Highlights

- The DUK stock surged over 11% over the past 12 months.

- Southern Company (NYSE:SO) gave a return of over 8% in the last 12 months.

- Avangrid, Inc. (NYSE:AGR) revenue surged around 16% YoY in Q4, FY21.

Dividend-paying utility stocks may provide hedge in uncertain times. The Russian-Ukraine crisis may snowball into a major disaster for stocks if the tensions escalate. Growth stocks could be a risky proposition. We already see a shift in focus toward value stocks. So, the utility sector might be one of the options to explore. Besides, their services are always in demand. Here we explore five dividend utility stocks that might be worth considering.

Also Read: What is OMI crypto? How its cash-for-gems feature works?

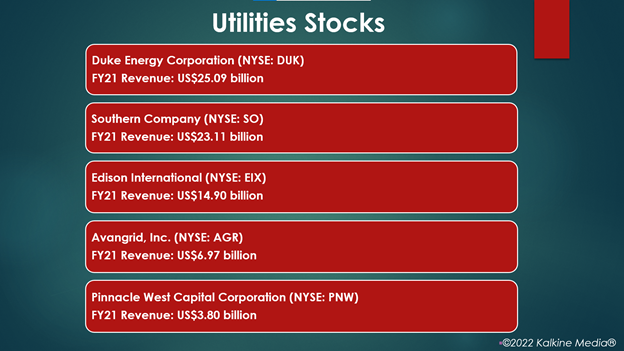

Duke Energy Corporation (NYSE:DUK)

Duke Energy is an energy holding company based in Charlotte, North Carolina. It provides electricity and gas infrastructure and other related services.

Its shares traded at US$99.19 at 11:44 am ET on February 25, up 2.17% from their closing price of February 24. Its stock value increased by 11.39% over the past 12 months.

The firm has a market cap of US$76.43 billion, a P/E ratio of 20.16, and a forward one-year P/E ratio of 17.74. Its dividend yield is 4.03%, and the annualized dividend is US$3.94.

The 52-week highest and lowest stock prices were US$108.38 and US$85.56, respectively. Its trading volume was 4,207,758 on February 24.

The company's total operating revenue was around US$6.23 billion in the fourth quarter of fiscal 2021, while its net income came in at US$0.93 per share. For fiscal 2021, the company's net income was US$3.57 billion on operating revenue of US$25.09 billion.

Also Read: Why is Gala (GALA) crypto rising?

Source: ©2022 Kalkine Media®

Also Read: Shein IPO: Is the Chinese retail firm debuting in the US market?

Southern Company (NYSE:SO)

Southern Company is a gas and electric utility holding firm based in Atlanta, Georgia. It primarily engages in electricity sales and distribution of natural gas.

The stock of the company traded at US$64.33 at 12:01 pm ET on February 25, up 2.31% from its previous closing price. The SO stock rose 8.86% over the past 12 months.

The market cap of the company is US$68.08 billion, the P/E ratio is 28.42, and the forward one-year P/E ratio is 17.76. Its dividend yield is 4.2%, and the annualized dividend is US$2.64.

The stock saw the highest price of US$69.77 and the lowest price of US$56.69 in the last 52 weeks. Its share volume on February 24 was 8,625,572.

The company's total operating revenue rose around 12.7% YoY to US$5.76 billion in Q4, FY21, while its net loss came in at US$283 million. For fiscal 2021, the company's revenue was US$23.11 billion.

Also Read: BUD to STZ: 5 beer stocks to look for as Russia-Ukraine crisis mounts

Edison International (NYSE:EIX)

Edison International is a utility holding firm that focuses on generating and distributing electricity. It is based in Rosemead, California.

The shares of the company traded at US$61.73 at 12:08 pm ET on February 25, up 4.34% from their closing price of February 24. Its stock value soared 6.29% over the past 12 months.

The firm has a market cap of US$23.37 billion, a P/E ratio of 30.61, and a forward one-year P/E ratio of 13.26. Its dividend yield is 4.74%, and the annualized dividend is US$2.80.

The 52-week highest and lowest stock prices were US$68.62 and US$53.92, respectively. Its trading volume was 1,859,398 on February 24.

The company's total operating revenue was US$3.33 billion in Q4, FY21, while its net income came in at US$571 million, or US$1.37 per diluted share. For fiscal 2021, the company's total operating revenue was US$14.90 billion.

Also Read: Lemonade touches a 52-week low, what's next for LMND stock?

Avangrid, Inc. (NYSE:AGR)

Avangrid is an energy service and delivery company based in Orange, Connecticut. Its operations include energy transmission and distribution.

The stock of the company traded at US$44.52 at 12:12 pm ET on February 25, up 2.60% from its previous closing price. The AGR stock fell 6.14% over the past 12 months.

The market cap of the company is US$17.19 billion, the P/E ratio is 21.45, and the forward one-year P/E ratio is 19.11. Its dividend yield is 4.04%, and the annualized dividend is US$1.76.

The stock saw the highest price of US$55.57 and the lowest price of US$43.13 in the last 52 weeks. Its share volume on February 24 was 839,860.

The company's revenue rose nearly 16% YoY to US$1.93 billion in Q4, FY21, while its net income came in at US$134 million, or US$0.42 per diluted share. For fiscal 2021, the company reported a revenue of US$6.97 billion.

Also Read: Travelport IPO: Is the travel-booking firm going public this year?

Also Read: From MIME to DOCN: Top tech stocks to explore amid market correction

Pinnacle West Capital Corporation (NYSE:PNW)

Pinnacle West is an electric utility holding firm that focuses on providing energy and energy-related products and services to consumers. It is based in Phoenix, in Arizona.

The shares of the company traded at US$71.83 at 12:22 pm ET on February 25, up 6.60% from their closing price of February 24. Its stock value declined 7.75% over the past 12 months.

The firm has a market cap of US$8.06 billion, a P/E ratio of 14.12, and a forward one-year P/E ratio of 12.74. Its dividend yield is 5%, and the annualized dividend is US$3.40.

The 52-week highest and lowest stock prices were US$88.54 and US$62.78, respectively. Its trading volume was 1,111,829 on February 24.

The company's total operating revenue was US$798.85 million in Q4, FY21, while its net income came in at US$31.89 million, or US$0.24 per diluted share. For fiscal 2021, the company's total operating revenue was US$3.80 billion.

Also Read: From YNDX to MTL: Can US-listed Russian stocks duck Ukraine crisis?

Bottomline

This year, the financial market has retreated due to various macroeconomic and geopolitical concerns. The commodity prices have skyrocketed on supply concerns, adding pressure to the industries. The S&P 500 utility sector fell 8.82% YTD, while the S&P 500 index plummeted 10.02% YTD.