Highlights:

Podium Minerals Ltd (ASX:POD) reports a new copper-gold mineral estimate at Parks Reef

Resource expansion strengthens project’s integrated platinum group metals profile

Strategic enhancements aim to elevate operational and commercial standing within ASX 200 mining sector

The mining industry remains a fundamental pillar of economic output and raw material supply. Within this sector, companies in the ASX 200 index often seek to upgrade their mineral assets to maintain operational relevance and broaden their project pipelines. Podium Minerals Ltd (ASX:POD), which operates within the Australian mining space, has reported a notable development for its Parks Reef project, situated in Western Australia. This new update aligns with broader sector trends, where diversification and strategic resource expansion play a central role in shaping market value and operational direction.

Parks Reef Copper-Gold Resource Estimate

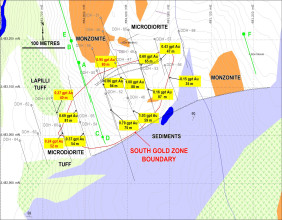

Podium Minerals has released a revised mineral resource estimate for its Parks Reef site, focusing on a copper-gold zone that complements its existing platinum group metals (PGM) resources. The newly identified area also includes nickel and cobalt mineralization. This latest estimate follows prior resource modeling in the PGM-rich strata and represents a significant advancement in the broader Parks Reef resource profile.

This copper-gold zone lies adjacent to the PGM-defined horizon, reinforcing the integrated resource composition at the site. The existing PGM segment encompasses platinum, palladium, gold, rhodium, and iridium, accompanied by associated base metals. The expanded copper-gold findings elevate the overall strategic worth of the project through resource synergies.

Enhancing Strategic Value and Commercial Metrics

The location of the copper-gold zone enhances logistical and operational cohesion with the adjacent PGM reserves. By combining multi-metal zones into a unified mining operation, Podium Minerals strengthens the economic case for development. The resource uplift also contributes to a recalibrated podium basket price for PGM output, improving commercial metrics and reinforcing the broader economic appeal of Parks Reef.

This integration enhances market confidence and project scalability, offering a resource profile that accommodates varied extraction and processing approaches. The copper-gold zone’s position, above the existing PGM and base metal strata, further optimizes the vertical sequencing for mining operations.

Technological Advancements in Recovery

Podium Minerals continues to pursue technical advancements to boost process efficiency. Phase two of its flotation work program remains ongoing, focusing on refining the recovery of platinum group metals. Central to this initiative is waste rejection, which aims to produce cleaner, higher-grade concentrate for downstream applications.

These technological enhancements are positioned to streamline the production cycle and improve product quality. Upgrades in refining circuits and material handling reflect a broader commitment to operational excellence and long-term project performance.

Market and Sectoral Response

Following the resource update, Podium Minerals Ltd experienced upward share momentum, reflecting interest from stakeholders monitoring mining-sector activity within the ASX 200 index. These developments underscore the significance of resource diversification and expansion in shaping the strategic direction of mid-tier mining companies.

Such milestones draw industry attention and contribute to ongoing sector-wide conversations surrounding asset development, mineral supply dynamics, and project management efficiency. Parks Reef, as a multi-metal asset, remains central to Podium’s growth trajectory and its positioning within Australia's competitive mineral exploration and development space.