Australian health care system is developing rapidly and is one of the best healthcare systems across the globe. It comprises of pharmaceutical manufacturing companies, biotech companies, medical device manufacturers & distributors, laboratories and hospitals. The health care sector is operated by federal, state and local government bodies. In Australia many health care companies dealing in drug development and research & development activities are generating good revenues by providing solutions for chronic diseases and unmet medical needs.

Here in this article, we are highlighting five ASX listed health care companies that have generated good revenue as compared to that in the previous financial year- (Nanosonics Limited, Clinuvel Pharmaceuticals Ltd, Avita Medical Limited, Healius Limited, Sonic Healthcare Limited)

Australia headquartered health care company Nanosonics Limited (ASX:NAN) is an innovator in providing solutions for prevention of infection. Nanosonics has its offices in North America, the United Kingdom, Canada and Europe. The company is engaged in the manufacturing and distribution of trophon® EPR and trophon®2.

On 31 October 2019 company announced the appointment of Lisa McIntyre as a Nonexecutive Director of Nanosonics effective 13 December 2019. Lisa holds a Bachelor of Science from the University of Sydney, and a PhD in Physical Chemistry from the University of Cambridge and is currently serving as a Non-executive Director of icare NSW, HCF Group, and The University of Sydney.

Annual General Meeting (AGM)

Nanosonics announced that it would conduct an annual general meeting in New South Wales, Australia on Monday, 18 November 2019. The main agenda of this AGM are-

- Re-elect Director â Mr Maurie Stang

- Re-elect Director â Dr David Fisher

- Elect Director â Mr Geoff Wilson

- To adopt Remuneration Report

- To consider Issue of 19,547 Performance Rights to the Chief Executive Officer and President, Mr Michael Kavanagh, under the 2019 Short Term Incentive (2019 STI)

- To consider Issue of 178,914 Options and 12,910 Performance Rights to the Chief Executive Officer and President, Mr Michael Kavanagh, under the 2019 Long-Term Incentive (2019 LTI)

- To Issue securities under the Nanosonics Omnibus Equity Plan

- To Adopt Nanosonics Global Employee Share Plan

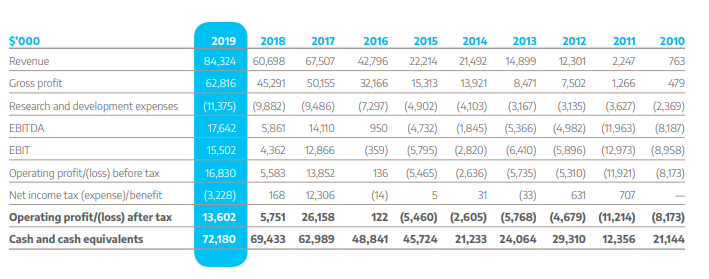

Financial highlights FY-2019

Nanosonics had a steady growth and reported strategic expansion reported for the last fiscal year ended on 30 June 2019.

- Total revenue of the company for the year 2019 was nearly $84.3 million.

- For FY-2019 company generated a gross profit of $62.8 million which increased by 39% compared to previous year.

- Research and Development expenses of the company for 2019 were approximately $11.3 million, and this is an increase of over 15% compared with the last financial year.

Source: Companyâs Report

Stock Performance

The companyâs stock closed at $ 6.790 down 0.147% with a market cap of nearly $2.04 billion on 1 November 2019. The stock has delivered a return of 144.60% on a YTD basis and 39.34% in the last six months.

Clinuvel Pharmaceuticals Ltd (ASX: CUV)

A global biopharmaceutical company Clinuvel Pharmaceuticals Ltd (ASX:CUV) is headquartered in Melbourne, Australia and has its operations in Europe, Singapore and the United States. The company is engaged in developing and delivering treatments for genetic and skin disorders. Its lead compound SCENESSE® was approved by USFDA in October 2019 and by the European Commission in December 2014 for the treatment of adult erythropoietic protoporphyria (EPP).

Priority registration for SCENESSE®

On 30 October 2019 the company announced that priority registration grant is issued to SCENESSE® (afamelanotide 16 mg) from Australian Therapeutic Goods Administration (TGA).

- The review timeframe would be 150 working days from application submission.

- The company plans to submit scientific dossier in first quarter of FY-2020 to the TGA.

On 31 October 2019 the company announced its Quarterly Cashflow Report for the period 01 July to 30 September 2019. According to this net Cash from Operating Activities increased by $5,385,000 and a cash balance of company as on 30 September 2019 was $58.3 million.

