About Webjet Limited

Webjet Limited (ASX: WEB) is a digital travel business in Australia and New Zealand. It provides complete online travel booking services for flights, hotels, car hire, cruises and tours.

Business:

-

B2C Travel :

-

B2B Travel :

-

Online Republic:

During May 2016, the company acquired Online Republic in order to support its core capabilities into appealing complementary travel divisions. This New Zealand business ranks amongst the top global e-commerce groups. It deals in online reservations of rental cars, motorhomes as well as cruises.

Financial Highlights for the year ended on June 30, 2019

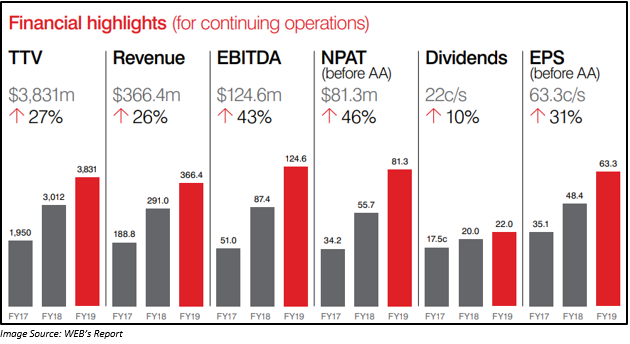

FY2019 for the company was an exceptional year during which the company reported a record performance across all key metrics.

- The total transaction value from the continuing operations increased by 27% to $3.8 billion.

- The revenue of the company soared up by 26% to $366.4 million.

- EBITDA also went up by 43% to $124.6 million.

- Net profit after tax before acquisition amortisation for the period was $81.3 million, a 46% growth on pcp.

- EPS increased by 31% to 63.3 cents.

- The company declared a final dividend of 13.5 cents per share (fully franked). Thus, for the full year, the dividend provided by the company was 22 cents per share, representing a growth of 10% on the previous corresponding period.

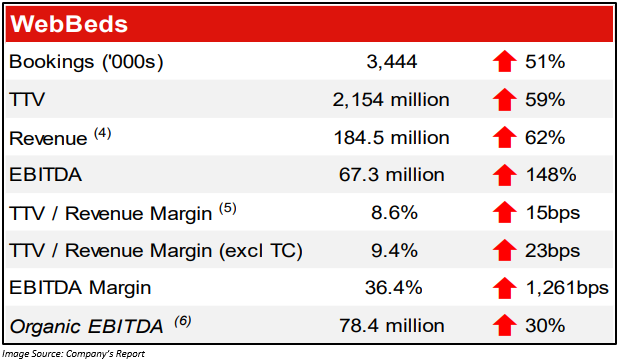

- After the acquisition of JacTravel as well as Destinations of the World, the WebBeds business became the biggest business across bookings, total transaction value and Earnings before interest, tax, depreciation and amortisation (EBITDA). From this business, TTV increased by 59% to $2.2 billion as compared to the previous corresponding period. EBITDA also soared by 148% to $67.3 million on pcp. Apart from this, the company also reported strong growth from other regions as well.

Business Unit Performance:

WebBeds:

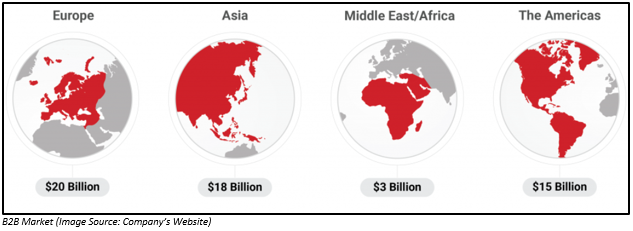

This business unit experienced an increased TTV and EBITDA margins in all areas. The business also felt challenges in the regions of Europe and the Middle East. Still, the unit delivered strong results in both the markets. It focused on selling contracted inventory directly and simultaneously improving margins. In North America, there was a solid growth in the bookings which supported EBITDA. APAC region remained the fastest growing B2B regions. The investment made in this region since the last two years has started providing a robust turnaround in profitability in the second half of FY2019.

