Highlights

- In January, DCI announced launching a new weld fume extractor.

- In Q1 2023, Donaldson said it achieved GAAP net earnings of US$ 87.2 million.

- During the trading session on Wednesday, February 15, the DCI share price was US$ 63.84 apiece.

One of the leading producers of replacement components and filtering systems, Donaldson Company Inc. (NYSE: DCI), is a Minneapolis-based company that provides services to a wide range of end markets, including truck, industrial, construction, mining, and agriculture. Also, engine products and industrial items make up its two main segments.

What's the latest news with DCI?

In January, DCI announced launching a new weld fume extractor that will enable fabricators to weld in various workstation setups. Todd Smith, the Vice President of Global Industrial Air Filtration, said that a difficult issue can be resolved through the new extractor and that effective weld fume extraction can be done without ductwork or hoods.

Meanwhile, in the same month, it also announced the launch of managed filtration services. In a statement, the company said Donaldson's Managed Filtration Services uses a unique connected technology and a large service network to deliver the condition-based maintenance and repair services necessary to keep industrial filtration equipment operating.

A look at DCI's latest financials

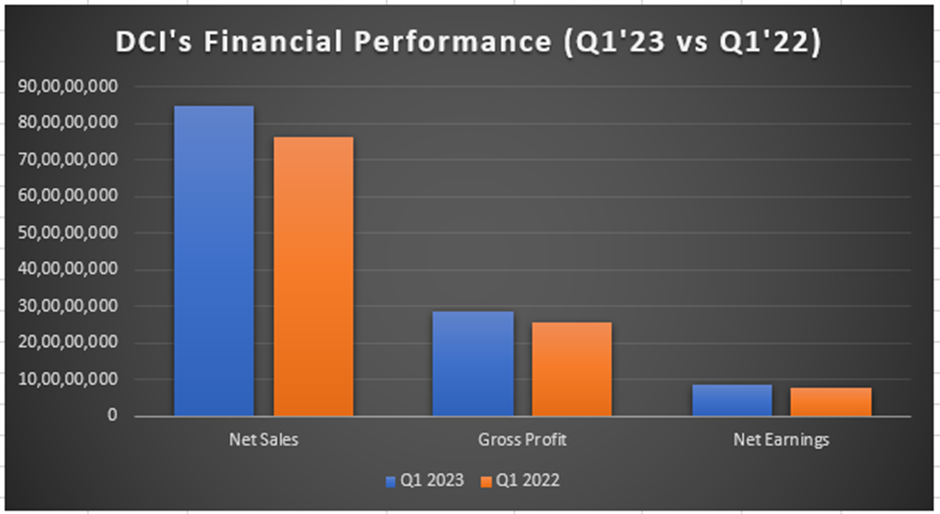

In the first quarter of fiscal 2023, Donaldson said it achieved GAAP net earnings of US$ 87.2 million, reflecting an increase of 13.1 per cent year-over-year (YoY). In Q1 2022, the GAAP net earnings of the company stood at US$ 77.1 million.

The GAAP and adjusted earnings per share (EPS) increased to US$ 0.7 and US$ 0.75 in Q1 2023 from US$ 0.61 in the same period of the previous fiscal year.

©2023 Krish Capital Pty. Ltd

©2023 Krish Capital Pty. Ltd

Notably, the sales of DCI jumped to US$ 847.3 million in Q1 2023 from US$ 760.9 million in Q1 2022. The company's gross margin was 33.9 per cent in Q1 FY23, up by 10 basis points from Q1 FY22.

For the full-year fiscal 2023, Donaldson expects its GAAP EPS to be between US$ 2.86 and US$ 3.02. Also, it expects its sales to grow between one to five per cent over the previous fiscal year.

Bottom line

On Wednesday, February 15, the DCI share price was US$ 63.84 per share and ended the day higher by 0.45 per cent from the previous trading session.

In the last 30 days, the DCI stock price surged by 2.39 per cent and gained 7.97 per cent in terms of year-to-date (YTD) performance.