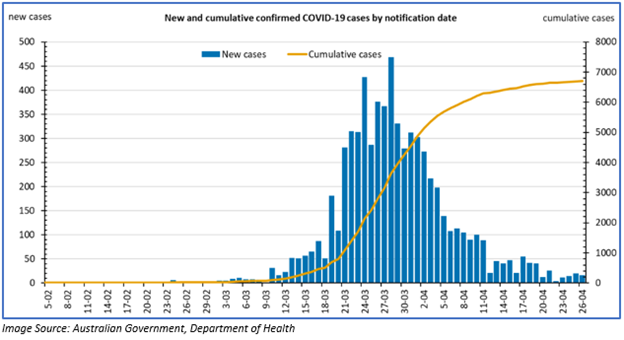

In the present scenario, the Australian economy appears to be coming back on track with an improvement in the recovery rate of the number of coronavirus cases. At present, the recovery rate is nearly 83% which is a positive sign for the country. The number of cases reported daily has also started going south. Four Australian states reported no new cases on the last day.

However, the coronavirus pandemic has impacted many businesses, and most of them have been facing liquidity issues. To raise capital, these companies can either go for debt or equity raising.

In this article, we would be looking at two companies, which have announced capital raising to reinforce their balance sheet and support their growth opportunities in the future.

Let us take a look.

Monash IVF Group Limited (ASX:MVF)

Monash IVF Group Limited provides assisted reproductive services and ultrasound services.

On 27 April 2020, the Company announced a complete package of initiatives to address the business impacts of coronavirus. The intent was to improve the balance sheet flexibility to pass through the COVID-19 pandemic and explore future growth opportunities.

The initiatives announced by the Company complement the previous plans related to cost reduction and cash preservation in response to the non?urgent elective surgery constraints imposed by the Australian government. The government’s restrictions on elective surgery were to shift focus towards the more severe challenges at hand.

The initiatives include:

- A fully underwritten equity capital raising worth $80 million which includes $39.8 million institutional placement along with $40.2 million 1?for?3.05 accelerated pro-rata non-renounceable entitlement offer.

- The second initiative includes a Syndicated Debt Facility which is amended to suspend covenant testing till 30 June 2021. The debt facility expires in January 2022.

These initiatives would support the Company in lessening debt which improves MVF’s balance sheet flexibility to pass through COVID?19. It would also aid in pursuing identified organic & inorganic growth prospects in Australia and South East Asia.

Immediately, post the completion of the equity raising, the Company would repay the debt of approximately $77 million. With this, Monash would have total cash and undrawn facilities of ~$97 million.

Trading Update:

MVF confirmed that its FY2020 YTD trading through to February 2020 as well as volume through to March 2020 was consistent with the prior guidance. By February 2020 end, the unaudited revenue for FY2020 YTD was $100.4 million, up 0.3% on the previous corresponding period (pcp).

Because of the Government restrictions on non?urgent elective surgeries, the Company’s trading performance was materially impacted.

As announced by National Cabinet on 21 April 2020, few elective surgery procedures can start from 27 April 2020.

Further, MVF updated that it is planning for a gradual return of patients. The initiatives announced would help the Company in improving its balance sheet as well as look for identified organic & inorganic growth opportunities in Australia as well as SE Asia.

Along with the latest initiatives, the Company also implemented cash preservation programs to minimise its monthly non-operating cash outflow to $4 million during the full hibernation period.

Update on Covenant Waivers and Interim Dividend:

Covenant Waivers:

MVF has updated that its lending group has decided to defer covenant testing to 30 June 2021.

Interim Dividend:

MVF confirmed that the Board does not expect to pay the final dividend for FY2020 or interim dividend of 1H FY2021.

Stock Information:

On 27 April 2020, the MVF shares were put under trading halt pending an announcement related to capital raising.

MVF shares have delivered a negative YTD return of 31.40%. However, in the last one month, the shares have generated an impressive return of 77.5%.

Charter Hall Retail REIT (ASX:CQR)

CQR owns as well as manages a portfolio of superior convenience-based retail. The business is managed by Charter Hall Group (ASX:CHC) and has more than 29 years of experience in property investment & fund management. The group is amongst the leading fully integrated property groups in Australia.

Capital Raising of $275 million via Placement and $25 million via SPP:

On 27 April 2020, Charter Hall Retail REIT announced that it is undertaking a fully-underwritten institutional placement to raise $275 million and another $25 million via a non-underwritten Unit Purchase Plan to the qualified unitholders in Australia and New Zealand.

The proceeds generated via equity raising would be used for bolstering the balance sheet as well as provide financial flexibility to facilitate continued execution of strategy.

After the completion of the placement, CQR projects its balance sheet gearing to drop to 22.6% and look-through gearing to 28.6%. The cash and undrawn debt facilities would increase to $407 million.

The new shares issued under the equity raising will be issued at $2.9 per share. It represents:

- 9% discount to the closing price of $3.15 on 24 April 2020.

- 4% discount to the 5-day VWAP of $3.167 on 24 April 2020.

Earnings and Distribution Guidance Update:

The Company in its previous announcement dated 20 March 2020 had announced that it had withdrawn its earnings and distribution guidance due to the uncertainty surrounding the coronavirus pandemic. On 27 April 2020, it made a further announcement related to its intention to pay distribution for 2H FY2020. The Company highlighted that the distribution would be considered considering the operating cash flow generated during the period.

CQR’s Update on its Operations:

CQR confirms its operations to remain resilient amid COVID-19 and is focussed on convenience retail. The Company reported that the impact of COVID-19 was significant. However, its anchor tenants remained open and were operational to fulfil the daily requirements of the people during this period. The sales performance of these anchor tenants increased during March 2020. The centres experienced a rise in the number of visits as well as foot traffic. The situation started normalising during April 2020 as the buying pattern returned to normal.

The Company also maintained social distancing measures and followed government regulations to ensure the safety of its employees, tenants as well as customers visiting the centres.

Some of the major tenants of CQR:

- Woolworths

- Coles

- BP

- Wesfarmers

- Aldi

These tenants represent more than 51% of rental income.

Stock Information:

On 27 April 2020, CQR shares were put under a trading halt pending an announcement related to the proposed capital raising.

CQR shares have delivered a negative YTD return of 26.57%. However, in the past one month, the shares have generated a return of 6.42%.