As per one update on 18 October 2019 company announced that Mr Willem Blijdorp would be the new Chair of the Board after the retirement of Mr Stan McLiesh. He will assume his new role from 30 November 2019 and onwards.

Product pipeline of the company-

SCENESSE® is approved in Europe and the United States and has completed Phase III trial in Australia and Japan for the treatment of adult erythropoietic protoporphyria (EPP).

Stock Performance

The companyâs stock settled at $30.640, up 0.262% with a market cap of nearly $1.5 billion, on 1 November 2019. The stock has delivered a return of 69.78% on a YTD basis and 26.70% in the last six months.

Avita Medical Limited (ASX:AVH)

A regenerative medicine company Avita Medical Limited (ASX:AVH) is engaged in providing solutions for unmet medical needs in various indications such as burns, chronic wounds and others. The company develops and manufactures treatment solutions by using its innovative patented technology and distributes in regenerative medicine and respiratory markets.

First Quarter 2020 Highlights-

- The company received $4.6 million from the United States sales of RECELL System, with a growth of 60% Q-o-Q.

- Achievements in the United States after approval-

- A total of 56 of 132 of the United States burn centers have placed orders for AVHâs RECELL System.

- About 50% of the United States surgeons and burn centers are trained on RECELL System

- The company received US FDA investigational Device approval for pivotal study protocol for evaluating RECELL System for soft tissue reconstruction and traumatic wounds.

Stock Information

The companyâs stock settled at $0.645, up 8.403% with a market cap of approximately $1.11 billion, on 1 November 2019. The stock has generated a return of 653.16% in the year to date.

Healius Limited (ASX: HLS)

One of Australiaâs leading healthcare companies, Healius Limited (ASX:HLS) is a provider of diagnostic imaging services, pathology services, and health technologies. Dental, IVF and Day Hospitals are the emerging business of Healius. The company provides its services to independent general practitioners, radiologists and other healthcare professionals. Healius is a market leader in Australia having a total 2,558 sites including 2,318 pathology and collection sites, 95 medical centres and day hospitals and 145 Imaging centers.

According to a recent update company announced that it would conduct its Annual General Meeting on 25 November 2019 in Sydney, Australia.

Stock Information

The companyâs stock closed at $3.130, up 1.623% with a market capitalisation of approximately $1.92 billion, on 1 November 2019. The stock has provided a return of 26.23% in the year to date.

Sonic Healthcare Limited (ASX:SHL)

Sydney based diagnostic company Sonic Healthcare Limited (ASX:SHL) provides laboratory, pathology, and radiology services. The company has its offices in Australia, the United States, Germany, Switzerland, the United Kingdom and others.

Notice of Annual General Meeting 2019

The company announced that it would conduct an AGM on Tuesday, 19 November 2019 in Sydney, Australia. The agenda of this meeting are-

- To Adopt Financial Statements and Reports of the previous year,

- To elect Directors

- To consider Remuneration Report

Sonic Healthcare plans to raise US$550 Million

On 10 October 2019 Sonic Healthcare announced that it has priced US$550 million of notes in the US private placement market and the expected date for closing this transaction is in January 2020.

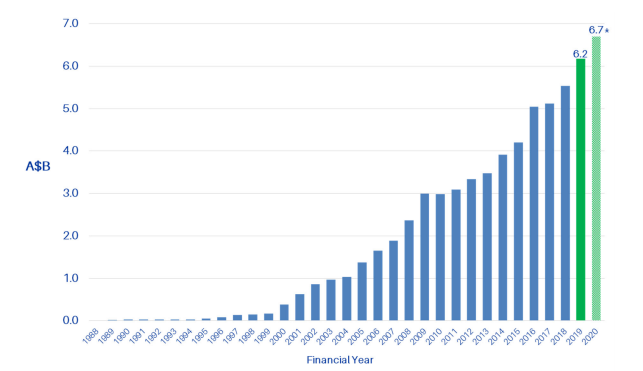

Financial highlights for FY-2019

- Sonic Healthcare generated revenue of $6.2 billion, a growth of 11.6% over the prior corresponding period (pcp).

- Per-share earnings of the company for this year was $1.22, a growth of 8.8% over pcp.

- The company recorded a net profit growth of 15.6% year over year to $550 million.

Source: Companyâs Report

Stock Performance

The companyâs stock settled at $28.990, up 1.577% with a market cap of nearly $13.55 billion, on 1 November 2019. The stock has delivered a return of 30.92% on a YTD basis and 9.90% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.