Webjet OTA

Webjet OTA (online travel agency) during the period, continued to gain market share. The flight bookings are growing double in the underlying market. Sales of higher margins products across air travel as well as additional products, led to growth in TTV margin.

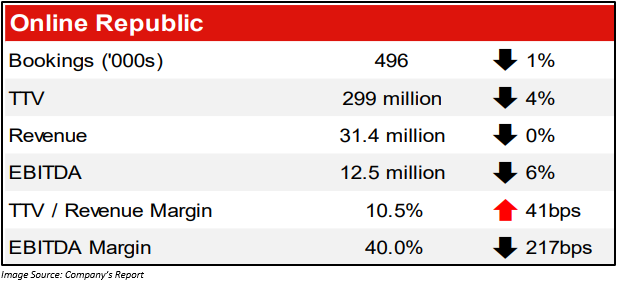

Online Republic

During the period, the company focused on more profitable bookings with elevated TTV margins along with smaller acquisition costs. This resulted in an improvement in the TTV margin. However, the demand for travel in New Zealand, especially in Motorhomes declined after the Christchurch incident which took place during March 2019. The car division performed well during the period. On the other hand, Cruise continued as an underperformer.

Outlook:

WebBeds:

For this segment, the company by FY2022 expects to deliver a profitability target of 8% revenue/TTV and 4% costs/TTV to deliver 4% EBITDA/TTV. The company also anticipates that its cost would grow at a lower rate as compared to the revenue which would be possible because of optimisation of IT platforms along with the ongoing impact of Rezchain (a leading blockchain solution from this industry).

Webjet OTA:

The company in FY2019 results declared that it is optimistic about the growth opportunities in domestic as well as international flights along with growth in a variety of ancillary products.

Online Republic:

The company would be focusing on increased TTV margin along with lower acquisition costs.

Thomas Cook entered Compulsory Liquidation:

Headquartered in Mumbai, India, Thomas cook is an integrated travel and travel-related financial services company, as well as among the largest travel service provider networks. Thomas Cook is a customer of WebBeds B2B business and has recently entered compulsory liquidation.

On 23 September 2019, the company released an announcement related to the same and stated that it would impact its results for FY2020.

- Loss of Total Transaction Value: The company earlier highlighted that it expected to earn Total Transactional Value in the range of $150 to $200 million from Thomas Cook.

- Apart from that, Thomas Cook as at 23 September 2019 owed Webjet ~ EUR 27 million in outstanding receivables. The impairment of any outstanding receivables will be considered as a one-off cost to the income statement. Other than this, there would be no material influence on the Webjetâs liquidity as any write off would be taken care of by the available cash reserves of the company along with the undrawn facilities.

The company also clarified that it would not have any influence on 3,000+ hotel contracts which it acquired from Thomas Cook during August 2016. These are now completely owned by WebBeds and is made available for sale to the customers of WebBeds. Majority of these contracts at present is being sold to the non-Thomas Cook clients. It was the key reason behind the profitable growth of the companyâs European business in the last three years.

As indicated by the company in FY2019, it expected that WebBeds business would be earning further EBITDA in the range of $27 million to $33 million in FY2020 from various factors which also included Thomas Cook. Now, with the collapse of Thomas Cook, the company expects a fall in its EBITDA by $7 million.

Conclusion:

Webjet has a track record of giving a strong result in the last five years. After seeing the whole picture, one cannot deny that compulsory liquidation of Thomas Cook would have significant impact on the financial health of the company. But itâs just a phase which the company would soon overcome as other parts of the business are not being impacted.

Stock Performance:

The shares of Webjet Limited have generated ??a YTD return of 3.02%. The shares on 01 October 2019 opened at a price of $10.900, down by $0.01 as compared to its last closing price. The shares at AEST: 2:46 PM were trading at a price of $10.620, down by 2.658 % from its previous closing price. WEB has a market capitalisation of $1.48 billion and approximately 135.6 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.