Introduction

The stock market in October will be greatly influenced from the fresh round of talks between US & China related to tariffs. This is because China is Australiaâs one of the largest trading country. There is an anticipation that there will be some agreement that will be reached to end this ongoing trade war. This is on the back of US President Donald Trump statement, that both countries are in âgood conversationsâ and there could be an agreement shortly.

Further, the stocks that could continue to perform are stocks that have good visibility of the business in the future and have long term prospects. Let us now have a look at such stocks as follows:

Australia and New Zealand Banking Group

Simplifying its business:

Australia and New Zealand Banking Group (ASX:ANZ) is among the top five listed company in Australia and bank market share. It is the largest bank in New Zealand that have the total assets of AU$980.2 billion. ANZ is simplifying its business as it is concentrating on Institutional and Large Corporate banking in Australia.

The bank has recently on 23 September announced the completion of the sale of its Retail, Commercial and Small-Medium Sized Enterprise (SME) banking businesses in Papua New Guinea to Kina Bank, which is a 100% owned subsidiary of Kina Securities Limited. The company has already sold its retail and wealth businesses in various countries, that includes Singapore, Hong Kong, China, Taiwan, Indonesia and Vietnam.

As notified on 19 August 2019, the company sold its 55% interests in JV or Joint Venture ANZ Royal Bank to J Trust.

As updated by the company on 2 May 2019, ANZ had already sold 23 businesses and have reduced risk-weighted assets (RWA) in Institutional by $50 billion. This had led to freeing up of $12 billion of capital which will help the company re-balance its portfolio and invest in growth of the entity. Further, ANZ is considering RBNZ's proposal for enhancing the capital in New Zealand. This proposal is projected to add NZ$6 billion to NZ$8 billion of additional capital over the period of next five years, which means around 50% more than what ANZ is currently holding.

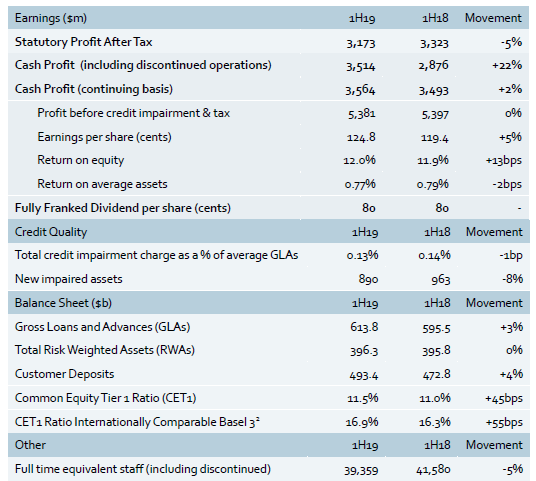

Moreover, for the first half report of 2019, released on1 May 2019, the bank reported rise in the cash profit for its continuing operations to $3.56 billion, though during the period, there is 5% decline in the Statutory Profit after tax to $3.17 billion. During 1H 2019, there was 25 basis point expansion in the Common Equity Tier 1 Capital Ratio to 11.5% & 13 bps expansion in Return on Equity to 12%.

1H FY 19 Financial Performance (Source: Companyâs Report)

On 1 October 2019, the stock of ANZ was trading at $28.51 (at AEST 11:52 AM), moving down by 0.035 percent. ANZ has a market cap of 80.84 billion, with around 2.83 billion shares outstanding.

Coles Group Ltd

Demerger, Strategic Partnership & Decent Financial Performance in FY 19:

Coles Group Ltd (ASX:COL), formed after the demerger from Wesfarmers, has in FY 19 signed the strategic partnership with Ocado, Witron, Optus and SAP, Viva Energy, Australian Venue Co and Eastgardens. This is for bringing the online grocery website to be the world leader, bringing two automated single pick fulfilment facilities and home delivery solution to Australia, developing two world class automated distribution centres, boost technology driven transformation of stores, support centres and supply chain, restoration of fuel growth and for commencing the rollout of new store formats.

