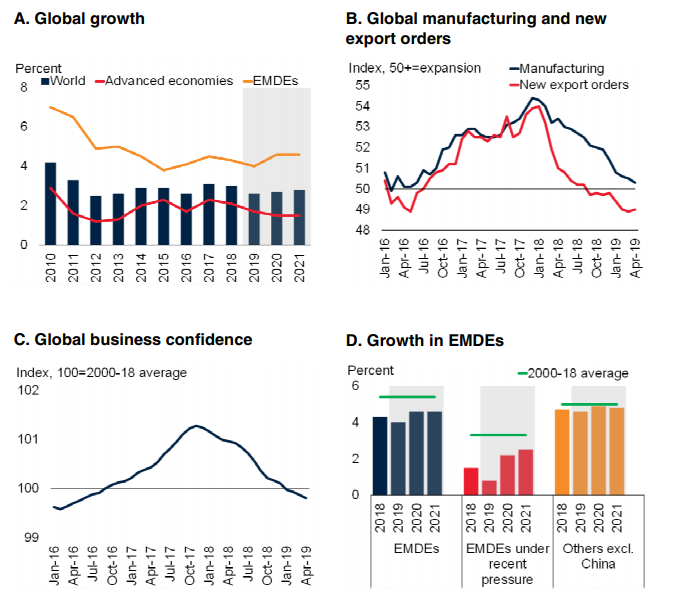

Global growth in 2019 has been lowered to 2.6 %, 0.3% point below prior predictions, signalling softer-than-anticipated international trade and investment at the beginning of the year. Growth is likely to slowly rise to 2.8% by 2021 and increased policy uncertainty, including a latest re-strengthening of trade tensions between key economies like the US and China, have been accompanied by a slowing in global investment and a drop-in confidence. Global trade increase in 2019 has been revised down a full percentage point, to 2.6 percent, which is slightly below the rate seen during the 2015-16 trade slowdown, and the lowest since the global financial crisis.

Nobody likes low growth environment and when macroeconomic growth slows down, investors gets nervous. However, economy is not the only thing that drives earnings and revenue growth of a company. There are many industries that are prepared to expand at a rapid rate even if the economy rate is muted or slowing.

There are many industries that are not really tied to the economic cycle and are taking advantage from technological innovation, longer term trend or consumer preferences.

Also, in a rapidly growing economy, investors must pay a close attention to a companyâs business model, profit dynamics and sources of revenue.

Global Growth Prospects (Source: Worldbank)

In this article we have outlined a beginning point on where one can look to discover investing chances in a low growth environment:

Companies besides large caps: Growth in a low growth environment is very difficult to be found in blue chip companies because in a tough environment blue chip companies may find expansion challenges. For example, if we look at the financial sector of the country, more growth could be found in regional financial companies than the big four banks.

Defensive Sector: Consumer staple companies are generally considered from the defensive sector and are good in a low growth environment because of their defensive nature as they are less economic sensitive. People will always need utilities and need to buy groceries.

Regularly Evaluate your Portfolio: In a low growth environment, it is very important to actively manage your portfolio and you could consider regularly adding undervalued companies.

ETFs of Emerging Markets: Although the Australian markets are experiencing low interest and low growth environment, there are many other countries in the world that are experiencing growth. Growing markets like China and Brazil are experiencing growth and you can get exposure to markets of these countries by investing in ETFs of these markets.

Technology: Companies need to be more efficient if they want to make money or grow in a slow growth environment. You should look at the companies that are able to utilise technology and cut costs to make their company more cost efficient as companies need to change their processes and lessen operating cost to remain competitive in the market.

Smart Acquisitions: In a low growth environment, look for the companies that make smart acquisitions, as these are generally tough times and the companies that do smart acquisitions can remain sustainable in the market.

Growing Industry: Invest in the companies that are high quality (good market cap, dividend yield) that have genuine growth business. Look for the companies in the growing sectors.

Companies that have target customers in growing countries: There are many countries around the globe that are still strong. One of the countries is China. Chinaâs GDP growth is 6.2% and other economies like US and Australian markets have slowed down. As Australian brands have good reputation in China because of their higher standard than local products.

Tips for Investing in Low Growth Environment

Below we have highlighted few options where investors can put their money.

Bonds: After equity, the first option that comes into mind is bonds. Although, bonds are expensive, but they cannot be avoided. With slow growth comes low bond yields and less return expectations. Investors should dodge taking substantial interest-rate risk and credit risk and should not forget that pursuing yield or income in a low- growth environment is the worst thing possible.

Liquid Assets: In a low growth environment, about eighty per cent of the portfolio should be held in liquid investment that can be sold immediately. This is because if the economy improves you would have plenty of buying opportunities over the next six months.

Currencies: The exposure to Australian dollar currency should be kept to a minimum as in a low-growth environment, currency volatility has a more significant impact on returns. An important thing to note is that, major portion of your investments must be in your base currency or hedged back to your base currency.

Stay Away from The Gold Hype: Buying gold in such low growth environment is basically speculating not investing. When markets get volatile, investors sell their gold to maintain short term liquidity and when markets recover, investors again sell their gold and buy riskier assets like equities.

Invest in Large Cap Global Equities: Large-cap global equities look reasonably valued and low growth does not certainly connect to low profitability. It is company as guidance and profitability that pushes share price growth and not geopolitical events.

Keep Commodities in Portfolio: As growth expectations improve in longer period, exposure to base metals, agriculture and oil becomes important as exposure to commodities can also provide some portfolio diversification benefits.

Put Limit on âAlternativeâ Investment: In an environment of low growth, investors should prevent unnecessary leverage and safeguard access to high levels of liquidity. With employment concerns, property and bank lending remain muted, itâs still too early in the cycle to allocate.

Beware of High Fees: The total investment fees should be no more than 0.8%, which includes custody fee charges, execution costs, management fee charges and any retrocessions or rebates, which should be returned to you as the client as in a low-growth environment, wastefulness on fees equates to the obliteration of your wealth over the long term.

In a Nutshell

Picking stocks whose sales wonât get affected by slowing economy, purchasing the fastest-growing names while inflation is flat, focusing on high-yielding dividend stocks and buying stocks of those companies that have business overseas will be advisable to look at in a state of low growth environment. Growth is hard to come by presently, but it can be very rewarding for investors who know where to find it.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.