Highlights

- Varied institutional outlook updates reflect shifting market conditions and company performance.

- A major share repurchase initiative combined with a dividend enhancement underscores strong financial stability.

- Notable internal and institutional movements highlight diverse stakeholder engagement.

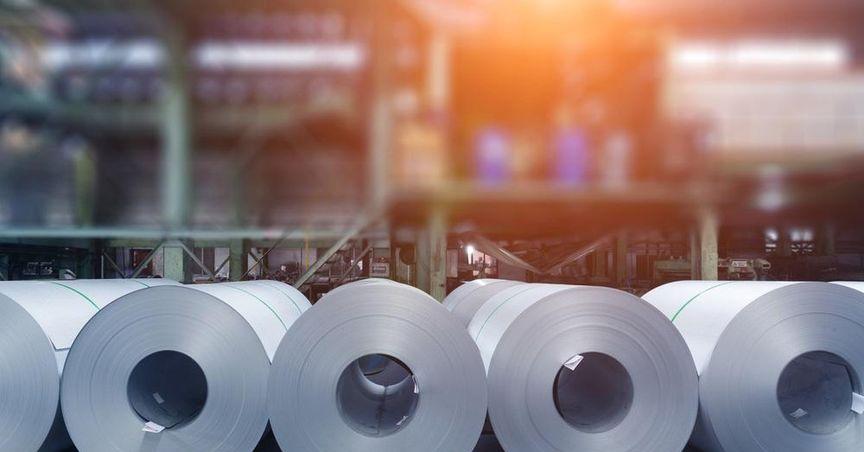

Steel Dynamics, Inc. (NASDAQ:STLD) operates within the steel production and metal recycling arena, providing a wide array of steel products and engineered specialty bars. The company’s operations span from the manufacturing of rolled and coated steel to comprehensive metal recycling services. This sector plays a crucial role in supporting industrial applications and infrastructure development, contributing significantly to economic activities across various industries.

Market Outlook

Several prominent financial institutions have recently revised their valuation outlooks in response to evolving market conditions and shifts in performance metrics. These updates from leading institutions come with a range of perspectives that mirror changes within the broader industry framework. The revisions reflect adjustments made in response to current operational performance and overall market sentiment. This evolving market view emphasizes the dynamic environment in which Steel Dynamics operates and underscores the importance of continuously monitoring performance trends.

Capital Management Strategies

Steel Dynamics has embarked on a significant share repurchase program while simultaneously enhancing its quarterly dividend. This dual approach serves to return capital to shareholders and maintain a stable financial footing. The share repurchase initiative reduces the number of shares in circulation, a maneuver that can contribute to higher earnings per share. In tandem, the enhanced dividend offers a consistent cash return to the shareholder base, aligning with the company’s robust cash flow generation. Both initiatives underscore a disciplined approach to capital management and demonstrate a commitment to sustaining financial strength.

Corporate and Institutional Activity

Notable movements within the company and adjustments by major investment entities have drawn considerable attention. Key changes include significant transactions by top management personnel alongside shifts in holdings by well-established financial institutions. These internal moves, coupled with active repositioning by institutional investors, contribute to a diversified ownership structure. A large portion of the company’s equity is held by these financial entities, reflecting a high degree of market participation from established investment communities. This evolving composition of shareholders contributes to a dynamic stakeholder environment, reinforcing Steel Dynamics’ established role in the competitive steel production landscape.