Introduction: Amcor PLC (ASX: AMC) operates in consumer packaging segment and provides services to the leading companies across food, beverage, pharmaceutical, medical, home and personal care, and other products categories. The company has a wide range of products across flexible and rigid packaging segments such as specialty cartons, closures, and others. The products of the company are light-weighted, recyclable and reusable in nature. The company operates across two segments namely Flexibles and Rigid Packaging.

Segment Overview: Amcor Flexibles derives 38% of the total revenue from Europe, Middle East and Africa, 6% form North America, while 15% and 11% come from Asia Pacific and Latin America, respectively. Industry wise the company derives more than 60% of its total revenue from food and beverage segment (approx. 62%) while it supplies 15% to healthcare and 6% to home & personal care segments. From the Flexibles segment, the company derives roughly ~70% of its Income while the rest comes from Rigid Packaging. Regarding profitability, the Flexibles reports ~72.61% of the total net profit and the rest 27.39% comes from Rigid Packaging.

FY19 Financial Highlights: AMC announced results for the year ended June 2019 wherein, sales came in at U$9,458.2 million, higher than 1.5% in FY18 while net income came stood at U$729.5 million, as compared to U$697.3 million. The company reported EBITA at U$1,393.9 million during the year, higher by 0.3% y-o-y. On the balance sheet front, cash and cash equivalent stood at U$601.6, total assets at U$17,165 million and total shareholder' equity at U$5,674.7 million. Long-term debt (including capital lease obligations) came at U$5,314.4 as on 30 June 2019. The company reported U$776.1 million as net cash provided by operating activities, U$10.2 million in net cash provided by investing activities and net cash used in financing activities at U$764.9 million.

Operating performances: Europe witnessed an increase sale aided by growth across healthcare, pet care, coffee and ready meals segments while, product mix within the snacks and confectionary and fresh food segments remained unfavorable. Strong revenue growth prevailed across Europe and Americas in the healthcare business. North America segment witnessed beverage ~1% higher volumes on y-o-y. The company reported 4% lower volume on prior-corresponding-period basis across combined preform and cold fill container segments. Smaller regional customers strong witnessed volume growth during FY19.

In the Rigid packaging segment Latin America witnessed 3% growth in volume on y-o-y basis which includes volume de-growth in Argentina. Excluding Argentina, ~10% higher volumes were realized in Mexico, Colombia and Brazil. Adverse Economic conditions resulted due to low consumer demand in Argentina. Growing demand from the emerging markets resulted higher sales across Asia Pacific followed by lower operating and overhead expenses as compared to FY18 due to several cost savings initiatives benefits implemented during previous financial year.

On 11 June 2019, Amcor successfully acquired Bemis Company, Inc. under the terms of the agreement of the all-stock acquisition. The above collaboration was made at a constant exchange ratio of 5.1 Amcor shares for each equity share of Bemis. Shareholders of Amcor Limited will get one share of CHESS Depositary Instrument.

The results were mixed, on account of slowdown across few geographies and created pressure on the bottom-line for the company.

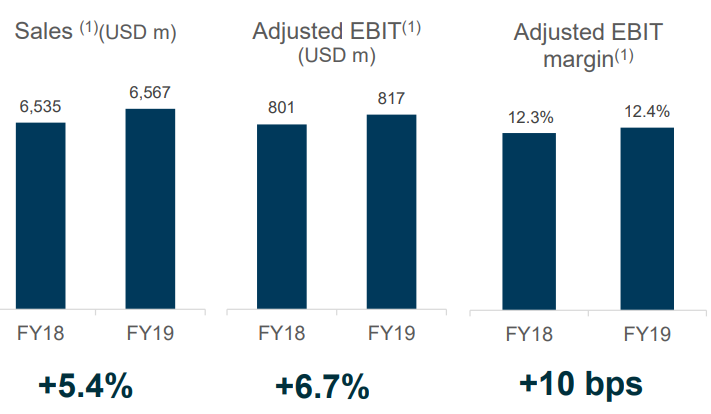

Financial Highlights (Source: Company Reports)

Dividend distribution: The Board of Directors declared an unfranked dividend of USD 0.12000000 for each ordinary share held, payable on 8 October 2019. Annualized dividend yield of the stock stands at 4.5%.

Outlook: The management has given a guidance of 5% to 10% EPS growth on adjusted constant currency basis. This guidance range is calculated determining the pre-tax synergy benefits associated with the Bemis acquisition worth U$65 million. The company projects a cash flow after dividends in the range between U$200 to U$300 million, after subtracting approximately U$100 million allocated for cash integration costs. General and corporate expenses are expected to be within U$160 to U$170 million on constant currency terms. The Board also highlighted that net interest costs will likely come in between U$230 million to U$250 million on constant currency terms while adjusted effective tax rate range is estimated at 21% to 23%.

Stock Update: The stock of AMC closed at $14.450 on 18th September 2019, and it has a market capitalization of $ 23.22 billion. The 52-weeks trading range of the stock stood at $12.665 to $16.740. Currently, the stock is trading below the average of its 52-week high and low prices. The stock has generated negative return of 1.99% during last one month. Price to earnings ratio of the company stood at 27.480X.

Challenges: Recently one of the esteemed Research Firm has downgraded the stock on account of reduction in virgin plastic by 35% by 2025 by Pepsi. As per the plan, the consumption of virgin plastic would be reduced by 2.5 million tonnes. Last year, Pepsi acquired an Israeli-based company which would provide minimum usage of single-use plastic bottles. The above step could motivate other big players to reduce plastic consumption. Thus, the above move could impact the order book of the company.

Conclusion: While we believe, strategic collaboration with Bemis Company Inc has positioned Amcor as one of the top players in consumer packaging segment with global footprint along with better scalability and top-notch R&D facilities. The company is well placed to witnessed growth from emerging economies as well as from the Euro region in coming years. Looking at the aforementioned factors, we believe, during the medium term, the company is in an advantageous position within the industry which underpins a stronger value proposition for the shareholders and clients. We also believe that any upcoming change in the trend in the industry would drag the business during the long term. Reduction in consumption of plastic as a packaging tool may act as a negative factor for the company as the majority of inputs used for producing packaging material by the company is plastic.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.