Moreover, in FY 19 results, the company has reported 3.1% rise in the Group sales revenue (excluding Fuel sales and Hotels) to $35.0 billion on the back of growth of Supermarkets, Liquor and Express segments. However, during the period, there has been 8.1 percent decline in the Group EBIT (without Hotels and significant items) to $1.3 billion due to minimal volumes of Express fuel and rise in corporate costs related with being a standalone ASX entity and one-off demerger expenses.

On 1 October 2019, the stock of COL was trading at $15.415 (at AEST 12:09 PM), moving up by 0.097 percent. COL has a market cap of 20.54 billion, with around 1.33 billion shares outstanding.

Stockland

Development Pipeline:

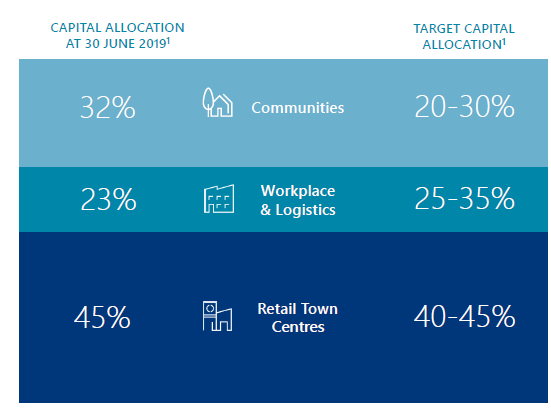

Stockland (ASX:SGP), the leading company that has presence in the development of the retail town centres, workplace and assets related with logistics, residential and retirement communities.

The company has a target to optimise its Weighted Average Cost of Capital, have recurring income in the ratio of 70:30 and its group ROE is said to be more than 10%. The company has a target payout ratio to be in between 75â85% of FFO and the distribution growth is said to be according to the growth of FFO per security. The company has total return (IRR) in the range of 7â9% pa recurring income assets and in the range of 12â16% pa active income assets.

Moreover, for Retirement Living, the company has more than 3,500 total development units in its pipeline, which would give revenue in the future. For Residential, the first settlements from the companyâs 8 new projects are expected to be done over the next two years and would boost landbank activation and ROA.

For fiscal 2020, the company expects to settle more than 5,000 lots and the segmentâs operating profit margin to be approximately 19%, which is above through cycle range of approximately 14%. In FY 20, for Commercial Property, the company expects Comparable FFO growth to be about 1%. Additionally, in FY 19 results, the company has reported 4% increase in the Funds from operations (FFO) to $897 million & expects flat FFO per security growth in FY20.

Portfolio Allocation (Source: Companyâs Report)

On 1 October 2019, the stock of SGP was trading at $4.555 (at AEST 12:29 PM), edging up by 0.11 percent. SGP has a market cap of 10.85 billion, with around 2.38 billion shares outstanding.

Ramsay Health Care Limited

Negative Core EPS growth in the range of -6% to -4% Projected for FY 20:

Ramsay Health Care Limited (ASX:RHC) is an operator of chain of private hospitals in various countries like Australia, UK, France, Indonesia etc.

On 17 September 2019, RHC notified the market that Paul Ramsay Holdings Pty Limited sold 22 million shares in Ramsay to institutional investors at the price of $61.80 per share and has reduced its holding to 21% of the issued share capital.

On the other hand, the company in FY 19 results has reported 24.4% growth in the Group Revenue to $11.4 billion, and 14.1% increase in the Group EBITDA to $1.6 billion. It also reported 40.5% increase in the statutory reported net profit after tax and after non-core items to $545.5 million.

Moreover, in FY 20, the company will be investing $72.34 million for Greenslopes Private Hospitalâs Surgical, Medical & Emergency Centre expansion. It will also be investing $67.7 million for Hollywood Private Hospitalâs New Emergency Department & Beds, both of which is projected to open in fiscal 2022. Further for fiscal 2020, the company expects Core EPS growth on a like-for-like basis to be in the range of 2% to 4% (means negative Core EPS growth in the range of -6% to -4%) and Core EBITDAR is expected to grow in the range of 8% to 10%.

On 1 October 2019, the stock of RHC was trading at $15.415 (at AEST 12:09 PM), moving up by 0.097 percent. COL has a market cap of 20.54 billion, with around 1.33 billion shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.