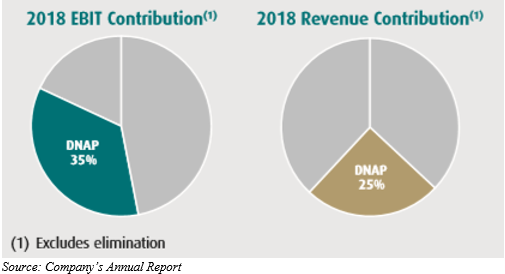

Incitec Pivot Limited (ASX:IPL) is an international leader in both the sectors - agriculture and resources. The company has 20 Manufacturing plants across the globe in nations like Canada, Turkey, Mexico and so forth. IPL caters to its customers with production, innovation and technology. The company has three businesses namely, Dyno Nobel, Incitec pivot Fertilisers and Global manufacturing.

Recent Updates

Recently, the company notified that it would be hosting Investor Day on 4 September 2019 and released a related presentation. It contained strategic review and FY 2019 Guidance, manufacturing excellence, manufacturing excellence, leading technology solutions, Dyno Nobel Americas, Dyno Nobel Asia Pacific, balance sheet and strategic highlights.

The presentation also mentioned FY19 Group Guidance, wherein it mentioned the revised guidance for FY19 EBIT, reflecting lower commodity pricing and operational performance. The guidance issued in May 2019 had $370 to $415 million, which was based on disclosed forward commodity price and FX assumptions.

The updated guidance stated that applying publicly available actual pricing and FX lowered range was between $321 million to 366 million. Also, the operational factors lowered guidance was around $285 million to $295 million. Further, NPAT range was anticipated between $133 million - $143 million.

IPLâs strong progress on strategic agenda in the last 12 months, Source: Companyâs Report

On 2 September 2019, IPL announced the commencement of strategic review of Fertilisers Asia Pacific division. Incitec Pivot Fertilisers is the renowned distributor dealing with fertilisers in the Australian region, along with being an exclusive manufacturer of phosphate fertilisers and the only producer of nitrogen fertilisers on the East Coast of Australia.

Incitec Pivot Fertilisers made good progress on operational issues and strategic milestones during FY 2019. It comprised of the discussion of numerous gas supply and other arrangements to enable the ongoing manufacturing operations at Gibson Island. Also, the rationalisation of SSP or Single Super Phosphates manufacturing operations at Geelong along with the return to consistent production at Phosphate Hill in Queensland area.

Incitec Pivot Fertilisers has lucrative growth opportunities and the company thinks that it is a logical time to evaluate the future of the business and the optimal path for it to acknowledge its capabilities. The review will assess various options including sales, demerger, or retaining of the business. Further, IPL has appointed UBS to give advice on the strategic review and is expected to progress over FY 2020 period.

In May this year, the IPLâs EBIT was mentioned from ~$370-$415 million. The revised FY 2019 EBIT ranges between $285 million to $295 million. The prior interest expense guidance would remain unchanged to $145 million.

Stock Performance

On 4 September 2019, IPLâs stock was trading at A$3.020, down by 0.984 per cent (at AEST 1:42 PM) with a market capitalisation of A$4.9 billion and approximately 1.61 billion outstanding shares.

CIMIC Group Limited

CIMIC Group Limited (ASX: CIM) headquartered in Australia, provides services in construction, mining, engineering, mineral processing and maintenance services. The company operates its operation and maintenance service through its subsidiary UGL while pacific partnerships operates public Private Partnerships. It has a presence in more than 20 countries throughout in APAC, South America, North America & Sub-Saharan Africa.

The company focuses on six value drivers as mentioned below to increase the return for its shareholders.

Recent Updates

On 2 September 2019, CIMIC announced that it has been nominated by the Victorian authorities for the delivery of the Early Works package for North East Link. It is the major road transport project in the history of Victoria.

Also, CIMâs CPB contractors along with the JV or Joint Venture partner has secured earthworks project to build Western Sydney International (Nancy-Bird Walton) Airport. Both, CPB and its partner would provide with work, producing revenue standing at roughly $323 million to CPB.

As per Michael Wright, CEO, CIMIC Group would continue to provide new infrastructure for NSW, nationals & International operation.

Earthworks include drainage design and overall topographies for the entire airport. The work will commence at the end of this year and is scheduled to be completed in 2022.

On 28 August 2019, Moodyâs Investors Services, has assigned a credit rating of Baa2 to both -CIMIC Finance (USA) Pty limited and CIMIC Group. The outlook remains stable.

Financial & Operating Performance of the company for the Half-year Report 2019

CIM on 17 July 2019, declared half-year report closed 30 June this year, the highlights are as follows:

- NPAT for the period stood at $367 million from $363 million in the corresponding previous year.

