Highlights:

- HON and NOC stocks grew in morning trading on Thursday.

- Honeywell International Inc. (NASDAQ:HON) reported a two per cent YoY increase in its second-quarter revenue.

- Northrop Grumman Corporation (NYSE:NOC) reiterated its sales guidance for fiscal 2022.

Stocks of Honeywell International Inc. (NASDAQ: HON) and Northrop Grumman Corporation (NYSE: NOC) have been trending as the industrial companies posted their latest earnings on Thursday, July 28.

Notably, the US Commerce Department reported on July 28 that the country's GDP contracted at an annual rate of 0.9 per cent in Q2, declining for the second straight quarter amid intensified recession fears. However, the S&P 500 industrials sector soared about 1.50 per cent in morning trading this day, fuelled by gains in both HON and NOC stocks.

Let's explore Honeywell and Northrop's stocks and latest earnings.

Honeywell International Inc. (NASDAQ:HON)

HON stock soared 3.45 per cent to US$ 189.99 at 11:31 am ET on July 28, giving it a market cap of over US$ 129.29 billion.

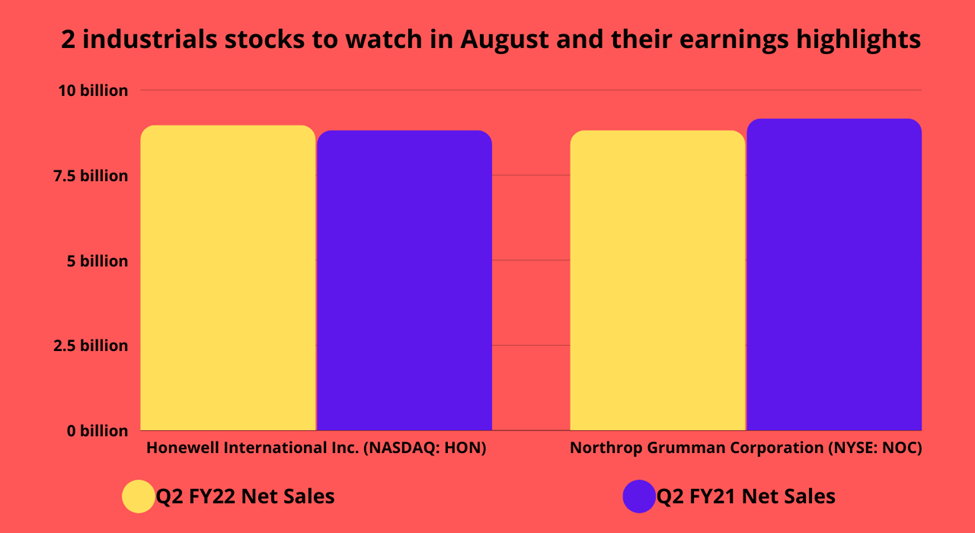

The building technologies firm reported sales of US$ 8.95 billion in Q2 FY22, up two per cent year-over-year (YoY). Honeywell's net income was US$ 1.26 billion in the fiscal 2022 second quarter, down from an income of US$ 1.44 billion in Q2 FY21.

The Charlotte, North Carolina-based firm cut its upper range sales guidance for fiscal 2022 to US$ 36.1 billion, from its previous upper range of US$ 36.4 billion. However, it has raised its organic growth outlook for the year to between five per cent and seven per cent, from its prior forecast range of four per cent to seven per cent.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Northrop Grumman Corporation (NYSE:NOC)

NOC stock grew 0.82 per cent to US$449.47 at 11:41 am ET on July 28. The US$-69.86 billion market cap company reported total sales of US$ 8.80 billion in Q2 FY22, posting a four per cent decline YoY.

The net earnings of the aerospace and defence firm fell nine per cent YoY to US$ 946 million in the fiscal 2022 second quarter. In Q2 FY22, Northrop's diluted earnings per share (EPS) was US$ 6.06, against US$ 6.42 apiece in Q2 FY21.

The Falls Church, Virginia-based company has reaffirmed its sales guidance range of US$ 36.20 billion to US$ 36.60 billion for fiscal 2022.

NOC stock grew 25.21 per cent in the past 12 months while showing gains of 16.49 per cent year-to-date (YTD).

Bottom line

The economy seems to be cooling amid rate hikes and hindering consumer demand due to higher prices. On the other hand, the industrial sector is cyclical, meaning it tends to perform better amid economic growth.

The S&P 500 industrial segment lost 13.26 per cent YTD while declining 10.87 per cent in 12 months. However, on a 30-day basis, it showed gains of 3.80 per cent.