- During the period, CIM implemented âAASB 16 Leasesâ standard which led to the rise in finance costs, EBITDA & EBIT margins.

- EBIT and PBT increased by 8.2% and 7.2% respectively.

- $1.8 billion of operating cash flow delivered in LTM.

- Undrawn debt facilities were noted at at $2.7 billion for Half-year 2019

- S&P reaffirmed the strong investment grade of BBB with a stable outlook.

- The company was awarded with $8.3 billion of new work in HY 2019 period.

- Work in hand increased by $2.5 billion, year-on-year basis.

- Stable revenue of $7.0 billion.

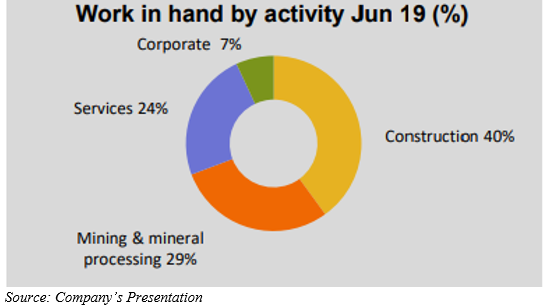

Segment Performance

- Construction revenue represents a substantial contribution from the delivery of transport infrastructure projects.

- Strong revenue number of mining & mineral processing was reflected by the number of contracts extensions and increased production levels with continued focus on driving efficiencies and creating values for the clients contributed to an extended PBT margin.

- Services segment provided with stable margins and continuous revenue progress contributed towards the outcome.

- Corporate segment included contributions from EIC activities, corporate, Pacific Partnerships, Residential business and BICC.

Dividends

The company announced an interim dividend of 71 cps, fully franked, payable on 3 October 2019. It has an ex date of 11 September this year with a record date of 12 September this year.

Outlook

Mining segment would continue to strengthen both domestically and globally with a positive outlook. The company focus on generating sustainable cash - backed profits and managing working capital. The huge pipeline of $60 billion for Mining, Services & Construction provides opportunities for the remaining year and $400 billion for 2020.

Stock Performance

On 4 September 2019, CIMâs stock was trading at A$29.295, down by 4.825 per cent (at AEST 2:35 PM). CIMâs stock has a market capitalisation of A$9.98 billion with ~324.25 million shares (outstanding).

Valmec Limited

Valmec Limited (ASX:VMX) offers equipment, in addition to construction, maintenance services and so forth. The company caters infrastructure sectors, oil & gas and energy clients. Some of the companyâs subsidiaries includes of Valmec Australia Pty Ltd, Valmec Plant and Equipment Pty Ltd and Valmec Services Pty Ltd.

Financial Performance of the company for FY 2019

The company declared the full year result for the period closed 30 June this year on 28 August 2019. Some of the highlights are as follows:

- Record EBITDA of $8.06 million increased by 64% to $8.06 million compared to the same period last year.

- Sales revenue was noted at $110 million, representing an increase of 6.7% on pcp.

- NPAT for the company stood at $3.5 million.

- The segment accounted for 42% of total revenues and 50% of Group earnings.

- VMX has more than $595 million of work related to construction and services and an Order Book of ~80 million.

- VMX cash in hand for the FY 2019 period was noted at ~$3.82 million.

Outlook

The company anticipates the EBITDA to improve in financial year 2020 period, with rising pipelines of construction activities with additional development in its asset service. To strengthen the cash reserves, Valmec is anticipating growth in the larger project activity.

AGIG Contract

On 5 June this year, VMX announced that it was chosen by AGIG or Australian Gas Infrastructure Group to deliver the foremost hydrogen production facility in Australia.

A few highlights on the update are as mentioned below.

- The site of the project is said to be Tonsley in South Australian region and is worth of around $4.5 million.

- EPC services on the project would be provided by the company.

Newmont Goldcorp Services Contract

On 19 June 2019, VMX notified that it had gained a fresh contract at a consideration of around $6 million with Newmont Goldcorp Services Pty Ltd for the purpose of infrastructure works.

The highlights of the update are as follows:

- Under the contract, the company would support the proposed Tanami Expansion of Newmount Goldcorp in Northern Territory.

- Most of the work of the contract is likely to be completed by November 2019.

- A final decision with regards to the financing of TE 2 Project is to be decided by H219 period.

- This deal depicts the initial step to be taken for the companyâs development strategy towards both the infrastructure and gas sectors.

Stock Performance

VMX stock, on 4 September 2019 (AEST 3:15 PM), was trading at AUD 0.265, slipping by 3.636 percent. The company has a market cap of around AUD 34.57 million and approximately 125.72 million outstanding shares. The stock has a PE multiple of 9.72x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.